The future is tokenized!

Now is the time to talk about tokenization, especially tokenization of real-world assets.

This year we have seen tremendous growth within the tokenization space, with many big banks reportedly wanting to tokenize just about everything on Wall Street and put it on the blockchain.

What is tokenization of real-world assets?

If you’re not already familiar with the term, tokenization of assets refers to the process of converting real-world assets into blockchain-based tokens, according to Larry Fink, CEO of Blackrock. "Tokenization will be the next big thing in the market".

There are several reasons why this is so big and why a huge market is moving towards it. Tokenization solves many problems with the current financial system, making it faster, cheaper, more efficient, and eliminating the need for many of the intermediaries that exist within the current system.

What can be tokenized?

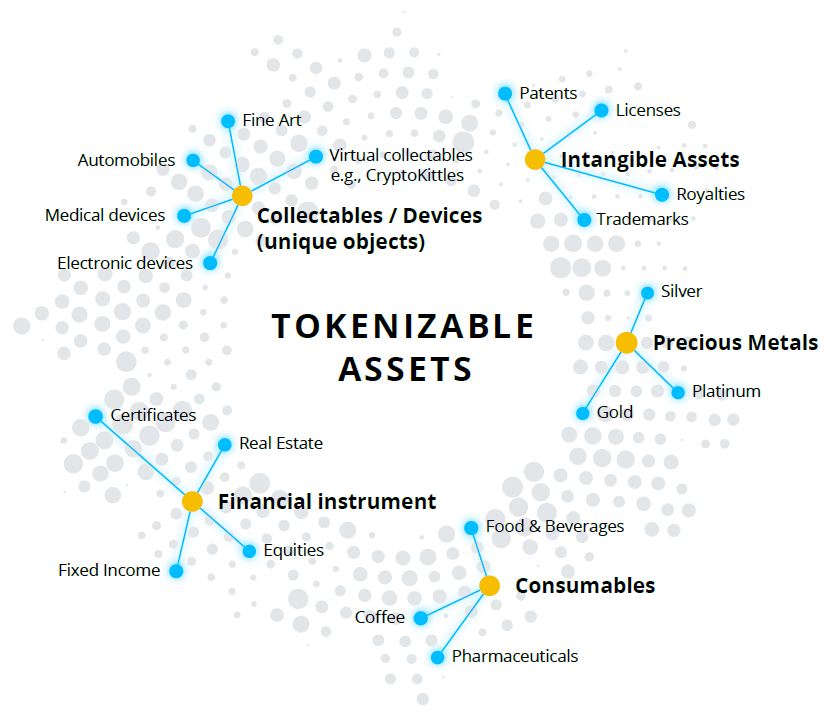

Below is an infographic of some of the sectors where tokenization of assets is already underway. However, tokenization of real-world assets is not limited to this list, as almost any real-world asset can be tokenized.

This is a trillion dollar industry

Current market research estimates that the current market size for tokenized assets is approximately $18 billion, and the banking industry estimates that 5-10% of all assets will be tokenized by 2030.

We are just starting to see tokenization of real-world assets happening. Last month, HSBC launched a platform to tokenize the London gold market.

Tokenization of real-world assets is estimated to be a trillion-dollar opportunity, and you need to be in the cryptocurrency industry to take advantage of this opportunity.

If tokenization of real-world assets is a new concept for you, I hope this helped introduce you to it.

If you are already familiar with this concept, we hope to cover this in more depth in future reports and identify potential investment opportunities created by these and other emerging trends within the cryptocurrency space.

December Altcoin Selection

If you missed our December Altcoin Picks, they are already up. 28% in the last 24 hours. To learn more about this and our future Altcoin recommendations, please consider becoming a member.

Join us – as we build up.

Although prices are still relatively low, now is a great time to enter the market. If you want to know what we’re buying, join us as we share our monthly Altcoin recommendations in anticipation of the upcoming bull market. All you have to do is become a member.

Richard.

Top 100 popular altcoins:

Cryptocurrency markets are full of green this week too.

Today’s Crypto Fear and Greed Index:

today’s Cryptocurrency Fear and Greed Index = avarice –> Decrease to 71 (from 73 last week).

Bitcoin and Ethereum price changes

Bitcoin ~ went up 2.87% Here are the prices it is currently trading at last week: $38,740. Over the past 90 days, Bitcoin has increased by: 49.74%.

Ethereum ~ went up 0.63% Here are the prices it is currently trading at last week: $2,086. Over the past 90 days, Ethereum has increased by: 27.4%.

Global cryptocurrency market capitalization It increased to $1.45T (from $1.43T last week).

Top 100 Gainers – Last 7 Days

The biggest gainers over the past 7 days (in the top 100) are:

TerraClassicUSD (USTC) +294% – 96th

TerraClassicUSD (USTC), originally known as TerraUSD (UST), was an algorithmic stablecoin designed to maintain a stable value, generally pegged to the US dollar. Unlike traditional stablecoins backed by fiat reserves, TerraUSD used a mechanism involving the minting and burning of its sister cryptocurrency, Luna, to stabilize its value.

However, in May 2022, TerraUSD experienced a catastrophic peg event, losing its dollar peg and incurring significant market losses. This event led to the creation of the new Terra blockchain and the rebranding of the original TerraUSD to TerraClassicUSD (USTC) on the Terra Classic blockchain.

After the collapse, USTC no longer functions as a stablecoin and is subject to market fluctuations and is carefully reviewed due to the risks and history associated with its algorithm.

Terra Classic (LUNC) +86.2% – 86th

Terra Classic (LUNC) is a cryptocurrency that is part of the Terra blockchain ecosystem, originally known as Terra (LUNA). It performed a variety of roles, including staking, governance, and maintaining the stability of TerraUSD (UST), an algorithmic stablecoin. Stability mechanisms included exchanging TerraUSD for LUNA to regulate supply and maintain a peg to the US dollar.

However, in May 2022, the Terra ecosystem collapsed when TerraUSD lost its dollar peg, which led to a sharp decline in the value of LUNA. In response, the Terra community created a new blockchain using a new version of LUNA, renaming the original blockchain to Terra Classic and its native token to Terra Classic (LUNC).

After the collapse, LUNC is separated from its original purpose and exists on the Terra Classic blockchain depending on market conditions. These dramatic changes highlight the risks and complexities of the cryptocurrency market, especially algorithmic stablecoins.

IOTA +30.7% – 71st place

IOTA is a cryptocurrency that differs significantly from existing blockchain-based cryptocurrencies through its unique underlying technology and focus on the Internet of Things (IoT), providing scalable, efficient, and secure transactions without transaction fees while also being energy efficient. It is efficient and quantum resistant. IOTA is also considered one of the few cryptocurrencies that is ISO 20022 compliant.

BEAM +30.8% – 99th

Beam is a privacy-focused cryptocurrency based on the Mimblewimble protocol, launched in 2019. It encrypts transaction details, including amounts and participant identities, and removes unnecessary data from the blockchain, providing improved privacy and scalability. The result is a more compact and efficient ledger.

Transactions on Beam are private by default and do not store address information on the blockchain, greatly improving user privacy. The cryptocurrency has a deflationary emission schedule similar to Bitcoin, with block rewards halving approximately every four years.

Biggest microcap gain in the last 30 days

We review and analyze small and micro market cap cryptocurrencies every week to find the next low-cap gem. The best performing (quality) microcap projects over the last 30 days are:

Top performing quality microcaps (last 30 days):

- R.S.C. +1,564% – DeSci – Research Paper (Micro-Cap)

- NOISEGPT +1,412% – Decentralized AI (Micro-Cap)

- husky +1,350% – Avalanche (Nano-Cap) dog NFT

- XPB +1,147% – Layer 1 for mining (Nano-Cap)

- D3D +1,051% – Decentralized social returns (Nano-Cap)

- 3ULL +729% – Game ecosystem (microcap)

Monthly altcoin selection:

We have just released our latest Altcoin Picks for December. And it’s already been released. 28% in the last 24 hours!

If you would like access to this and future monthly Altcoin recommendations, please consider becoming a member. It’s just the price of two cups of coffee a month.

Altcoin recommendations are emailed to members as soon as they are posted. If you’re wondering how we choose our monthly Altcoin picks, this is the method we use.

Altcoin recommendations from previous months can be found here.

We express our gratitude and respect to all members!

Until next report,

Richard.