- Are you an aspiring cryptocurrency investor?

- Do you like cryptocurrency?

- Do you want to learn how to analyze different cryptocurrencies?

If you answer yes…

Then read on.

Cryptocurrencies may only have been around in the last decade, but they are by far the hottest investment we’ve seen.

That’s why no one really knows how to analyze it and get the most out of it. However, there are several tools and services that provide a sufficient amount of cryptocurrency insight that can help you decide what to do during your research.

In this article, we are sharing some of the essential cryptocurrency analysis tools you should use to improve your research on cryptocurrencies before investing. These tools are being used by most cryptocurrency investors around the world to make the most of the cryptocurrency revolution.

However, always remember that these tools and services only provide insights that you, as an investor, must analyze and decide for yourself. And the good news is that most of the tools are free to use.

So, let me explain these tools and services one at a time.

14 Time-Saving Cryptocurrency Analysis Tools for Investors

1. Dex check

Dexcheck is a new cryptocurrency analysis and research tool that leverages the power of AI to help you find profitable cryptocurrencies. I think I’ve been lucky enough to be a part of the tool’s growth, and if the Dexcheck developers keep building on it, this could become one of the best crypto analysis tools out there.

Below are some of the amazing features of Dexcheck that made me include it in this exclusive list.

- Token Analysis – View analysis and insights about your tokens, including token graphs and top holder lists.

- Cryptocurrency Wallet Analysis – You can analyze and track the purchases/sales of your cryptocurrency wallet. For cryptocurrency whale watching, this is a great option.

- Best Cryptocurrency Traders – This feature allows you to identify the best traders based on their activity and P&L, which helps you discover tokens and projects before anyone else.

- INSIGHTSGTPT – This feature automates the process of discovering what smart money is doing and helps you take action.

The screenshot below shows all existing and upcoming features of Dexcheck.

The platform also has a utility token called $DCK, which is required to access the pro features of this tool. Utility tokens are already traded on many exchanges, including KuCoin, Gate.io, and MEXC.

Overall, I’ve discovered a lot of gems using this tool and I’m more than happy with the results so far. We’ll be creating a detailed video guide for this tool in the future, but for now, let’s take a look at it yourself.

2. CoinMarketCap

When talking about cryptocurrency analysis, the first place to start is CoinMarketcap. This is the OG of cryptocurrency analysis tools and helps you understand everything about a project on a single page.

- Go to CoinMarketCap.

- Search for the token you want to analyze

Here you will find all the information you need to get started with cryptocurrency analysis. You’ll also find links to websites, communities, and white papers to help you get started with your research.

- A quick look at market capitalization and FDV can help you make quick decisions.

- You can scroll down to the page to see price charts and historical data.

You can enhance your experience by creating a free account at CoinMarketCap and adding tokens to your watchlist. This simplifies the analysis process and allows you to customize the environment to suit your needs.

Overall, this is the first cryptocurrency analysis website you should use.

3. Glassnode Studio

Glassnode Studio is an on-chain market intelligence platform that provides large amounts of data related to all coins.

Let us help you see the benefits of Glassnode Studio.

Provides data to analyze exchange inflows and exchange outflows of all coins. Now, if you see that the amount of coins deposited on the exchange has increased, it is a sign that there are more people willing to sell. Analyzing Bitcoin exchange inflow data from January 2019, we can see a significant increase in Bitcoin deposits on exchanges, which was followed by the beginning of a painful bear market.

You don’t need to be a data scientist to understand this. You just need to understand what the different indicators mean and what types of indicators they are.

A detailed review of Glassnode Studio will be available in the coming days. For now, bookmarking Glassnode will help you analyze cryptocurrencies better.

4. Mood

Santiment is a behavioral analytics platform for cryptocurrencies, sourcing on-chain, social and development information for over 900 coins.

Like Glassnode, it provides tons of on-chain data, exchange data, and social data to help determine the overall price movements of all cryptocurrencies. Santiment has free and paid plans.

I often use this tool to understand the accumulation behavior of coins as it helps me determine future price predictions for the coins. I believe you should take the time to understand Santiment’s various indicators. Then, more data will be available to make informed decisions.

5.TokenUnlocks

This is a relatively new website on this list, but you will find tremendous value in it as a cryptocurrency investor.

Understanding TokenMoik is key to deciding whether or not to invest in cryptocurrency. TokenUnlocks helps you measure the unlock schedule of all your tokens. When a big unlock happens, it often leads to a price drop and is probably a good time to offload a location (before unlocking).

The platform allows you to create a list of projects you’re interested in and get notified when they’re about to be unlocked.

6. Token terminal

Financial indicators are one of the pillars of fundamental analysis, and TokenTerminal is the platform that supports them. TokenTerminal aggregates financial data for major blockchain and decentralized applications.

It supports many popular blockchains and protocols. For example, in the screenshot below you can see GMX protocol financial data.

7. Cryptocurrency fees

As the name suggests, this platform allows you to see how much fees are being generated by different chains and protocols. This helps identify new entrants or growing protocols.

8. Coin Market Cal

All of you have probably heard the famous quote.Buy that much rumor, sell that much News“. The same concept applies to cryptocurrency. But where can you find real rumors and news? Well, that is what I will answer in this section.

I’ve been using CoinMarketCal, an evidence-based, community-driven cryptocurrency calendar, for six months. It’s the perfect free tool to get real news and rumors about your favorite cryptocurrency. You can then formulate a buy/sell/HODL strategy based on timeline-based evidence. I myself have used it several times and can easily get up to 20% based on rumors and news as indicated by CoinMarketCap. CoinMarketCal is evidence-driven, so you can expect 90%+ accuracy on anything. And anyone using CoinMarketCal can see the same evidence.

9. Into the Block

Intotheblock is a unique data analytics tool that uses machine learning and advanced statistics to provide actionable intelligence on crypto assets.

It provides data that can be leveraged by short-term or long-term investors for every cryptocurrency asset on the market. The dashboard is easy to use, and once you know how to use data to make investment decisions, your cryptocurrency analysis will become faster and more data-driven.

Watch the video below to understand how Intotheblock works.

10. Cryptocurrency Portfolio Tool (Cryptocurrency Profit Tracking)

great. All of the above tools will have helped you choose a successful project and have made some investments.

The question is how to monitor your investments.

You need to know how many units of coins you have and what their total value is. Most importantly, you need to know your current profit/loss ratio.

Well, for that you need a crypto portfolio tool.

There are more, but these two will serve your purposes well.

To learn more – Best Crypto Portfolio Trackers

11. Coin checkup

CoinCheckup is a one-stop shop, just like a health checkup, and the most integrated free solution on the market for cryptocurrency analysis.

It is a cryptocurrency research platform that provides many insights on various cryptocurrencies from various angles. Some of these angles include:

- chart

- Basic analysis of coins

- Coin specifications

- investment statistics

- prediction

- News, etc…

Of these, I like ‘General and Average Investment Statistics’ the most. This is because it gives you a holistic picture of the volatility and returns you can expect to earn for that asset over a period of 7 to 30 days. For example, take a look at the Cardano investment statistics below from CoinCheckup.

Again, here in Monero’s matrix we can see a Compound Monthly Growth Rate (CMGR) of 12.44%. You can get similar insights about cryptocurrencies through this tool, which can help you decide to buy/sell/HODLing.

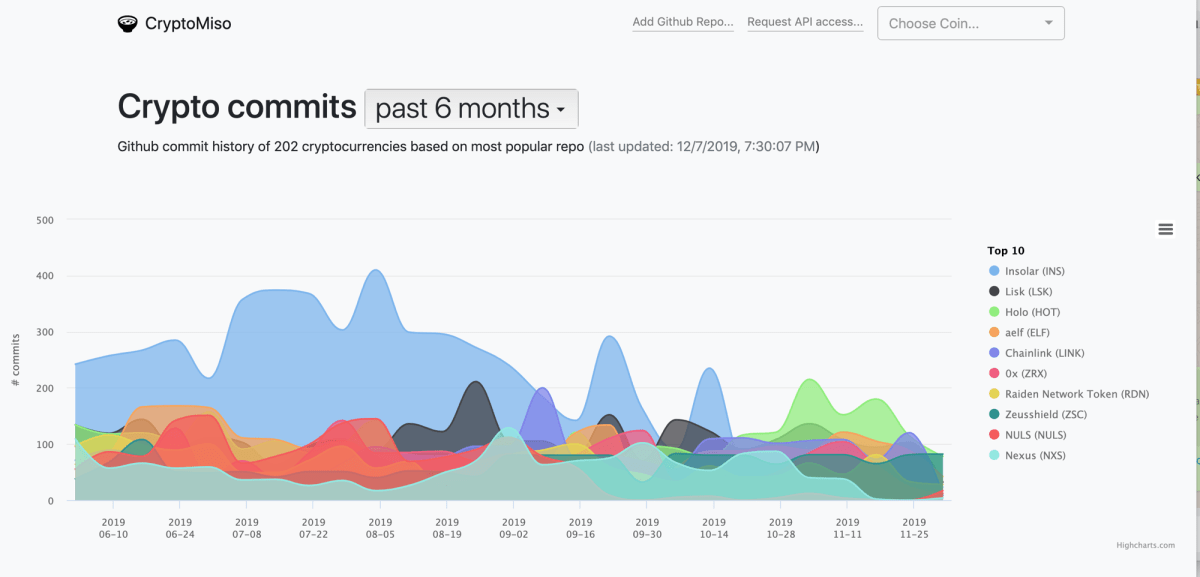

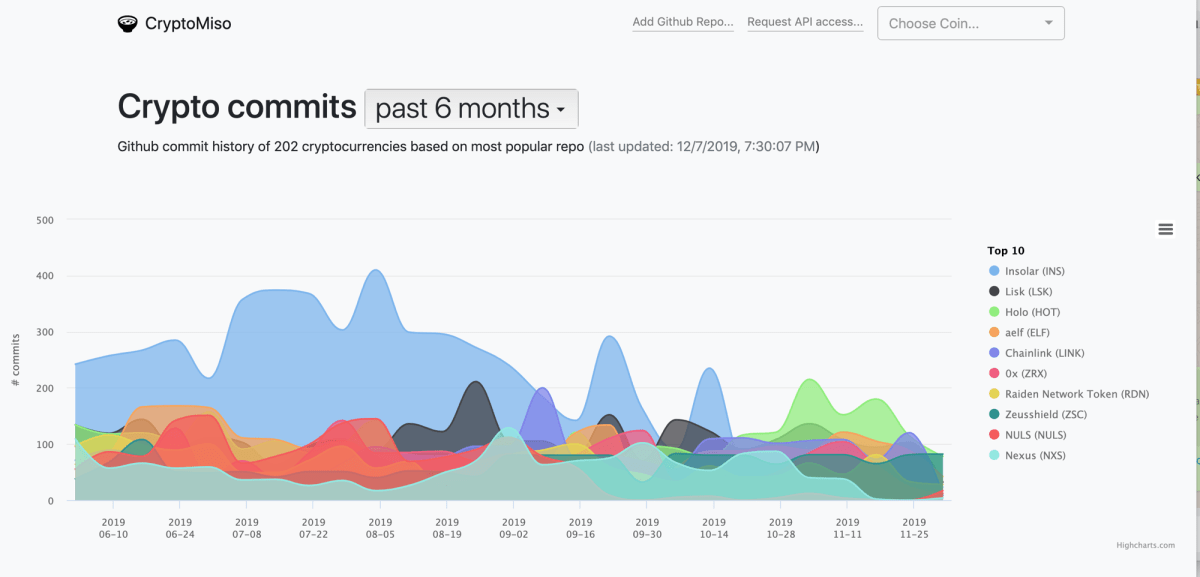

12. Cryptomiso

Any cryptocurrency investor who ignores the development of a particular currency before investing in it is doing it wrong.

After all, cryptocurrencies are software protocols, so if they are not developed, maintained, and improved, they will have no future and will eventually die out.

Therefore, it is very important to monitor the development of specific blockchain and cryptocurrency projects. Additionally, most of the projects are open source on Github, making them easy to track.

However, you cannot simply check Github for every cryptocurrency. This is where GitHub monitoring tools like CryptoMiso come into play.

CryptoMiso allows you to see how many commits a specific crypto project has made over a specific period of time. A commit is nothing more than the number of times code is improved or added to a project’s code base.

This provides a high level of tracking of the development activities occurring in a specific cryptocurrency project.

13. Cryptocurrency News Aggregator

A cryptocurrency news aggregator is not a tool, but a concept offered by many tools to aggregate cryptocurrency news all in one place.

This tally helps investors stay on top of the market and easily distinguish between rumor and reality.

These news aggregators gather news from all major cryptocurrency publishers, including:

- coinsutra.com

- newsbtc.com

- cointelegraph.com

- bitcoinist.com

- etnes.com, etc.

Additionally, some aggregation tools pull news from Twitter already separated for investors to analyze.

This way, cryptocurrency investors can quickly and easily check news about different cryptocurrencies and formulate their strategies accordingly.

Some of the services/tools suggested for this niche include:

14. Trading bots and rebalancing tools

If you are adventurous from the start, you should also have a cryptocurrency trading bot and rebalancing tool.

Once you are connected to an exchange, the trading bot will trade on your behalf.

And in cryptocurrency, this is necessary when one coin is on one exchange and another coin is on another exchange. Therefore, trading bots allow you to trade and access multiple exchanges simultaneously.

Additionally, HODL coins are not always good during bear and boom markets, but a new way forward is to rebalance your portfolio.

Proposed services/tools for this niche:

Conclusion: Cryptocurrency Analysis Software

These tools are important for every investor before deciding to invest their money in a particular cryptocurrency project. I have used these tools synergistically to find optimal solutions for investment decisions.

However, using these cryptocurrency analysis tools does not guarantee profits. This means you are making more informed decisions. Additionally, using these tools together may be difficult at first, but once you get the hang of it, you’ll understand which tools to use, when to use them, and how to use them.

I will be back with something new to keep you ahead of the game in this dynamic world of cryptocurrency.

Let us know what you think and which tools you use or plan to use on this list in the comments section below.

If you liked this post, please share it with your friends and family!

Additional suggested resources from CoinSutra:

Thanks for your feedback!