A glaring problem within the cryptocurrency market is becoming apparent. The proliferation of altcoins, with more than 2.52 million coins created, is suffocating the industry.

This unprecedented growth of new tokens was initially a sign of a booming market, but now presents serious challenges.

2.52 million new tokens created

In 2020, the cryptocurrency market experienced a frenzy. Liquidity has surged as retail investors and venture capitalists (VCs) pour money into the industry. In particular, VCs have invested heavily and contributed to the development of numerous projects.

Will Clemente, co-founder of Reflexivity Research, reflected on how simple the strategy was at the time. Investors have had the pleasure of allocating capital to high-beta altcoins and seeing them outperform Bitcoin.

“In 2020, if you go out on the risk spectrum, you’re going to see a higher beta for Bitcoin and all the bullshit and everything,” Clemente explained.

This trend continues in 2022, with VC funding reaching a record $11.1 billion in the first quarter alone. However, this flood of new capital has caused the number of altcoins to grow unsustainably.

The number of tokens tripled between 2020 and 2022, but the subsequent bear market took its toll. High-profile failures such as the collapse of LUNA and FTX have led to widespread market turmoil. The project, which had raised significant funding, decided to postpone its launch pending more favorable market conditions.

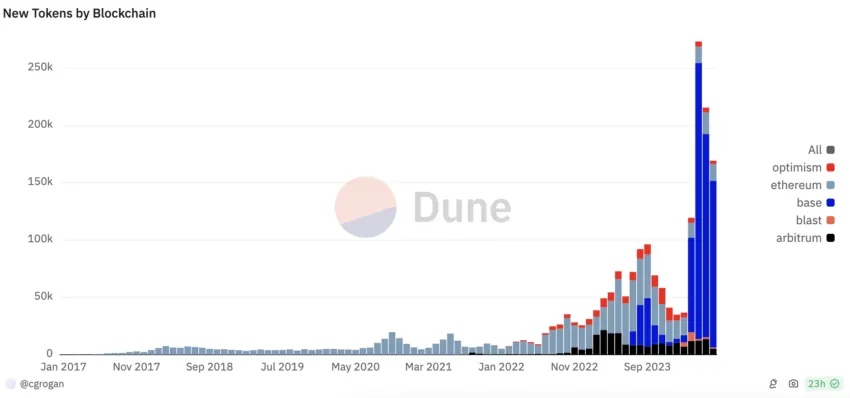

By the end of 2023, market sentiment had improved, leading to a surge in new altcoin launches. This resurgence has continued into 2024, with over one million new tokens introduced since April. As a result, the total number of altcoins across various blockchains reached 2.52 million.

“Nearly one million new cryptocurrency tokens were created last month, which is double the total number created on Ethereum from 2015 to 2023,” said Coinbase Director Conor Grogan. said.

Read more: 7 Hot Meme Coins and Altcoins That Will Be Trending in 2024

Although these numbers may be inflated due to the ease of meme coin creation, the volume of new tokens is enormous.

How altcoins are harming cryptocurrencies

The flood of new tokens is problematic. The more altcoins flooding the market, the greater the cumulative supply pressure.

Estimates suggest that an additional $150 million to $200 million worth of new supply enters the market every day. This continued selling pressure drives prices down, much like inflation in a traditional economy. As more altcoins are created, their value decreases compared to other currencies.

“Think of token dilution as inflation. When the government prints U.S. dollars, this ultimately reduces the dollar’s purchasing power relative to the cost of goods and services. The same is true for cryptocurrencies, says cryptocurrency analyst Miles Deutscher.

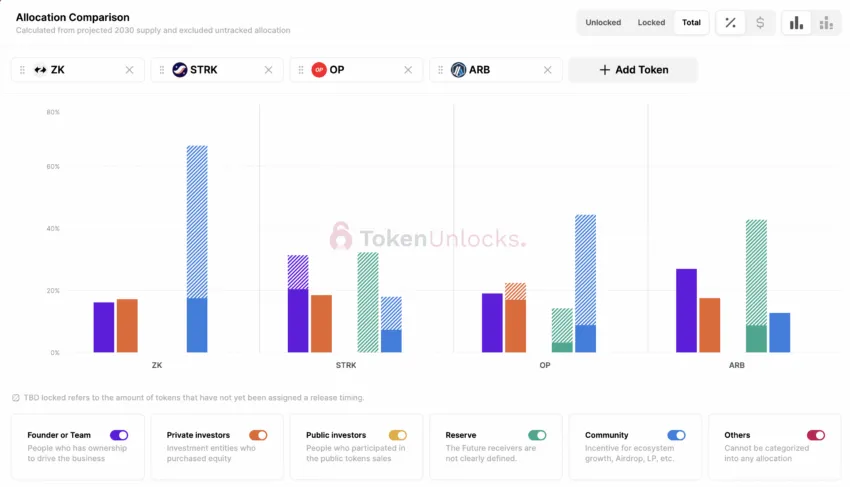

Many of these new tokens have low fully diluted value (FDV) and high float, exacerbating supply pressure and dispersion. This environment will become manageable as new liquidity enters the market.

However, the lack of new capital forces the market to absorb a constant influx of new tokens, suppressing prices.

Read more: What are the best altcoins to invest in June 2024?

This may be one of the reasons why retail investors feel at a disadvantage compared to VCs and are reluctant to participate.

In previous cycles, individual investors were able to reap significant returns. Now, tokens often launch at high valuations, leaving little room for growth and subsequent hemorrhaging as the unlock schedule begins.

“The bias toward private markets is one of the biggest problems with cryptocurrencies, especially compared to other markets like stocks or real estate. This bias is problematic because retailers feel they can’t win,” Deutscher concluded.

Solving this problem requires a joint effort from multiple stakeholders. Exchanges can implement stricter token distribution rules and project teams can prioritize community allocation. Additionally, a higher percentage of tokens may be unlocked at launch and there are mechanisms in place to potentially prevent dumping.

Read more: 10 Best Altcoin Exchanges in 2024

The current state of the market reflects the need for greater pragmatism. Exchanges should consider delisting non-existent projects to secure liquidity. The goal is to create a more retail-friendly environment that benefits everyone, including VCs and exchanges.

disclaimer

In compliance with Trust Project guidelines, BeInCrypto is committed to unbiased and transparent reporting. These news articles aim to provide accurate and timely information. However, before making any decisions based on this content, readers are encouraged to check the facts and consult with experts. Our Terms of Use, Privacy Policy and Disclaimer have been updated.