Q2 2025 delivered a decisive message. After turbulence, encryption goes up again! The Cryptocurrency division earned 21.72%strong profits and faced all major US stock indexes.

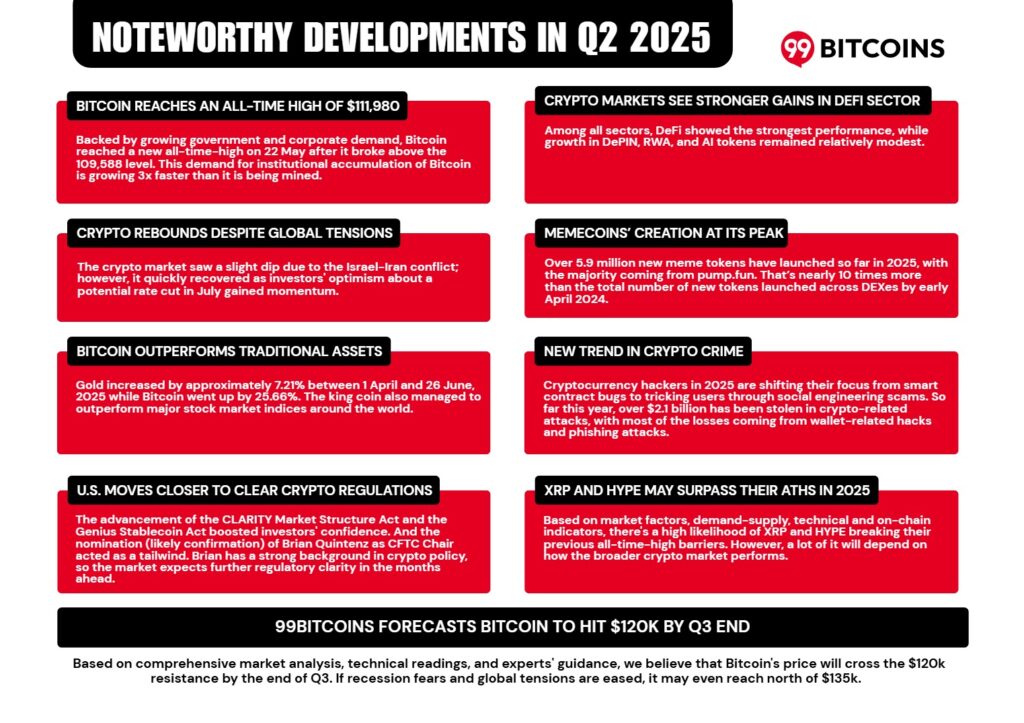

The encryption market has left US stocks in dust. According to 99bitcoins’ Q2 2025 Encryption Market Report Published on July 10, 2025 “Most US stock indexes have been maintained at less than 15% of quarterly (QTD) profits, and only the S & P 500 information technology division has risen by 18.4%. The wider S & P 500 has only gained 7.37%.

Interestingly, the encryption industry saw a 18% decrease in the first quarter of 2025. Therefore, Q2 rebounds are notable recovery. Encryption profit in the second quarter of 2025 surpassed the last few years, reversing the decline in the second quarter of 2024.

Discovery: 9+ highest high risks, high compensation encryption to be purchased in July 2025

What did you draw the performance of Crypto?

Was it helpful to promote Bitcoin’s dominance to up to 63%for four years? The interest of institutional investors was noticeable. Retailers preferred Bitcoin while focusing on Altcoins.

According to a 99 -bitcoins report, investors’ interest in encryption was picked up in 2Q. ” In April, the mention of the blockchain for submission of the SEC achieved 5,830 records due to the Trump administration’s approach to professional creepy. ”

The US government also provided the required regulatory clarity by delivering major laws and administrative orders that support the Crypto market extensively. In particular, if you remove the IRS report rules and comfortable requirements for the banks participating in the Crypto activity, the trust of the entire sector has increased.

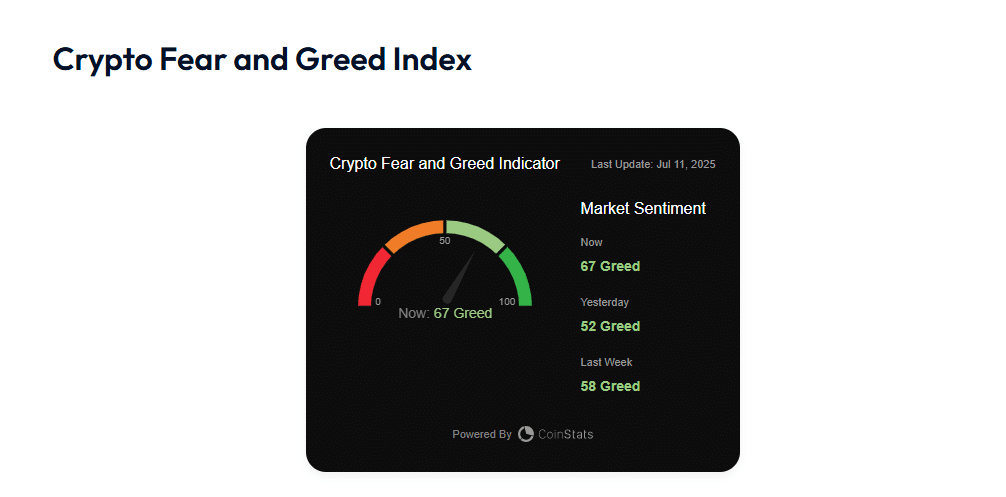

After the lowest level in March 2025, the encryption horror and greed index rebounded with “greed” territory for more than 60 days, gaining buoyancy with positive policy signals.

Yesterday, Bitcoin, which has more than $ 117,000 in the world’s most valuable encryption, has raised BTC and 6.76%to $ 118,409. The fear and greed index of 99bitcoins show the reading of “67”.

More Read: Bitcoin hit ATH without FOMO. Bitcoin Hyper is $ 2.3m increase

Chris Wright, a global marketing officer at 21Shares, measured the weight. “We believe that Bitcoin ETF will attract 50% more inflow this year compared to last year.” This showed that the net influx of about $ 550 billion in 2025 increased by about $ 20 billion year -on -year. If it continues, the total assets of management can now be almost doubled from $ 110 billion to $ 1200 billion from $ 110 billion to the end of the year. “

Stablecoins steals spotlights

In June 2025, the Web3 division surged. Ripple, Arbitrum Foundation, Stellar and AVA Labs have announced the expansion of the Web3 team, one of the companies that actively adopt various roles. The report said, “This recruitment is typical in the bull market and reflects the strong belief in the industry’s growth potential.”

But Stablecoins led the demand of the entire sector. According to the report, 81%of SMBs, who are used to encryption, are interested in using Stablecoins every day.

In addition, the number of Fortune 500 companies that want to use Stablecoins has three triples since 2024.

The successful IPA of CIRCLE, which has surged 168% of the company’s share price in debut, is a proof of appetite and exposure related to OD Stablecoin.

Discover: 16 Next encryption, 2025 explosion: Expert cryptocurrency prediction and analysis

Reasons for trusting 99bitcoins

Founded in 2013, the 99 -bitcoin team member has been an expert since the early days of Bitcoin.

90hr+

Weekly research

100k+

Monthly reader

Follow the 99BITCOINS in Google News Feed

Deliver the latest updates, trends and insights directly with your fingertips. Subscribe now!

Subscribe now