The market surpassed mid-November, with the overall altcoin market cap falling below $1 trillion. The ability of altcoins to bounce while sentiment bottoms can cause volatility and large-scale liquidations for several assets.

Which altcoins face these risks and what special factors should you pay attention to? Here are the details:

boost

boost

1. Ethereum (ETH)

Ethereum’s liquidation map shows a clear imbalance between potential liquidation volumes on the long and short sides.

Traders are allocating more capital and leverage to short positions. As a result, if ETH rebounds this week, we will incur bigger losses.

If ETH rises above $3,500, more than $3 billion in short positions could be liquidated. In contrast, if ETH falls below $2,700, the total buy liquidation amount is only about $1.2 billion.

Short sellers have reasons to maintain their positions. The ETH ETF recorded outflows of $728.3 million last week. Additionally, cryptocurrency billionaire Arthur Hayes recently sold ETH.

However, on a technical note, ETH remains within the key support area around $3,100. This level is likely to trigger a strong recovery.

Sentimental indicators for ETH are also in extreme fear. Historically, ETH has often rebounded sharply in similar situations.

boost

boost

This puts the ETH recovery on solid ground and could result in significant losses for short-term traders.

2. Solana (SUN)

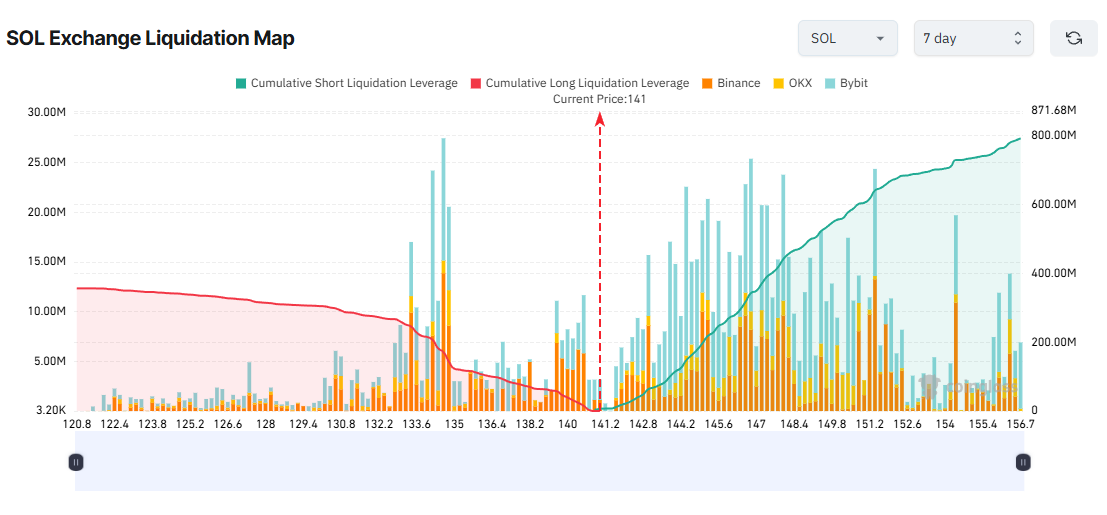

Similar to ETH, Solana’s liquidation map also shows a strong imbalance, with short-term liquidation volume dominating.

After SOL fell below $150 in November, many short-term traders expected a further decline towards $100. This month, whales as well as retailers have been short selling.

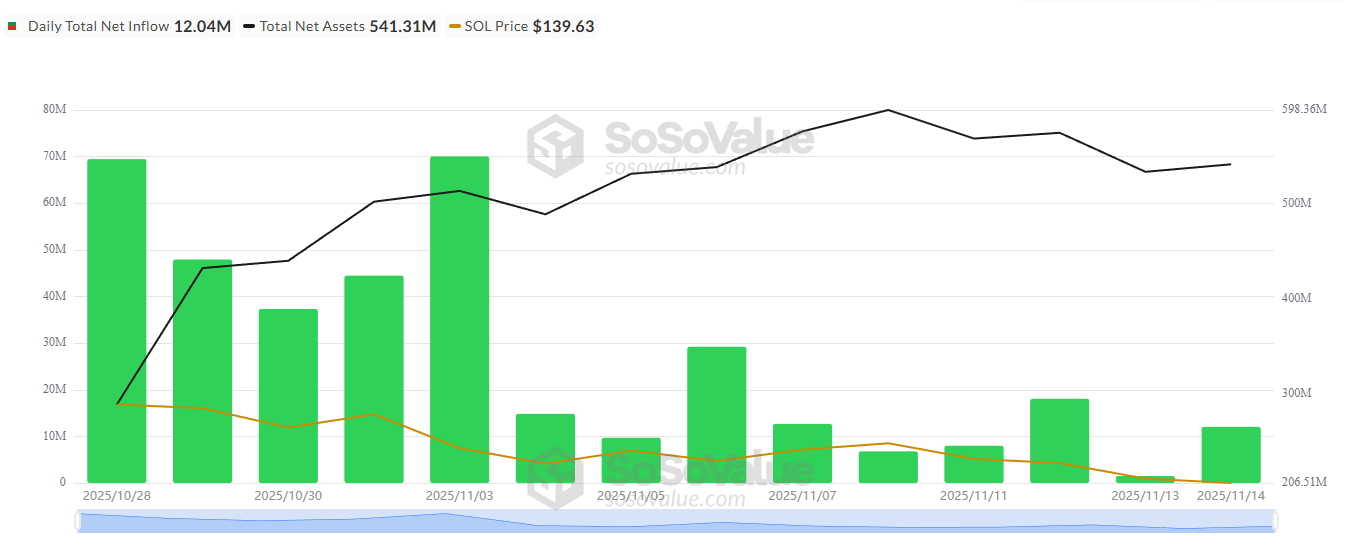

However, SOL ETF data shows a more positive picture. The US SOL ETF saw net inflows of more than $12 million on Nov. 14 and more than $46 million last week, according to SoSoValue. Meanwhile, both the BTC ETF and ETH ETF showed negative net flows.

boost

boost

This gives SOL a reason to rebound as investors still see strong ETF demand. According to the liquidation map, if SOL rises to $156, short-term liquidation could amount to nearly $800 million.

Conversely, if SOL falls to $120 this week, the buy liquidation value could be around $350 million.

3. Zcash (ZEC)

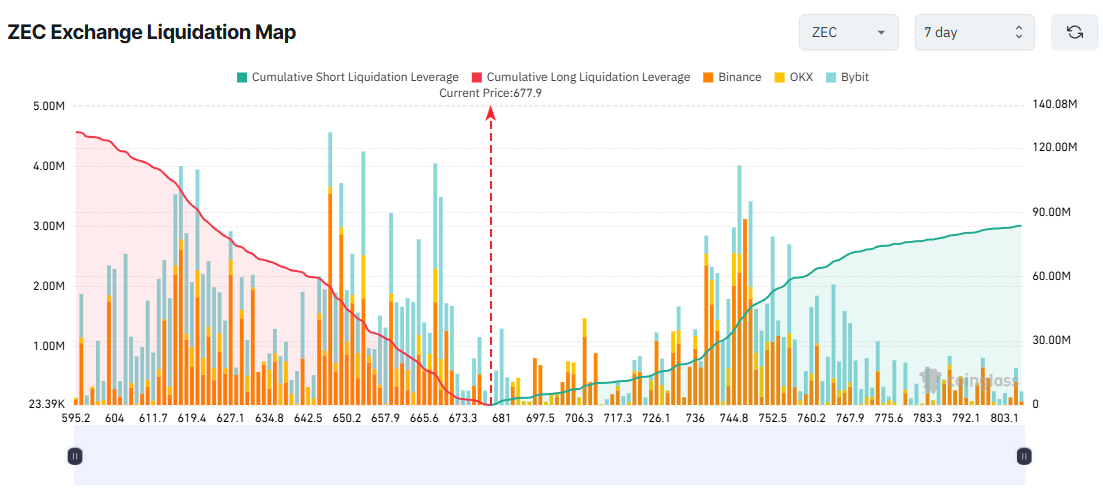

Unlike ETH and SOL, ZEC’s liquidation map shows that long-term traders face potential liquidation risk.

boost

boost

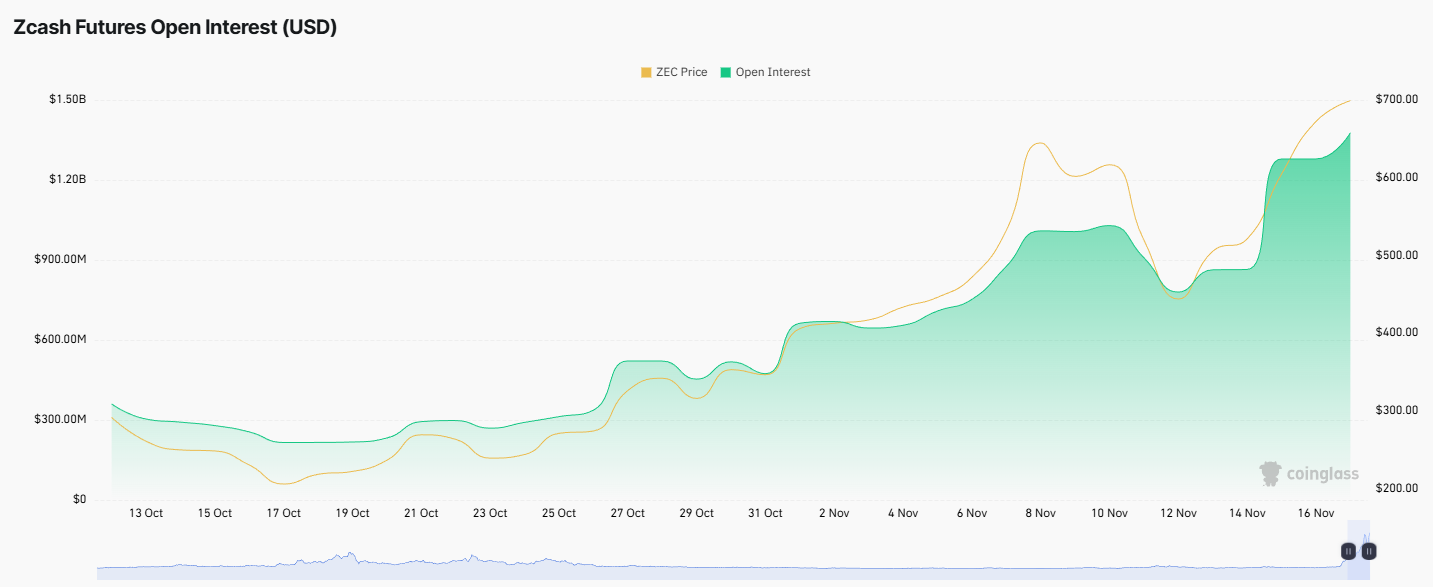

Short-term traders appear confident that ZEC will continue to make strong highs in November. There are reasons for this outlook. ZEC locked in Zcash shielded pools has increased sharply this month, with several experts still predicting ZEC could potentially reach $10,000.

However, ZEC has been repeatedly rejected near the $700 level. Therefore, many analysts are concerned about a correction this week.

If a correction occurs and ZEC falls below $600, long liquidation could exceed $123 million.

Moreover, ZEC’s total open interest reached an all-time high of $1.38 billion in November, according to Coinglass data. This reflects high levels of leverage exposure, which increases the risk of volatile moves and large liquidations.

Because of this, holding a long position in ZEC can provide short-term profits. However, without a clear take profit or stop loss plan, these positions can quickly face liquidation pressure.