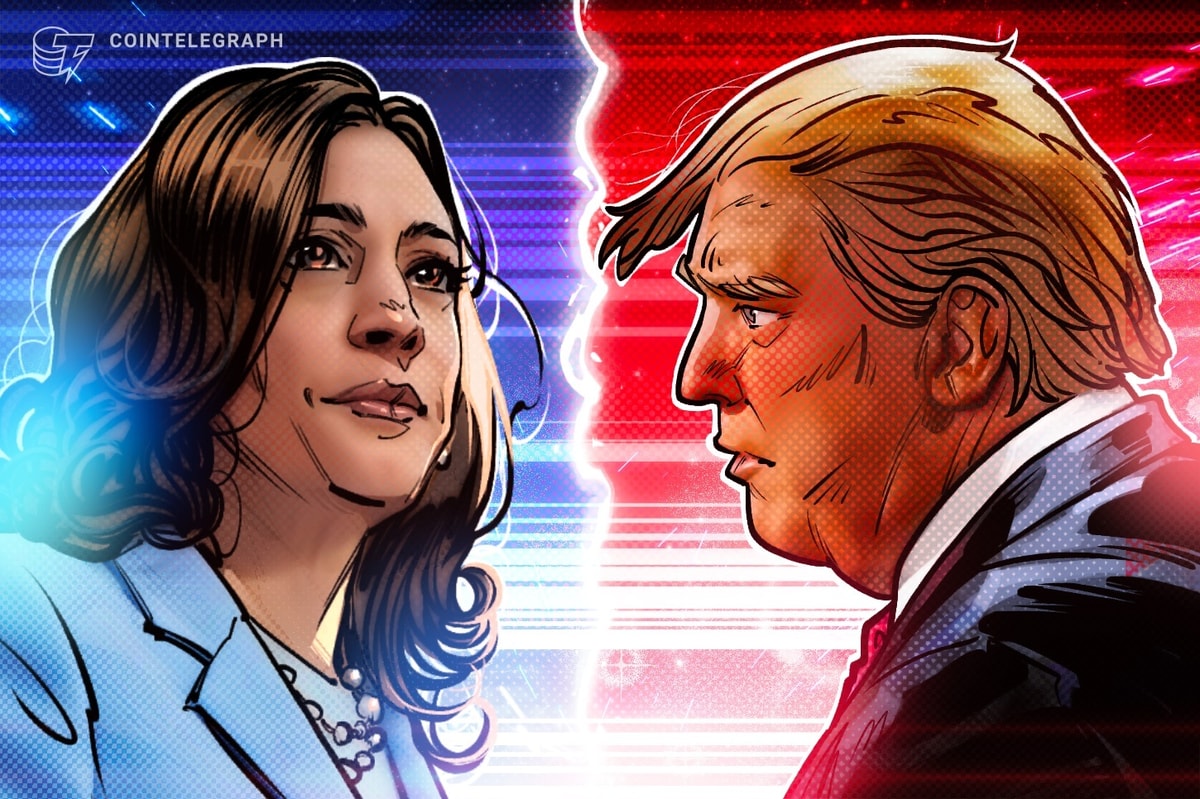

Bitcoin (BTC) is struggling to find direction with opinion polls depicting a tight race between former President Donald Trump and Vice President Kamala Harris a day before the US presidential election.

Here’s what analysts are predicting for Bitcoin as the Trump-Harris showdown approaches.

If Trump wins, Bitcoin could reach $80,000-$90,000

If Trump is elected, the price of Bitcoin will next reach $80,000 to $90,000, according to Bernstein analysts.

source: X

Trump’s support for Bitcoin and cryptocurrencies is the main reason for the optimism. He publicly advocated for the United States to become a leader in the cryptocurrency industry at campaign rallies.

Key proposals include appointing a cryptocurrency-friendly SEC chair to ease regulatory pressure, establishing a national Bitcoin reserve to support BTC adoption, and making the United States a hub for Bitcoin mining.

Bernstein’s bullish predictions for Bitcoin are consistent with a fractal analysis showing that BTC hit new all-time highs following the US presidential election, especially in conjunction with the halving event that occurs approximately every four years.

For example, after the first halving in November 2012, the price of Bitcoin surged approximately 9,500%, from around $12 to around $1,150 in late 2013, its highest at the time.

BTC/USD weekly price chart. Source: Mustache

Likewise, 2016 saw another strong rebound following the second halving. Bitcoin rose from about $650 in mid-2016 to about $20,000 in December 2017, an increase of more than 3,000% from the period before the halving.

The third cycle followed the same pattern. After the halving in May 2020, Bitcoin rose from around $9,000 to hit a new high of $69,000 in November 2021.

relevant: Cryptocurrency whales bet big on Trump winning ahead of US presidential election

With the fourth halving recently completed in April 2024 and the U.S. election scheduled for November 5, historical trends suggest the price of Bitcoin will rise again, perhaps toward Bernstein’s target of $80,000 to $90,000. there is.

Last October, they predicted that the BTC price would rise towards $200,000 in 2025, regardless of the outcome of the US election.

Bitcoin Will See an “Instant Dump” If Harris Wins

Market analyst Miles Deutscher suggested that whoever wins the US presidential election, Bitcoin will likely reach $100,000 or more, but the path and timing will depend on the outcome.

He claims that if Harris wins the US election, there will be an “immediate dump” on the Bitcoin market. This is likely due to market fears that the Harris administration may maintain or increase regulatory scrutiny of cryptocurrencies.

Source: X

This outlook is consistent with the increase in polymarket bidding following the Bitcoin price crash in November.

For example, the strongest bet is for a decline to $65,000, and there is a 75% chance that Bitcoin will reach that level, as evidenced by the 76-cent price of the “yes” stock.

This is a bid for the Bitcoin target price for November. Source: Polymarket

Bitcoin to $100,000 by the end of November?

November has historically been Bitcoin’s most profitable month since 2013, with an average return of 46%. This led analyst Lark Davis to expect a similar uptick in 2024.

“A 46% increase from current prices would put BTC at $104,000,” he noted in a recent X post.

BTC/USD 3-day price chart. Source: Lark Davis

The US Federal Reserve meeting on November 7, with speculation of a 25 basis point rate cut, could also boost Bitcoin’s upside potential, even if it means a rise towards Bernstein’s target of $80,000-$90,000.

The convergence of Bitcoin’s historically strong November performance, the possibility of a rate cut by the Federal Reserve, and cryptocurrency advocacy surrounding candidate Trump are creating a bullish outlook for BTC this month.

The price rose 0.25% in the last 24 hours, reaching around $68,760 on November 4, but is down 7.35% from the local high of $73,600 set a week ago.

BTC futures open interest. Source: Coinglass

The decline in BTC prices resulted in a $1.1 billion decrease in open interest in the futures market, resulting in the liquidation of positions worth about $300 million, indicating that many traders are reducing their exposure ahead of the November 5 election.

This article does not contain investment advice or recommendations. All investment and trading activities involve risk and readers should conduct their own research when making any decisions.