Identifying the optimal moment to exit the cryptocurrency market is just as important as your investment decision. Dennis Liu, also known as Virtual Bacon, shared his systematic and strategic approach to navigating Bitcoin’s highs and lows.

He proposed three exit plans designed to signal when the market has reached its peak.

1. Price target: first pioneer

An initial signal to consider is the achievement of specific price targets, such as $200,000 for Bitcoin and $15,000 for Ethereum. Liu suggested that reaching these numbers could indicate that the market has reached its peak.

These criteria are based on historical market cycles and declining returns. These are clear, quantifiable metrics that take the guesswork out of exit decisions and highlight the need to set realistic, informed benchmarks.

2. Time constraints: second signal

Another pillar of Liu’s strategy is time-based. Regardless of market performance, he plans to exit by the end of 2025. This decision stemmed from an analysis of Bitcoin’s halving cycle and historical periods of bull markets.

By setting temporal boundaries, Liu introduces a disciplined approach to investing, encouraging investors to avoid the pitfalls of overextension. This time-limited liquidation strategy relies on the importance of past patterns in predicting future market behavior.

3. Price Pattern: The Third Indicator

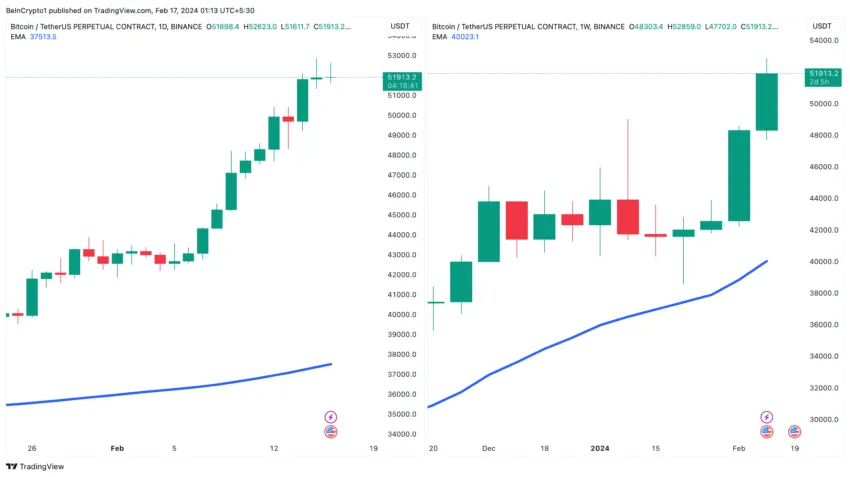

The final aspect of Liu’s plan involves closely monitoring Bitcoin’s behavior in relation to its price patterns, especially the 200-day and 21-week exponential moving averages (EMAs). A break below this support level will trigger a breakout, indicating a potential downtrend.

This approach relies on technical analysis and demonstrates the need for a nuanced understanding of market indicators and their impact on investment strategies.

“This is my exit plan. If any of the three conditions are met, go all out and never look back,” Liu concluded.

Read more: Bitcoin price prediction for 2024/2025/2030

Dennis Liu’s Exit Strategy provides a comprehensive guide to navigating the volatile cryptocurrency markets. By incorporating price targets, time constraints, and price patterns, Liu provided investors with a reliable roadmap. Sticking to this well-founded strategy can be the key to maximizing returns while mitigating risk.

disclaimer

In accordance with Trust Project guidelines, this price analysis article is provided for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate and unbiased reporting, but market conditions may change without notice. Always do your own research and consult with a professional before making any financial decisions. Our Terms of Use, Privacy Policy and Disclaimer have been updated.