Prediction markets are emerging as one of the most important growth stories for cryptocurrencies in 2026. Once a niche market in decentralized finance (DeFi), these platforms are now attracting billions of dollars in trading volume, increasing institutional interest, and increasing regulatory clarity.

These conditions could give a significant advantage to small-cap altcoins linked to the sector’s infrastructure and markets.

Low Capacity Altcoins to Benefit from Predicted Market Growth in 2026

By the end of December 2025, prediction markets had recorded weekly notional trading volume of over $4.5 billion, a new industry record. This is an increase of approximately 12.5% compared to the previous week.

According to industry commentator Martins, the Kalshi forecasting platform alone is worth over $1.7 billion and accounts for nearly 38% of all weekly activity.

boost

boost

This surge highlights how quickly prediction markets are expanding beyond their experimental roots.

This growth builds on the momentum seen throughout 2025. In November, prediction markets reached $9.5 billion in monthly trading volume, decisively outpacing meme coins and NFTs.

During the same period, meme coins generated about $2.4 billion and NFTs generated about $200 million, but traders have increasingly turned to outcome-based platforms that offer clear utility and informational value.

From speculation to utility-oriented market

The renewed interest in prediction markets reflects a broader shift in cryptocurrency behavior. Instead of chasing hype, traders are participating in platforms that make money by making predictions across political, sports, macroeconomic, and cryptocurrency events.

Dune data shows nearly 279,000 weekly active users, weekly notional volume of over $4 billion, and 12.67 million transactions, highlighting ongoing engagement rather than short-term speculation.

Institutional momentum is also accelerating adoption. Coinbase is reportedly preparing to launch a prediction market, and Gemini’s affiliate has secured regulatory approval to offer it in the United States.

Trump Media & Technology Group has also announced plans to enter the space. This move suggests that prediction markets are transitioning from fringe DeFi tools to regulated financial products.

As the sector grows, there is increasing demand for front-end platforms as well as reliable back-end infrastructure, especially Oracles, that accurately resolve outcomes. Meanwhile, several low-cost altcoins are attracting attention.

boost

boost

one

With a market capitalization of approximately $63 million, UMA plays a fundamental role in the prediction markets ecosystem. Secure Polymarket, one of the leading decentralized prediction platforms.

UMA’s optimistic Oracle design assumes data submissions are accurate unless disputed, a model that has proven effective at scale.

Since 2021, approximately 99% of claims have been resolved without controversy, and dispute rates have decreased as integration has improved, according to UMA.

These same dispute resolution mechanisms are now being used beyond prediction markets, including in intellectual property protection systems such as the Story Protocol.

As of this writing, UMA is trading at around $0.71, up slightly on the day. Although recent price action has been relatively quiet, UMA’s influence on market growth forecasts lies in infrastructure demand rather than retail speculation.

boost

boost

This could make it a potential long-term beneficiary if volumes continue to grow in 2026.

infinity

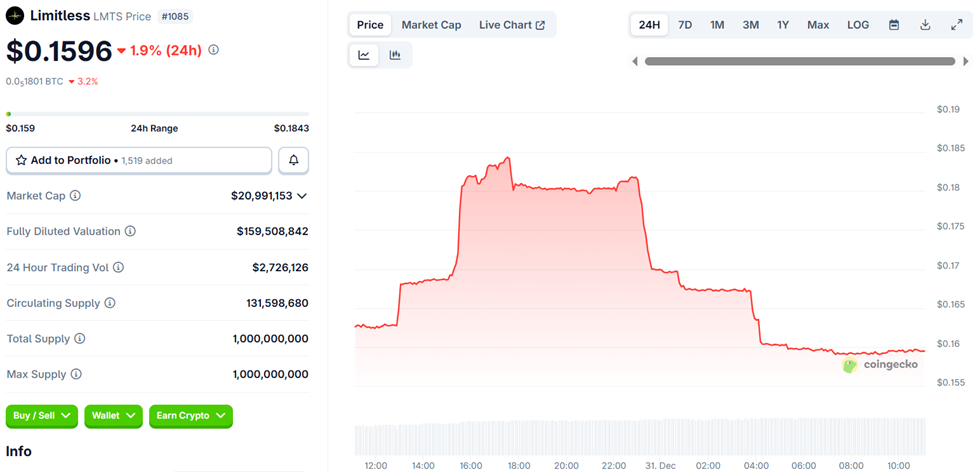

Limitless is another low-cap project that is gaining popularity, with a market cap of around $21 million. In December alone, the platform recorded more than $760 million in notional trading volume, compared to about $8 million in July.

Community commentary highlights continued growth in monthly active traders and expanding market coverage, including sports.

The LMTS token that powers the ecosystem fell slightly on the day, but adoption metrics show actual usage is increasing rather than hype-driven activity.

If prediction markets continue to expand in 2026, platforms like Limitless could benefit from getting in early with proven user engagement despite relatively small valuations.

boost

boost

prediction.fun

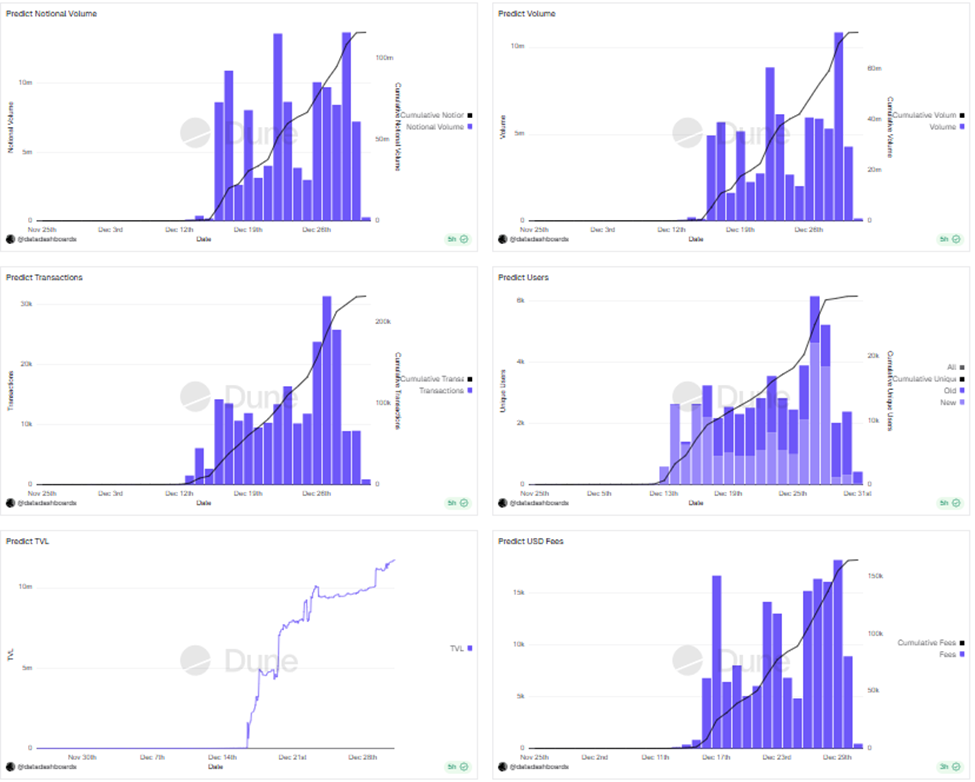

Predict.fun, built on the BNB chain, is a new entrant but has quickly gained attention. Despite its recent launch, the platform has surpassed $100 million in nominal volume, has over 30,000 daily transactions, and attracted over 6,000 unique users at its peak of activity. The total value locked recently exceeded $11 million.

Predict.fun, backed by YZi Labs, distributes weekly airdrops through its Predict Points system to provide liquidity and encourage active participation.

Early data suggests that the platform already has about 1% of the total forecast market size, an impressive number for a new entrant.

Forecast market outlook until 2026

Prediction markets are no longer just experimental betting tools. It is transforming into a data-driven financial product with institutional relevance.

As trading volumes increase and regulations stabilize, small-cap altcoins associated with this sector may see large-scale opportunities along with increased risks.

Projects such as UMA, Limitless and Predict.fun highlight the different ways investors can be exposed to these trends. If the current momentum is maintained, 2026 could be a defining year for prediction markets and the low-cap tokens built behind them.