- Huge amounts of USDT flowed from Tether to Ethereum exchanges.

- Network activity remained stable as ETH price fell.

Ethereum (ETH) has witnessed tremendous price volatility over the past few days. However, Tether (USDT)’s recent actions may help improve sentiment towards ETH.

USDT is in the mix.

According to data from Lookonchain, in the past 18 hours, a significant amount of USDT, specifically $318 million worth of USDT, has moved from Tether’s treasury wallets to exchanges on the Ethereum network.

These leaks significantly reduced Tether’s Ethereum holdings. At press time, their treasury holdings were only 124 million USDT.

To meet potential demand, Tether is expected to mint an additional 1 billion USDT on Ethereum soon.

Source: X

Tether has a history of issuing large amounts of USDT during periods of increased cryptocurrency activity. This does not necessarily guarantee a surge in Ethereum usage.

Ethereum is the primary platform for USDT, but other blockchains such as Tron can also be used for the same purpose.

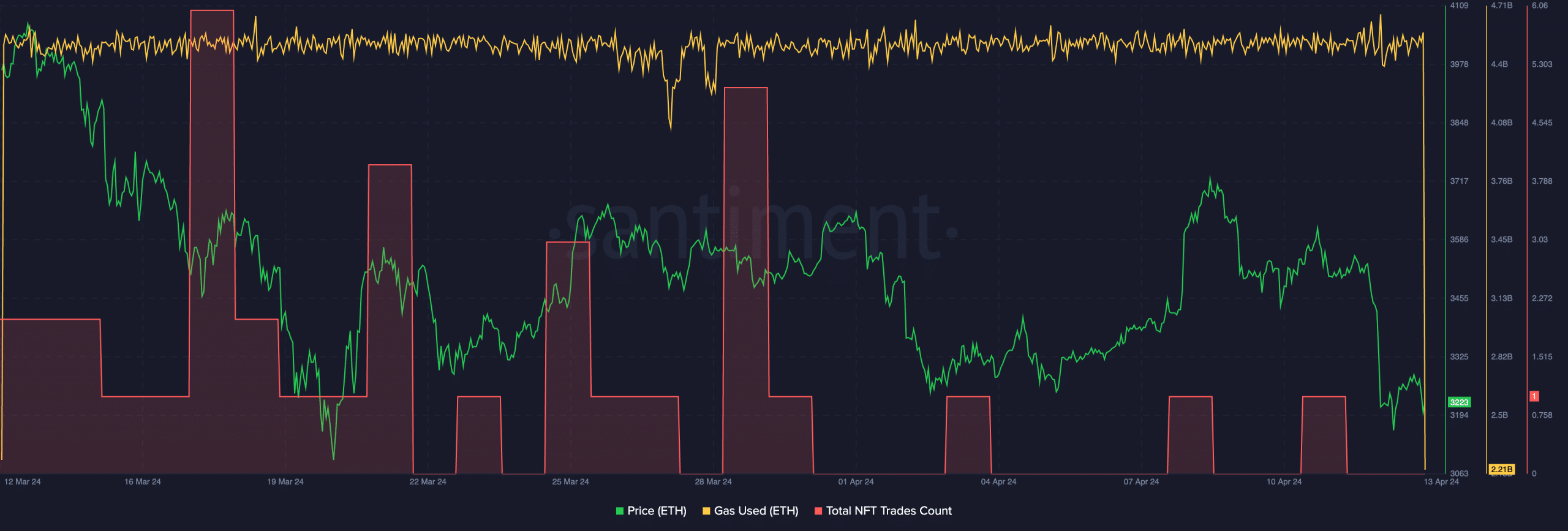

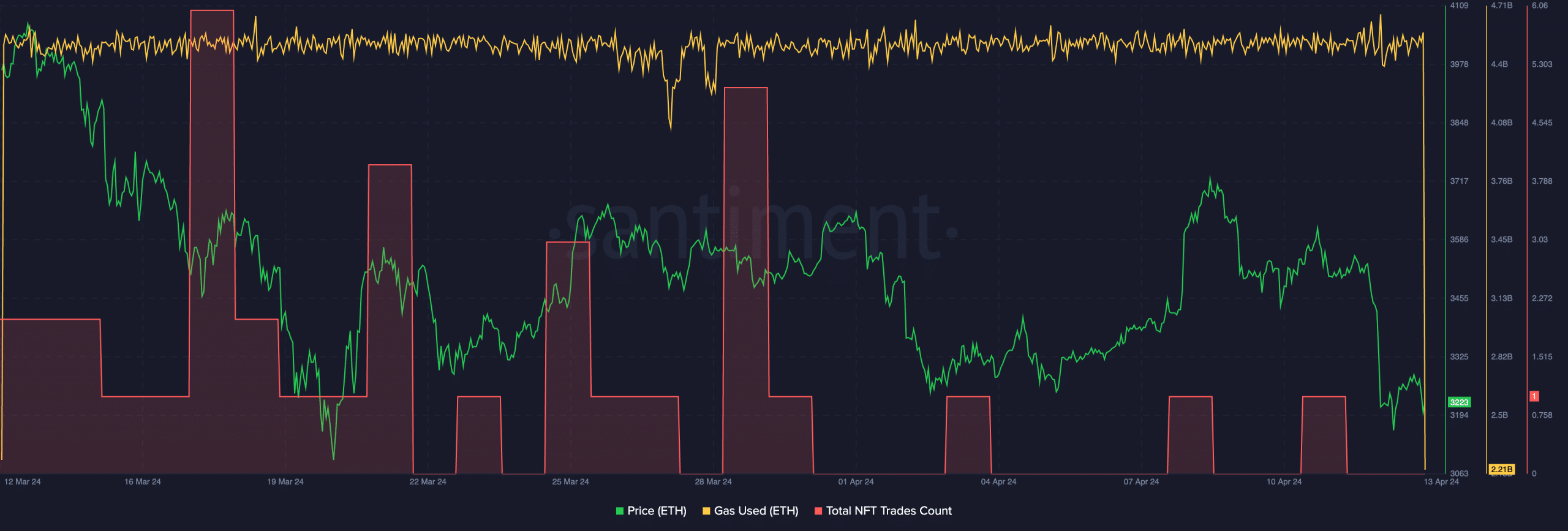

At press time, gas usage on the Ethereum network has remained the same over the past few days. However, NFT transactions taking place on the network have decreased significantly.

This suggests that other types of activities are picking up the slack. DeFi transactions, stablecoin swaps, or general token activity can contribute to stable gas usage.

On the NFT side, market corrections or a decline in public interest may play a role.

Source: Santiment

How are the holders doing?

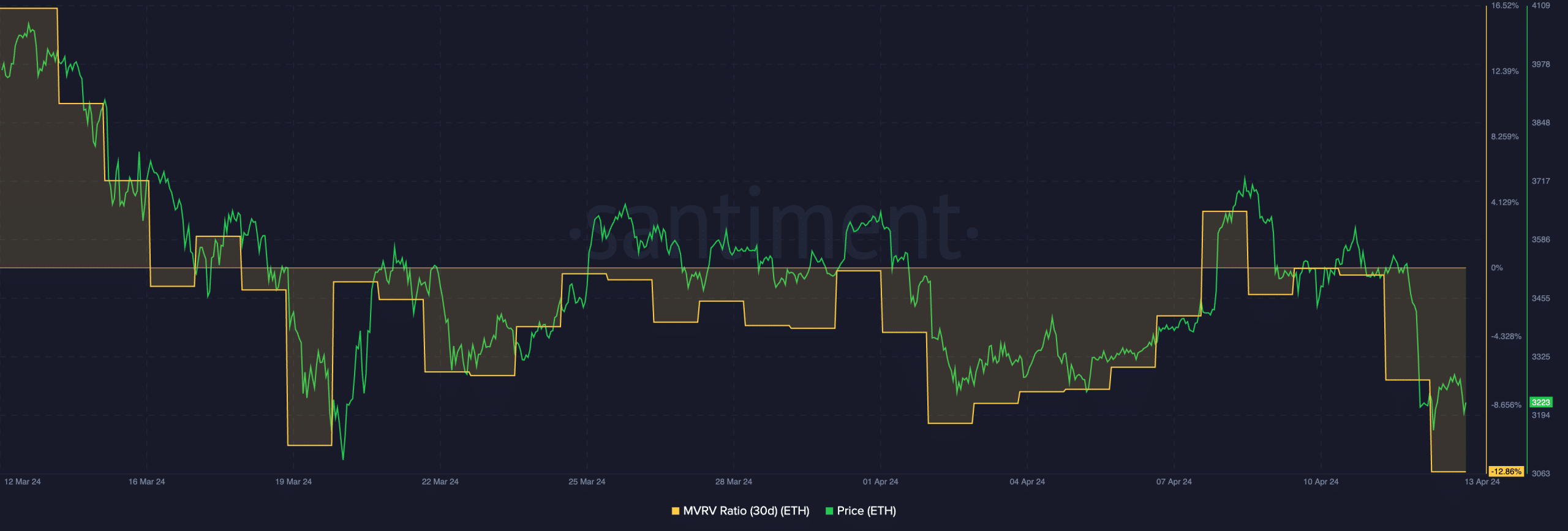

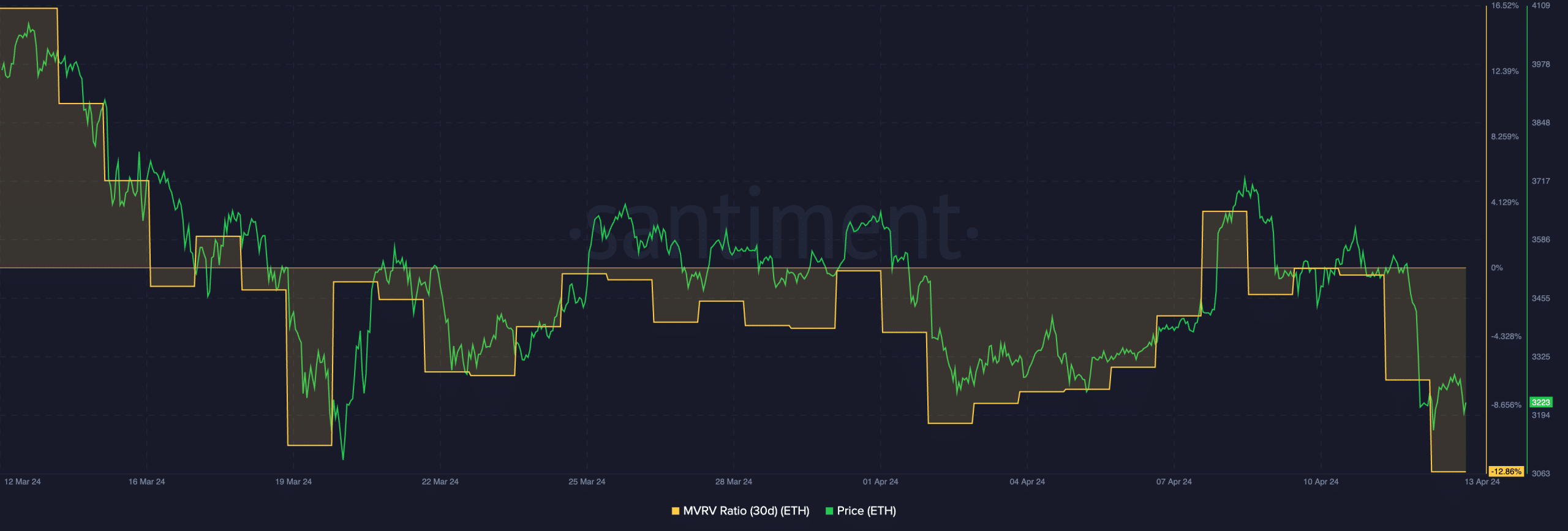

While Ethereum’s activity has been consistent, ETH’s price action has shown no signs of greening up. At press time, ETH was trading at $3,000.70, with the price down 2.74% in the last 24 hours.

If the price continues to fall, it could stay above the $3,000 level forever, which could send the market into further panic.

Read Ethereum (ETH) price prediction for 2024-25

As the price of ETH has fallen significantly over the past few days, the MVRV ratio of ETH has also fallen significantly. This indicates that most holders are unprofitable at the time of this writing.

However, ETH trading volume also increased by 11.79% during this period.

Source: Santiment