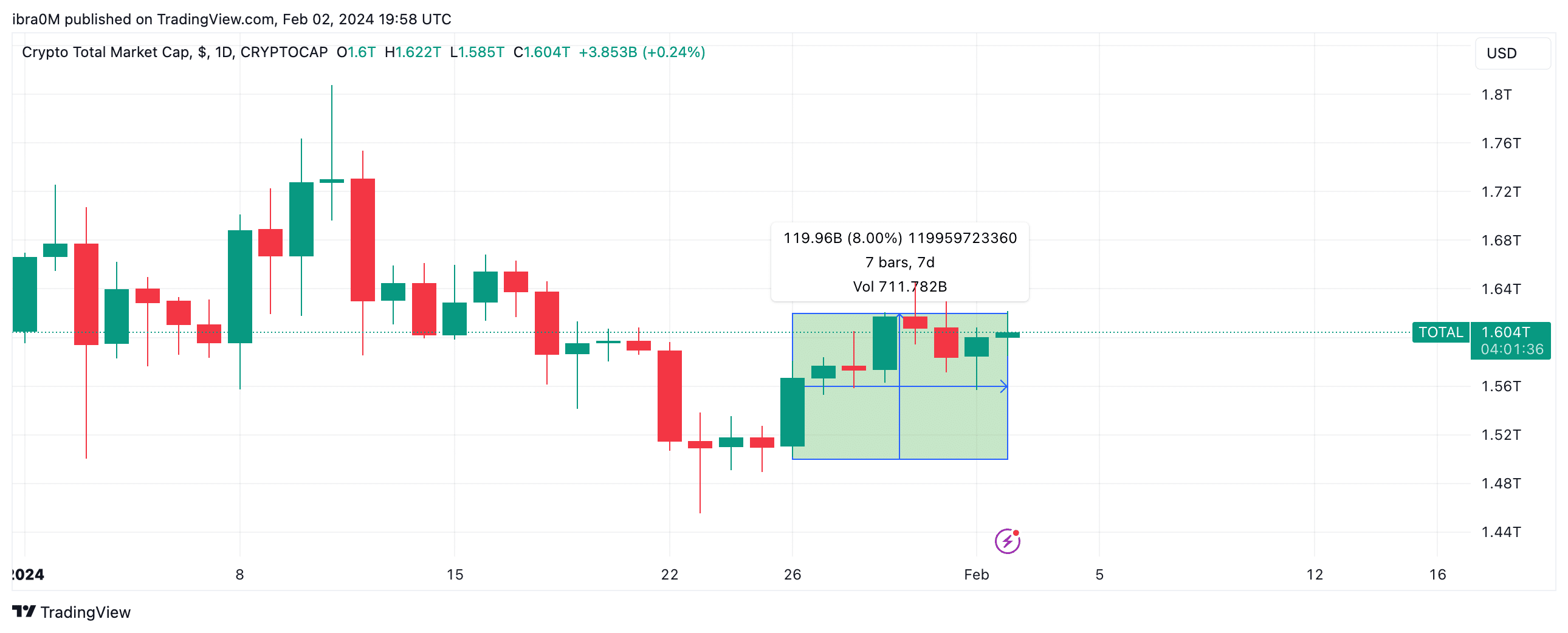

Global cryptocurrency market capitalization rebounded past $1.6 trillion on February 2 as the latest non-farm payrolls figures cast doubt on recent comments from US Federal Reserve Chairman Jerome Powell.

Jobs figures from the latest Nonfarm Payroll Report suggest that cryptocurrency bulls could have some positive price action.

Powell’s comments send cryptocurrency prices down $90 billion

On February 1, the global cryptocurrency market cap fell to $1.5 trillion. This comes just 48 hours after Powell made controversial comments suggesting delaying interest rate cuts until after March 2024, as had been widely predicted.

“Based on today’s meeting, I don’t think it’s likely that the committee will get to a point by the March meeting where they can confirm March as the time to do that. But that remains to be seen.”

Jerome Powell, Chairman of the U.S. Federal Reserve

Powell’s comments came after the Federal Open Market Committee (FOMC) meeting scheduled for January 31. This triggered significant declines across risk assets, including stocks and cryptocurrency markets.

Within 48 hours of Powell’s remarks, the prices of Bitcoin (BTC) and Ethereum (ETH) each fell 5%, and the overall cryptocurrency market fell 4.3%, falling 900% between January 30 and February 2, as shown in the chart. It fell by more than a billion dollars. above.

However, on-chain signals suggest that Ethereum investors have doubled down on their bullish positions despite the market decline. Additionally, the latest official non-farm payrolls report released on February 2 could set the stage for a more bullish recovery phase in the coming days.

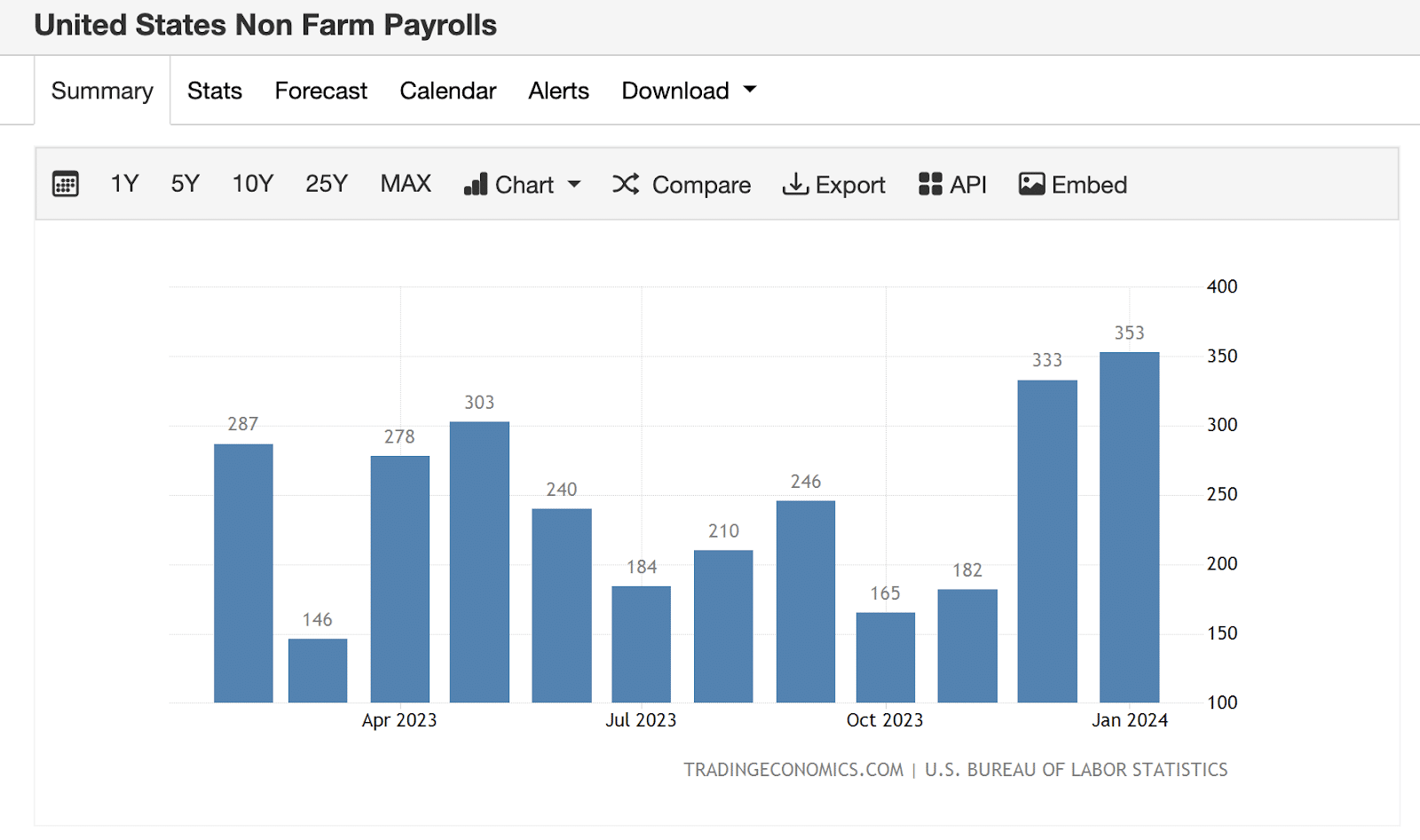

The non-farm payrolls report nearly doubled market expectations.

On February 2, the Bureau of Labor Statistics released the latest edition of its monthly Nonfarm Employment Report. Ahead of the latest numbers, market analysts had priced in an increase of 180,000 U.S. nonfarm jobs, according to consensus data compiled by TradingEconomics.

U.S. non-farm companies added 353,000 jobs in January 2024, 92.8% higher than market expectations, according to official figures released on February 2. A closer look shows that the 20,000 job gain represents the fourth consecutive month of growth since October 2023.

Impact of US Non-Farm Payroll Report on Cryptocurrency Markets

Strategic investors may interpret better-than-expected employment data as a potentially bullish indicator for risky assets, including stocks and cryptocurrencies. Job growth typically signals an overheating economy, which often leads to consideration of rate cuts to cool the market.

This calls into question Chairman Powell’s recent comments that the Fed may delay rate cuts beyond March 2024, as widely expected.

Essentially, the latest U.S. nonfarm payrolls report for January 2024 has raised expectations among investors that a rate cut is imminent. This could spark more bullish trading activity across cryptocurrency markets going forward.

As of press time on February 2, the global cryptocurrency market cap is trending at $1.6 trillion, with $3.6 billion being added every day. Since the non-farm payrolls report was released, Bitcoin price has returned above $43,000 and Ethereum price has also regained the $2,300 area.

This tame positive response could set the stage for a more optimistic outlook in the coming days.