Albert Einstein once said:

If you look deeply into nature, you will understand everything better.

There are certain patterns in the natural world that surrounds our daily lives. It is found in nature, is used in psychology, statistics, graphic design, and the stock market, and is probably the most important mathematical function to know when entering and exiting the cryptocurrency market.

First described by German mathematician Carl Gauss, this mathematical function goes by several names depending on the field in which it is applied.

If you’re a graphic designer, you might know it by the name Gaussian function (or Gaussian blur). In statistics, it is also called “normal distribution” or “standard deviation”, as it is used in probability distributions. However, most people will be familiar with the common name “bell curve,” which is the name that best describes the shape.

The bell curve is easily identifiable and has been an important technique used in the stock market to determine the best time to enter or exit the market, and cryptocurrency investors can (and should) use the same.

The bell curve can be found in almost every aspect of life and has proven to have very accurate applications in a variety of fields.

For example, if we look back at the first major Bitcoin bull run in late December 2017, when the price rose from around $3,000 to nearly $20,000, we can see the shape of a bell curve.

Mid-2021 saw the same curve emerge, with the Bitcoin price rising sharply from $11,000, peaking at $63,000, and then falling back to $30,000.

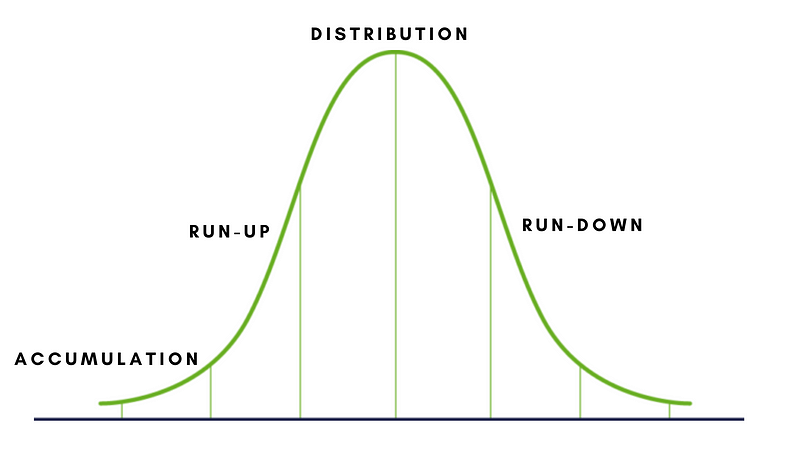

Although applying a bell curve can represent a normal probability distribution, a graphical representation of a bell curve can also be used to determine the four stages of a market cycle and identify the best times to enter and exit a market. .

4 stages of the cryptocurrency market cycle

The same bell curve can be used to identify the four stages found within a market cycle: slow accumulation, rapid rise, price stagnation, and subsequent price decline. This is a pattern that repeats itself over and over again in every market.

Unfortunately, there seems to be a belief, especially within cryptocurrencies, that prices will continue to rise without taking into account the cycles of the natural world, to which the cryptocurrency market is not immune.

There is a cycle and there will always be a cycle. All cryptocurrencies and markets have a natural tendency to follow this pattern.

The good news is that when this cycle ends, the next cycle begins.

The problem for many investors, especially cryptocurrency traders, is that they do not recognize that markets are cyclical in nature and are unable (or unwilling to admit) to predict the final stages of the cycle.

Although it is nearly impossible to accurately pick the highest or lowest point in a given cycle, understanding that cycles exist and knowing which cycle the market is in can help you identify the optimal times to buy and sell, maximizing and minimizing your profits. It helps you do that. your loss.

Borrowing from traditional market analysis, here are the four main stages of the market cycle and how to recognize them.

accumulation phase

The accumulation phase is the beginning of a new project or the end of a previous phase when the market has already bottomed out. For new projects, early adopters or insiders join the project.

When the market bottoms, the weak hands sell and the smart money buys, deciding that the worst is over. This is the beginning of a new cycle and many call it “buying the dip.” This is the point in the cycle where prices are lowest. This is also the point where market sentiment moves from negative (in the previous cycle) to neutral.

Preparation phase (bull market)

The rising phase (also known as a bull market when looking at the market as a whole) is the phase in which the market begins to move toward higher peaks at an increasingly faster rate. At the beginning of this phase, the technical analyst selects these projects and at this point early majority enter the market

This is the point when the market direction becomes clear and overall market sentiment becomes optimistic.

Towards the end of this stage, FOMO (fear of loss) increases. That’s because more and more investors are buying near the highs for fear of missing out.

The end of this step is marked by: Many reviews As we took the plunge, the market size increased significantly. This is often seen even when market valuations appear excessively high and overvalued.

This is also where the smart money and insiders start selling.

Once prices begin to stabilize, this will cause the market to Deployment Stage The final wave of investors is jumping in. This is where excessive profits appear over very short periods of time and where media interest in the market is at an all-time high.

Deployment Stage

In the third stage of the market cycle, prices stabilize and sellers begin to dominate. This part of the cycle is identified as a period in which the bullish sentiment of the previous phase gives way to a mixed sentiment. Prices appear to plateau as price momentum slows and trades within narrow ranges that can last for days or weeks.

This stage ends when the market changes direction. This is when classic TA patterns such as head and shoulders, double or triple tops are discovered and indicate a change in direction.

This is an emotional time as it represents the top of the market. The majority of the market is looking to the recent past in hopes of continued excessive profits, and greed is trumping common sense. We live in an era where smart money has already disappeared and expectations and fears coexist in the market.

Down phase (bear market)

The final stage of the market cycle is decline. For the majority of investors, this is one of the most difficult times and a very emotional one. Within the cryptocurrency market, this seems to be the time to spread the firm belief on social media that prices will continue to rise.

However, due to the nature of this world, there will always be a phase of decline and this seems to be one of the hardest lessons for the cryptocurrency community.

Psychologically, this is also the most difficult thing for cryptocurrency investors. This is because they fail to recognize or ignore the permanence of market cycles, which leads them to sell too late or not at all.

Of course, it is also possible to wait for the next price rise (HODL). However, doing so can significantly reduce your ROI and limit future investment opportunities.

How long does this cycle last?

Although the cryptocurrency market is still in its infancy, historical data indicating the duration of market cycles is limited. The biggest market rise occurred in 2017, when the price went from ~$3,000 to nearly $20,000.

2021 saw another large rally, with the price rising from ~$10,000 to ~$63,000.

These cycles are related to the Bitcoin halving cycle, a programmatic event in which the creation of new Bitcoins is halved, reducing supply and consequently increasing the market price.

Bitcoin Halving – How to Make a Crypto Millionaire

A 4-year method to create a cryptocurrency millionaire by using the Bitcoin halving cycle and leveraging it as part of a profitable investment strategy.

During the Bitcoin halving (the accumulation phase of the market), there was one type of cryptocurrency that outperformed all other investments. These are Small Cap Alts.

Opportunity to Make Millions in Cryptocurrency

This opportunity will make an investor a millionaire and it only comes around once every 3-4 years. This is a cycle that the cryptocurrency market has always followed.

When should you buy and when should you sell?

Known as contrarian investing, investors intentionally go against the general market trend, selling when the market is buying and buying when the market is selling.

When to Buy

The accumulation phase is the best time to buy into the market. For new projects, this may be when it is first proposed or after the end stage of the last cycle. This is when prices stop falling while the market is still weak. Also called ‘buying the dip’.

When to sell

According to contrarian investing, the best time to sell is after preparation and before the distribution phase begins. This is the time when market sentiment is at its most optimistic, prices are still rising and everyone, including the media, is talking about it. For the smart money, now is the time to sell.

reality

Unfortunately, we all want to believe that prices will continue to rise. Especially in the cryptocurrency market, when prices continue to rise, it becomes difficult for most investors to sell.

But the nature of reality is that prices always fall. The bell curve is a function of our reality. This is why a contrarian approach to investing in the cryptocurrency market is important.

conclusion

Knowing and using this knowledge when investing in cryptocurrency will help you minimize risk and maximize returns.