One analyst pointed out two areas of demand that could be important for Bitcoin. Based on these supply barriers, here’s what’s next for BTC:

Bitcoin on-chain support and resistance levels can provide hints about the next steps.

As analyst Ali explains in a new article: post At X, Bitcoin has recently been floating between the two major supply walls for the asset. The “supply wall” refers to the amount of Bitcoin acquired in a specific price range.

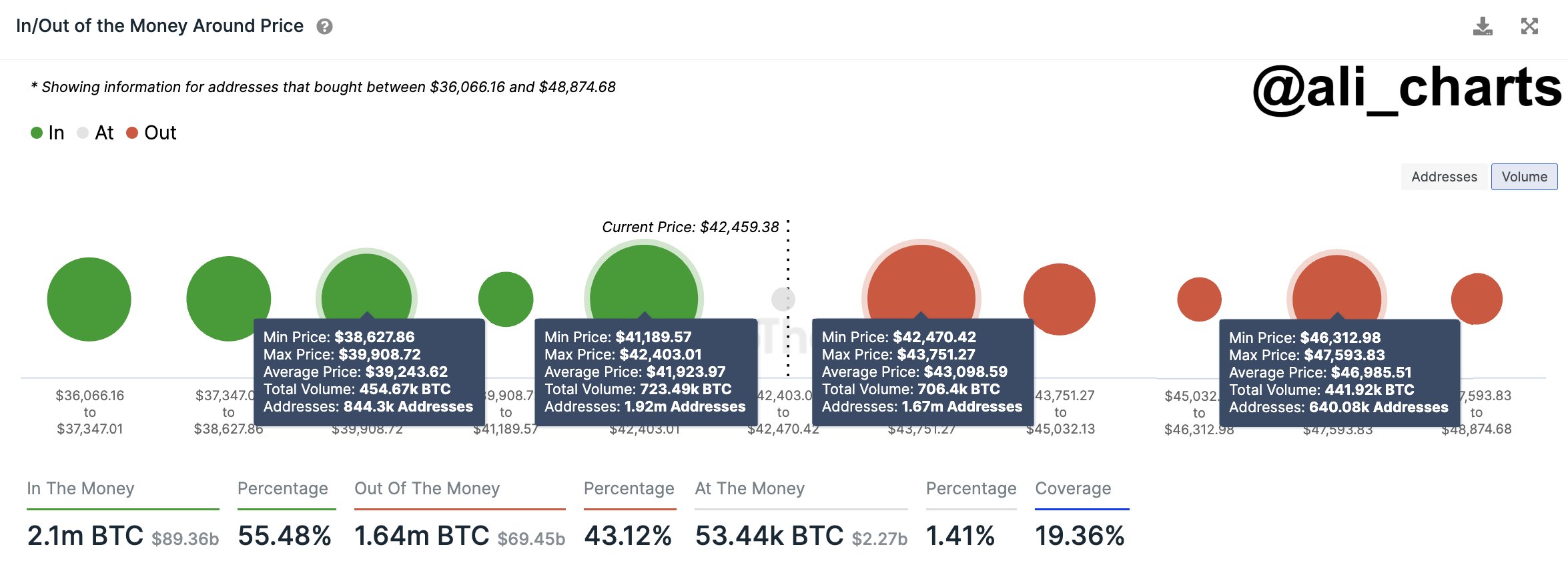

The chart below shows what BTC’s various supply walls look like for the cryptocurrency’s current spot price range.

The data for the on-chain support and resistance levels | Source: @ali_charts on X

In the graph above, the size of the dots represents the number of coins purchased by investors within that range. The $41,200-$42,400 and $42,400-$43,700 ranges appear to have particularly high supply.

More specifically, the former range saw 1.92 million addresses purchasing a total of 723,490 BTC, while the latter accumulated 706,400 BTC from 1.67 million holders.

For all investors, the acquisition price or cost basis is important. This is because the profit loss situation could potentially change if asset prices are retested. Holders are therefore more likely to show some reaction when such retests are conducted.

Naturally, the reaction of a small number of investors has no impact on the market, but if many addresses share a cost basis within a narrow range, the reaction following a retest can be significant.

For this reason, major supply barriers (like the two previously mentioned) could end up being a significant retest for Bitcoin. Typically, assets are more likely to feel support when these retests occur from above, while coins may feel some resistance when they appear from below.

This effect seems to follow because of the way investor psychology works. Investors who took profits before the retest may want to gamble further, believing that the same price range will be profitable again. These purchases are a source of support.

Likewise, loss holders will be tempted to sell when the price reaches the breakeven point. This is because you may not want to take the risk of holding any longer as the coin may fall again and pull you back into the water.

Bitcoin has been trading between two major supply walls during its recent consolidation. “Continued ad valorem beyond these boundaries will help gauge BTC’s trend,” says Ali.

The chart shows that the next major resistance ahead is between $46,300 and $47,600, while $38,600 to $39,900 holds the next major support below. “A break above the resistance line could push BTC up to $47,600, while a fall below the support line could trigger a correction towards $38,600,” explains the analyst.

BTC price

Bitcoin has recently continued its sideways trend and is trading around $42,700.

Looks like the asset's price has been stuck in consolidation during the last few days | Source: BTCUSD on TradingView

Featured image from Shutterstock.com, chart from TradingView.com, IntoTheBlock.com

Disclaimer: This article is provided for educational purposes only. This does not represent NewsBTC’s opinion on whether to buy, sell or hold any investment, and of course investing carries risks. We recommend that you do your own research before making any investment decisions. Your use of the information provided on this website is entirely at your own risk.

Source: NewsBTC.com