From predictions that BTC will hit $100,000 in 2024 to searching interest in “Bitcoin halving,” here’s a data-driven look at this rare event.

Bitcoin is approaching its fourth halving, and no two events are the same.

The market has become unrecognizable from what it was four years ago.

Here are five interesting facts about the 2024 halving.

1. Bitcoin is not far away

Bitcoin is structured so that most of its total supply is already in circulation.

After the halving, there will only be 1.3 million BTC left for miners to discover, which should last until 2140.

From now on, only 450 BTC will be created per day, meaning that between now and 2028, only 657,000 BTC will hit the market.

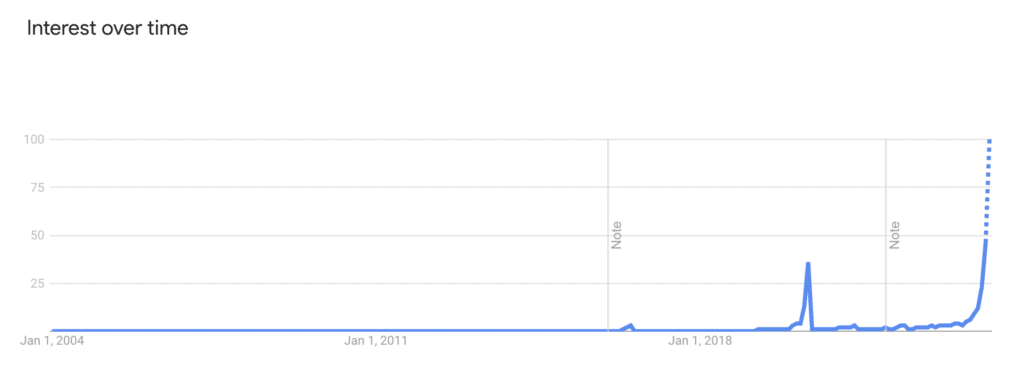

2. If you search ‘Bitcoin halving’ on Google, the record will be broken.

Although there were slight increases in 2016 and 2020, record numbers of internet users are scrambling to learn more about the 2024 halving.

Nigeria, Netherlands, Switzerland, Cyprus and Slovenia top the list of countries most interested in the upcoming 50% block reward cut, according to Google Trends data.

3. BlackRock is *very* bullish.

The world’s largest asset management company recently attracted attention by launching an exchange-traded fund based on the spot price of Bitcoin.

This means that for the first time, many institutional investors can gain exposure to the halving without owning the digital asset directly.

BlackRock executive Jay Jacobs said the iShares Bitcoin Trust, which currently has $18 billion in assets under management, is the fastest-growing ETF of all time. It’s still at an early stage. Last week he wrote to X:

“So many advisors and institutions are just beginning their educational journey about Bitcoin to ultimately determine whether it is a good fit to add to their portfolio. For many, this will be a journey that will take months or even years.”

Jay Jacobs

In a recent blog post, Jacobs said the halving was “critical to Bitcoin’s value proposition as a transparent cryptocurrency with a finite supply.”

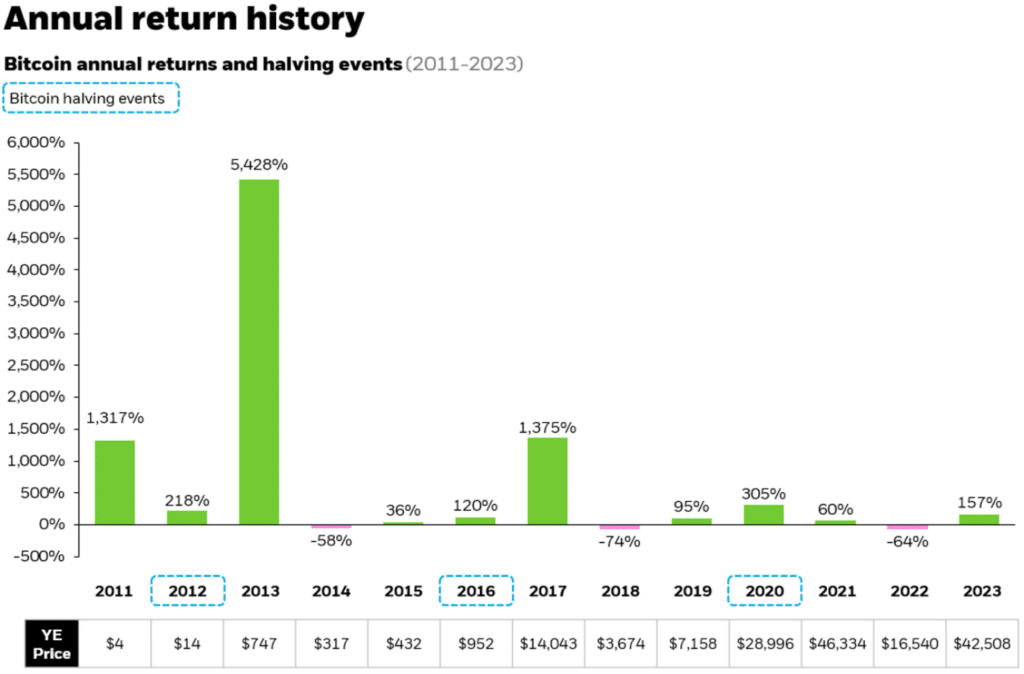

He also shared a chart showing that BTC typically has its highest returns in the year following a halving. It was 5,428% in 2013 and 1,375% in 2017.

But during the third halving in 2020, things were a little different. BTC’s 305% gain that year far exceeded the 60% growth that followed in 2021.

It remains to be seen how long the current bull market will last, with BTC hitting new all-time highs before its first-ever halving.

4. Bitcoin Ordinals also appear

A relatively recent development in the Bitcoin ecosystem concerns Ordinals, this blockchain’s answer to non-fungible tokens.

This allows rare messages, images and videos to be engraved on a single satoshi (equivalent to 100 millionth of a Bitcoin).

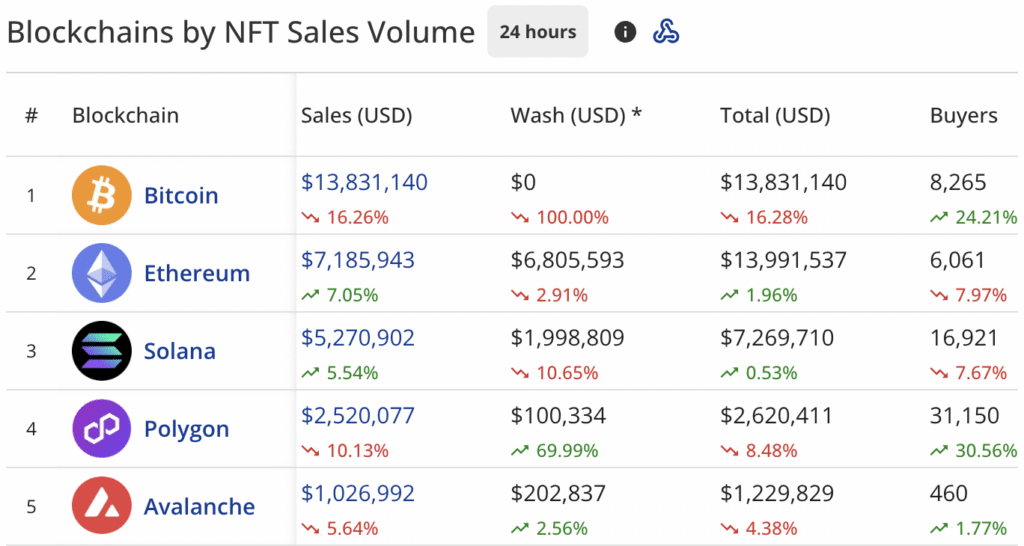

Demand for Ordinals has skyrocketed, and this despite Binance discontinuing support for these cryptocurrency collectibles.

Data from CryptoSlam! Ordinals sales hit $13.8 million in just 24 hours. This is more than Ethereum and Solana combined.

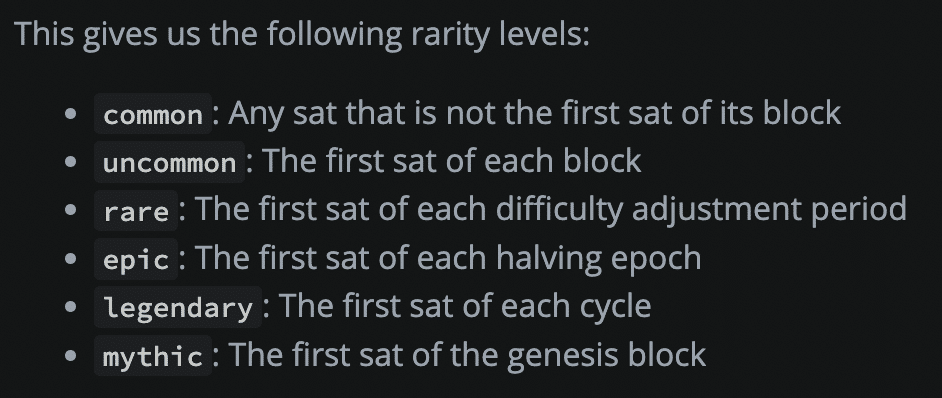

There are also special expectations for the first mining of Tots after the halving. Especially considering that this will be one of only four in existence.

Casey Rodarmor, creator of the Ordinals protocol, said the protocol would have “epic” rarity.

According to Ordiscan founder Tristan, if you are selected as one of the lucky miners to receive this sat, you could receive a huge payout that far exceeds the block reward reduction. He wrote in his blog post:

“Knowing that a Rare Sat is selling for $100,000 and its supply is 100 times greater than an Epic Sat (410 to 3), we can safely say that the value of an Epic Sat is probably at least 10 times more than a regular Sat. I rarely sat down.”

Tristan, founder of Ordiscan

Did you ask about the total price tag? A cool million dollars.

5. Short-term outlook is uncertain

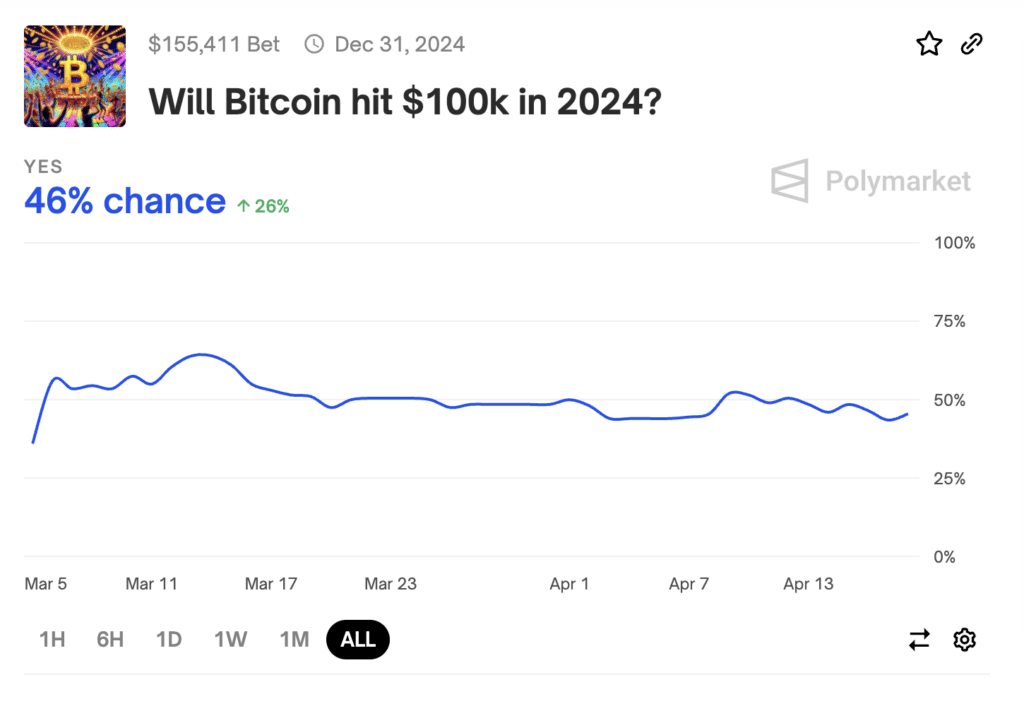

It would be too easy to randomly throw away Bitcoin price predictions, but in the betting market, people are putting their money where their mouths are.

And if Polymarket’s odds are to be believed, BTC’s prospects haven’t looked very promising in recent months.

According to the latest statistics, bettors believe there is only a 46% chance of Bitcoin reaching $100,000 this year, and sentiment has fallen over the past few weeks. Only 11% believe they will earn $250,000 by December.

With BTC briefly falling to its lowest price since February as the halving approaches, 17% believe the world’s largest cryptocurrency will not exceed $60,000 on the day.