- September is considered an important month for cryptocurrencies, with most assets seeing declines.

- Current market sentiment is fearful, which could impact the trend this month.

In recent weeks, Bitcoin (BTC) has experienced significant price volatility, dropping below the psychological level of $60,000.

While this downtrend is affecting the entire cryptocurrency market, it also shows the potential for a cryptocurrency bull market, especially since September is historically known as a month of negative trends in financial markets.

However, several indicators suggest that this pattern will break down in September and cryptocurrencies will show strength.

Decrease in foreign exchange reserves

One of the key indicators supporting the possibility of a crypto bull market is the decline in exchange holdings of Bitcoin and Ethereum (ETH).

Historically, a decline in the balance of these assets on exchanges meant that investors were moving their holdings into cold storage.

This indicates a long-term holding mentality rather than a desire to sell. This trend often precedes a bull market, as exchanges reduce the available supply of these assets, creating conditions for upward price pressure.

As of this writing, Bitcoin exchange holdings are down to around $2.62 million, continuing a downward trend. Likewise, Ethereum holdings have fallen to around $18.7 million.

This pattern of declining reserves intensified late last year and has continued to this day, which could provide a backdrop for significant price increases.

Market Psychology: Fear as a Precursor to Greed

Another factor that suggests a bull market in cryptocurrencies is the current market sentiment, as measured by the Crypto Fear and Greed Index.

This index measures the overall sentiment of the market, with extreme fear indicating a buying opportunity and extreme greed indicating a market peak. Historically, a shift from fear to greed often precedes a bull market.

According to data from Coinglass, the market is currently gripped by fear.

These emotions create an environment conducive to the start of a bull market, as fear often leads to surrender, which then turns to greed as prices recover.

The cyclical nature of market sentiment suggests that periods of fear may soon be followed by periods of strength.

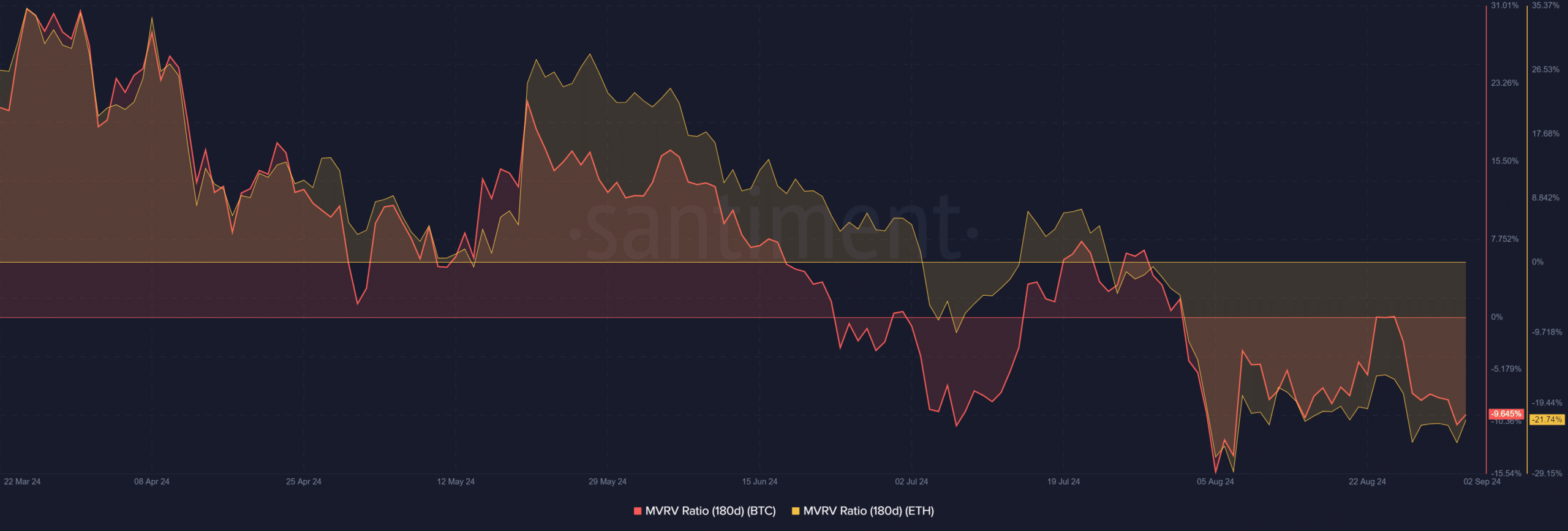

MVRV Ratio: Bullish Signal

The Market Value to Realized Value (MVRV) ratio is another important indicator of a potential bull market. The MVRV ratio measures whether the market value of an asset is higher or lower than its realized value.

When MVRV is below 0, it generally indicates that the holder is losing money, suggesting that the asset is undervalued and may need to be adjusted.

Source: Santiment

As of this writing, Bitcoin’s 180-day MVRV is around -9.6%, indicating that long-term holders are taking losses of more than 9%.

Likewise, Ethereum’s MVRV has been below 0% since July, and is currently at -23%, meaning Ethereum holders are seeing a loss of more than 23%.

These negative MVRV levels suggest that both assets are significantly undervalued, and a correction above zero could trigger a bull market.

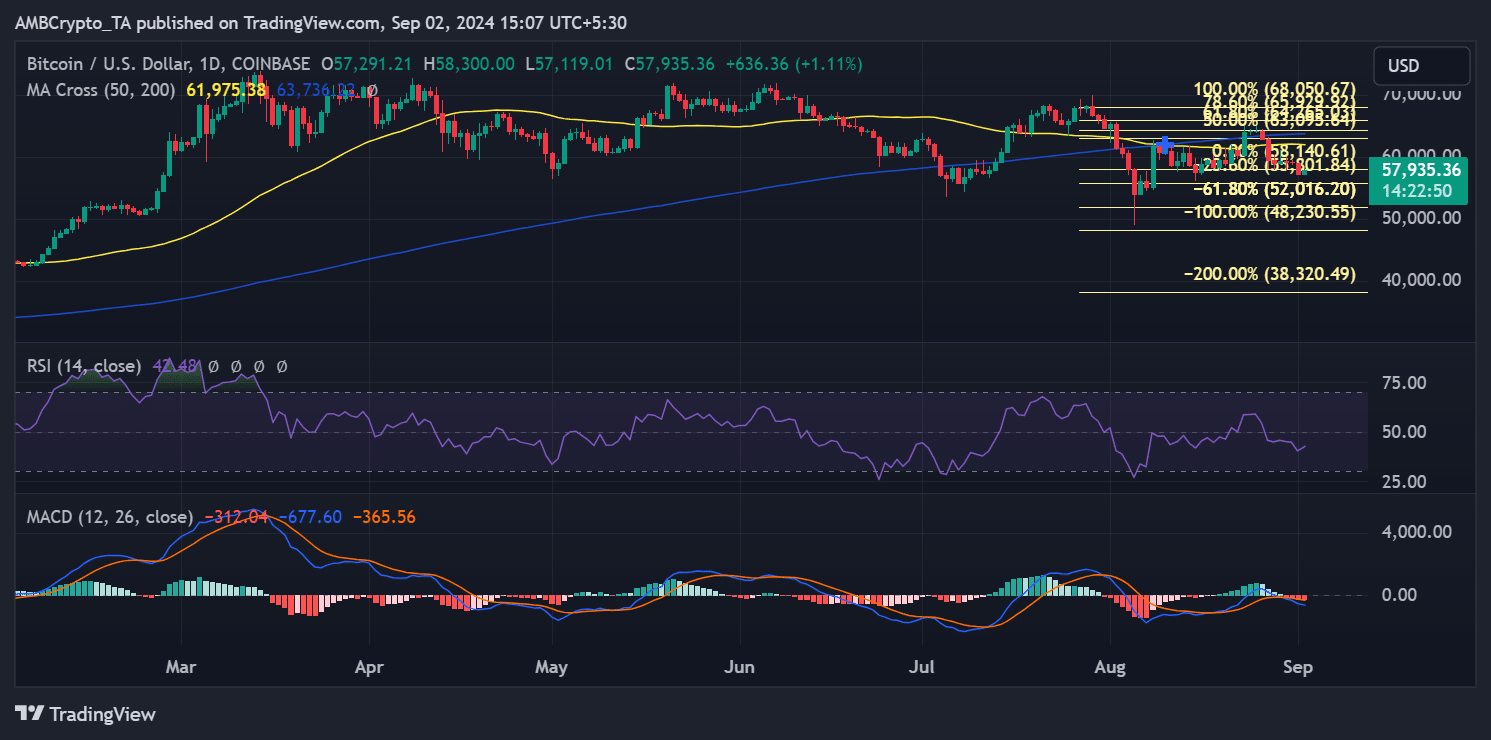

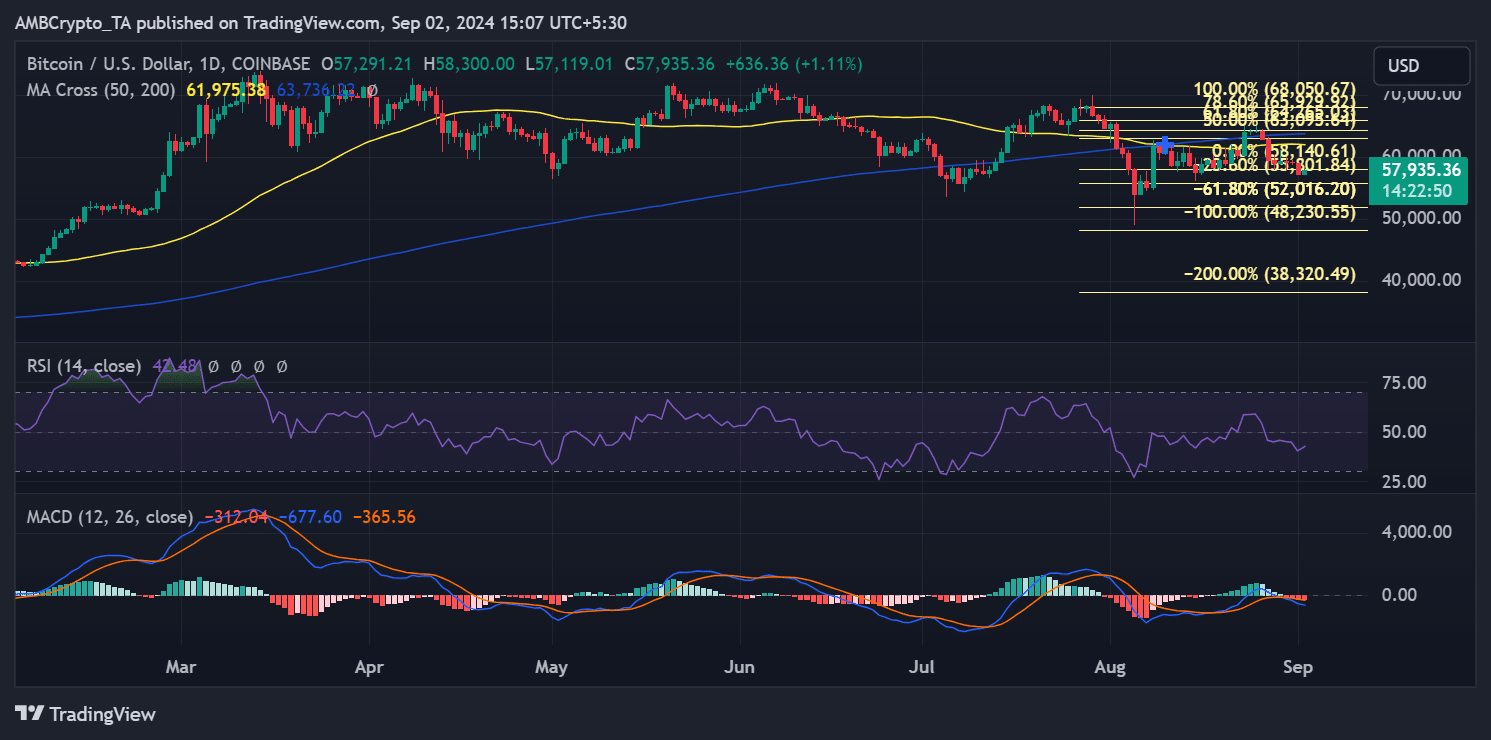

Support and resistance levels

From a technical analysis perspective, the Bitcoin price is below both the 50-day and 200-day moving averages, which indicates that the market is in a bearish or consolidation phase.

However, a move above these moving averages could signal the start of a new bullish phase.

Source: TradingView

Also important is the 61.8% Fibonacci correction level, which is currently acting as a key support level near $52,016.20.

Bitcoin has tested this level and is trading above it, so if it stays above this level, it suggests that the bullish trend could resume.

Also, the 38.2% correction level, which acts as a resistance line, is another key level to watch around $58,140.61. A break of this level could trigger further upside, signaling the start of a bullish trend.

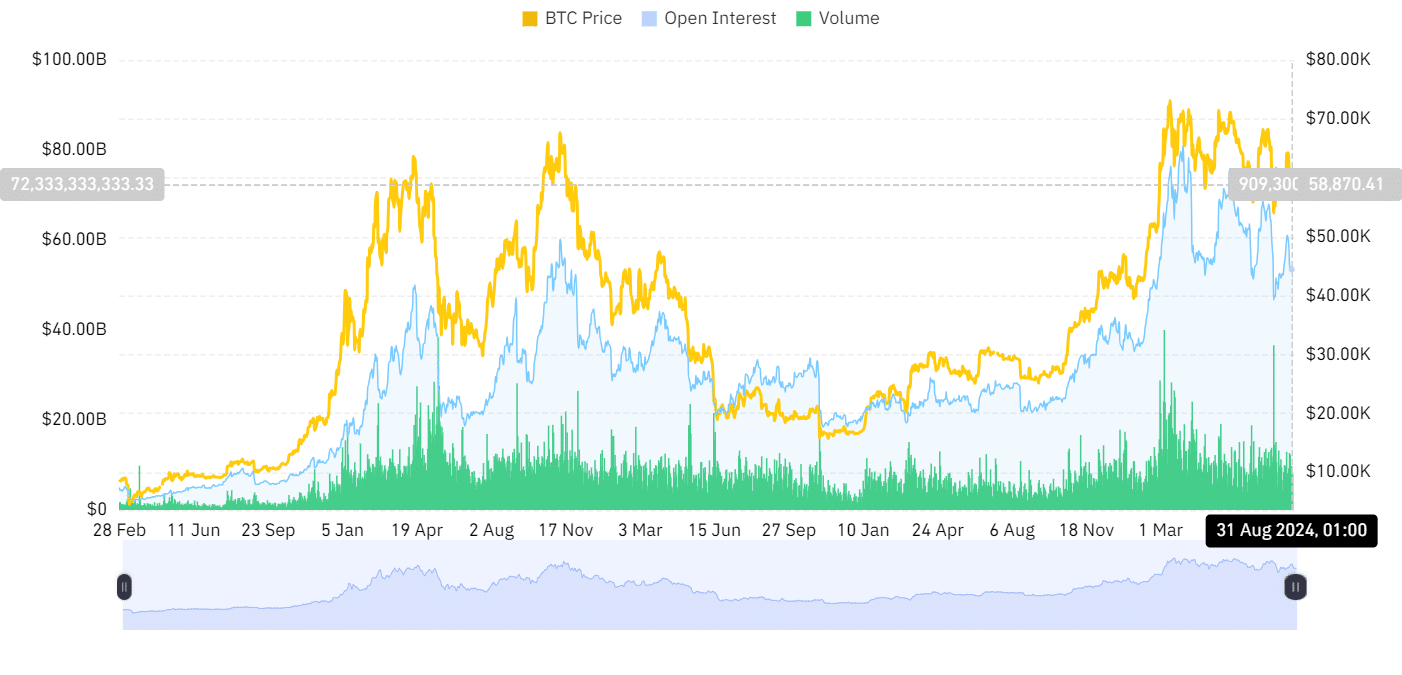

Unpaid Interest and Volume

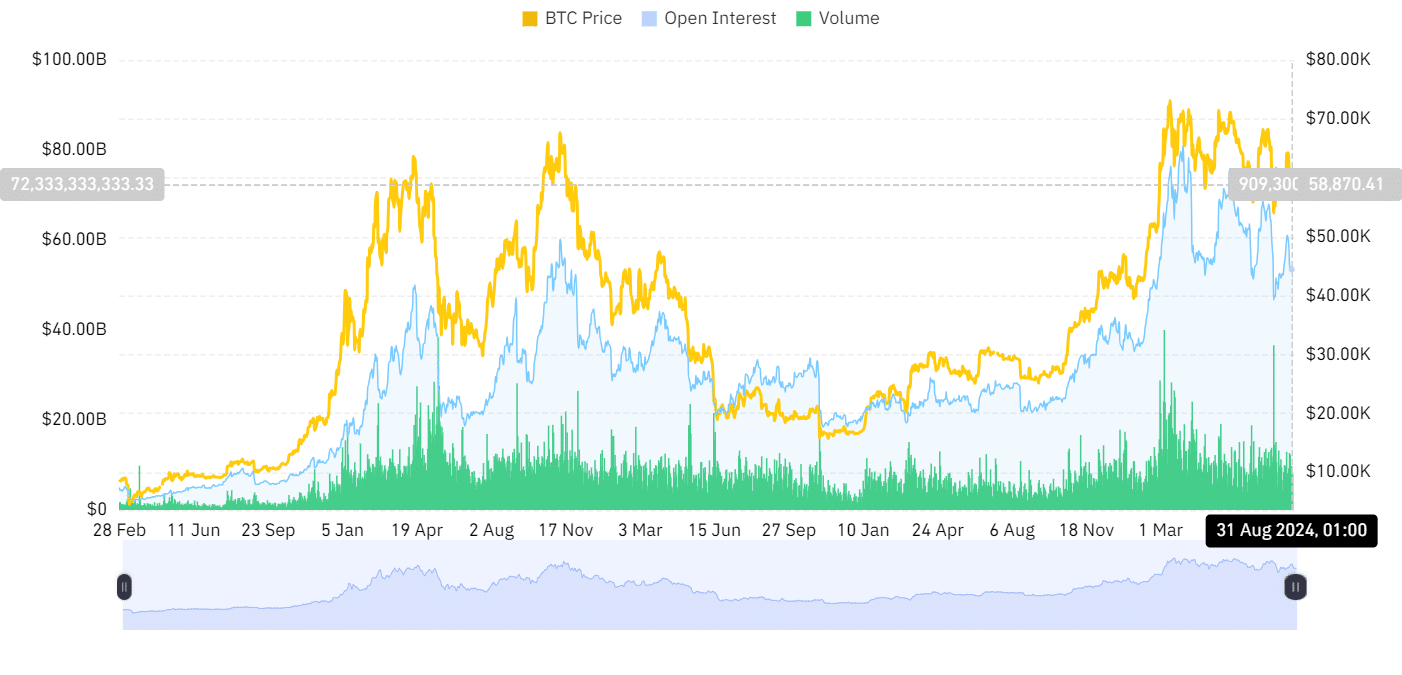

Open volume and trading volume are also essential metrics to consider when assessing the potential for a cryptocurrency bull market.

Earlier this year, the cryptocurrency rally peaked in March, with Bitcoin hitting an all-time high of around $73,000.

During this period, open interest and volume increased, with open interest exceeding $75 billion and volume exceeding $199 billion.

Source: Coinglass

The outstanding contract size also decreased to about $50 billion, and the trading volume decreased to about $100 billion.

However, if these indicators start to rise again, especially when combined with bullish sentiment, it could be a sign that a new bull market has begun.

Is a Crypto Bull Run Expected in September?

Historically, September has been a tough month for crypto markets, but several indicators suggest that this year could be different.

Read our Bitcoin (BTC) Price Prediction 2024-2025

Declining exchange reserves, a fearful market, a huge negative MVRV ratio, and key technical levels all point to the possibility that the cryptocurrency could soon see a bullish turn.

As Bitcoin and Ethereum continue to shape the broader market trend, the coming weeks could be crucial in determining whether the market shifts from fear to greed, potentially leading to significant price increases.