There are many layer 1 blockchains on the market. This means that there is fierce competition in this field, which also means it creates a healthy environment. Remember that only the strong survive. But who are those survivors?

There are several ways to determine which criteria make a difference. Lucas, a senior intern at Bankless, wrote: twitter thread About 5 indicators to evaluate blockchain. We think they will be helpful. So, let’s take a look and find out what we need to pay attention to.

Bitcoin, Ethereum, Solana, Avalanche, Cosmos, Polkadot…

The Layer 1 environment is highly competitive.

How do you evaluate which one can take first place?

Here are five questions to answer:

🧶

— Lucas 🔥_🔥 (@0x_Lucas) July 6, 2022

1. Security

Layer 1 blockchain is the payment layer for value. Their function is to provide a secure and immutable ecosystem. In this case, what makes a blockchain secure is its consensus mechanism with an advanced cryptographic model. On the other hand, immutability in blockchain refers to the ability to prevent modifications to confirmed blocks.

Moreover, you can measure blockchain security in these two ways.

a) How much does it cost to attack a network?

The only way to effectively attack a blockchain is to attack up to 51% of its hash rate. Therefore, if only a few people control network nodes, it is easier for them to agree and attack. This is most likely to happen in small networks.

Learn more about 51% attacks.#BTC #ETH #wazirXwarriors #blockchain #attack pic.twitter.com/QOmotZdAQt

— Nikhil D Prince 🇮🇳 (@NikhilDPrince) September 21, 2020

Another well-known form of attack is the Sybil attack. Here, the attacker will flood the network with many pseudonym nodes. This may affect your network.

b) How much does a validator receive in reward for being an honest actor?

Validators are equivalent to network nodes. This helps process and verify new blocks. This allows you to add blocks to the chain. In PoW blockchains, this means mining, and in PoS blockchains, this is called staking.

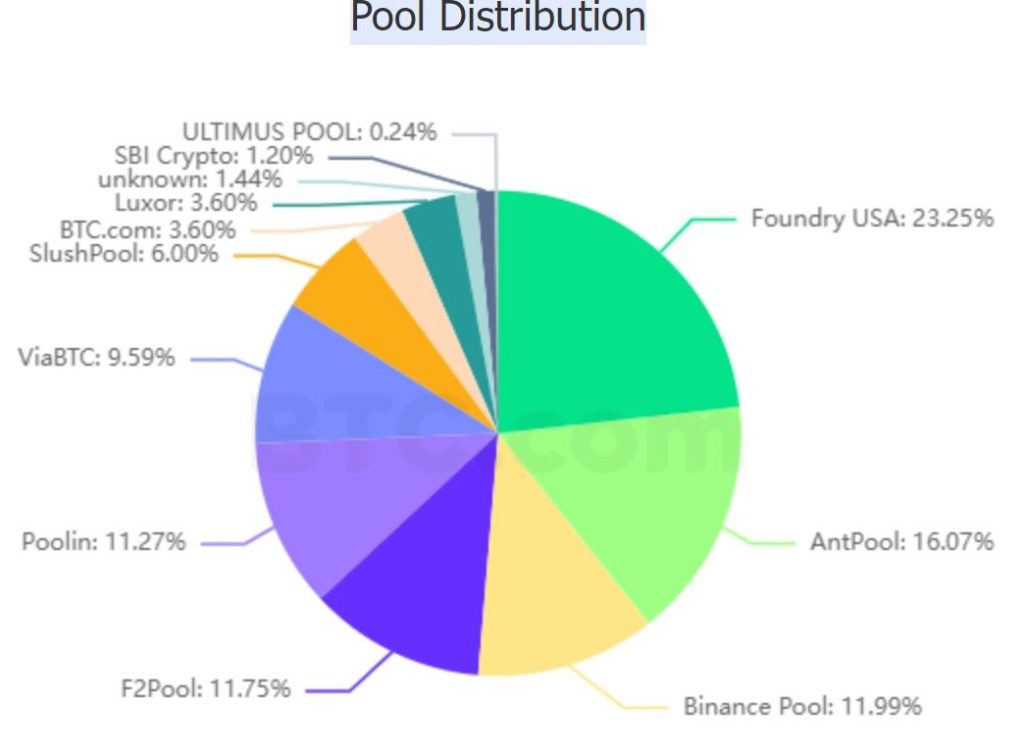

The amount of reward a validator earns varies from blockchain to blockchain. Becoming a validator sometimes requires a huge investment. Therefore, the reward must be greater than the investment. For example, Bitcoin currently has 12 mining pools worldwide. Please see the picture below:

Source: BTC.com

2. Dispersion

A blockchain is not decentralized if no one can participate in verification or run a node. In that case, you can use AWS (Amazon Web Services). This is a fully managed service. This allows you to quickly create and deploy blockchain networks. However, a blockchain with this feature cannot be called “decentralized.”

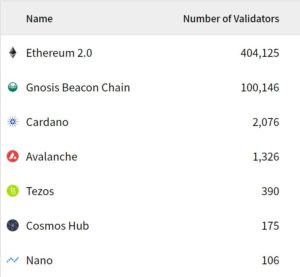

In the following figure, you can see how many validators are on each layer 1 blockchain. The more nodes there are, the more decentralized it is.

Source: Stakers.info

3. Number of developers

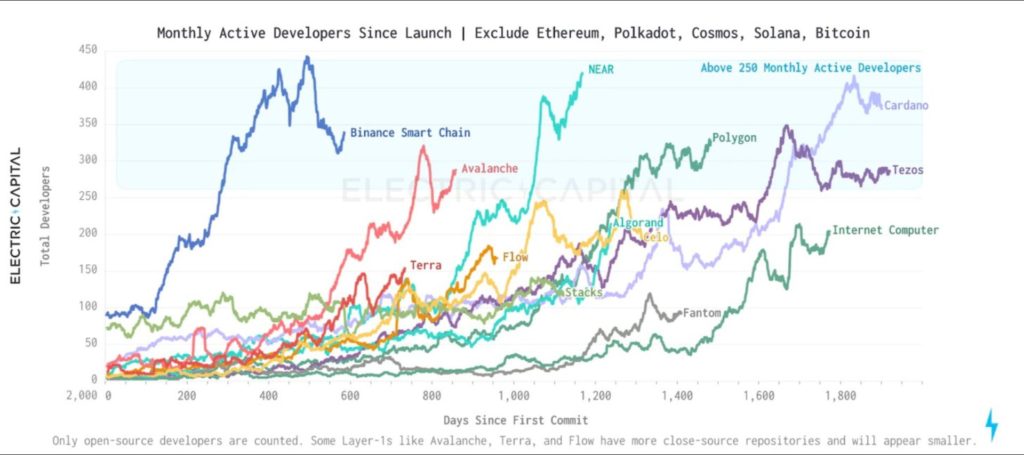

This is an important question. Without developers, there are no apps. Without apps, there are no users. If a project doesn’t have users, it’s worthless.

So, as Peter Schiff said, developers are worth their weight in gold. This is where the bucket stops when there are no developers building use cases on the blockchain. Ethereum has the most, with well over 200 monthly active developers in 2021.

The picture below shows how many developers are working on different blockchains.

Source: Twitter

4. How to use

This is definitely the most important part. But more than this, are users willing to pay for the services provided? In other words, will you be paying to use the app? So, the gas cost is like this.

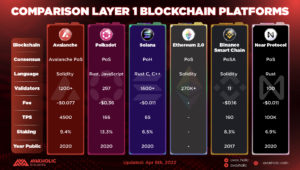

The cheaper the gas fee, the more popular blockchain becomes. Ethereum has an L2 solution. Every Ethereum killer has its own unique solution. The point is, everyone loves cheap gas prices. Below is a fee comparison chart for layer 1 blockchains.

source: Twitter

5. Profitability

To determine whether a chain is profitable, you need to compare two indicators.

How much does a blockchain pay for security?

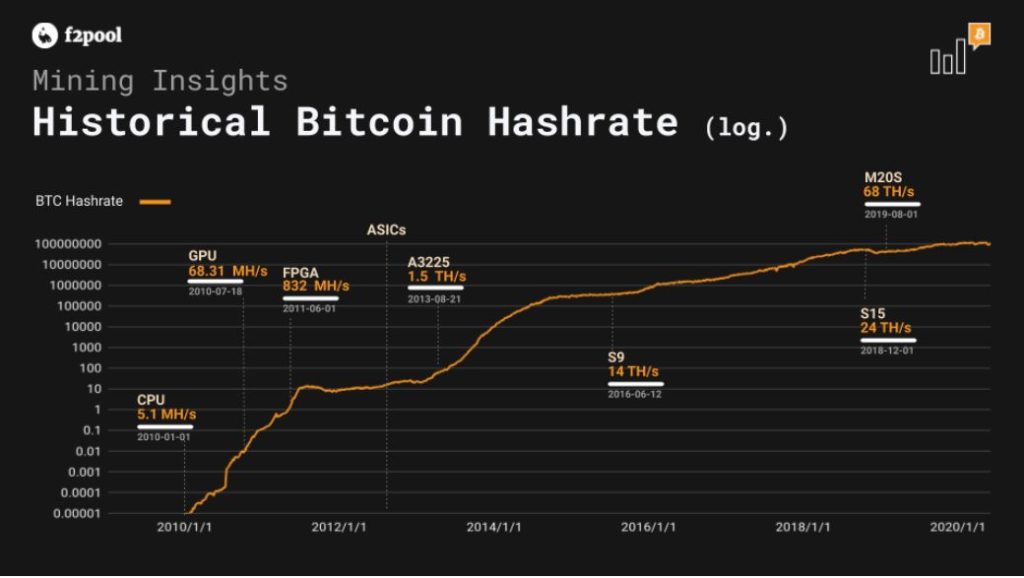

The chain uses hash rates to secure the chain, which costs money. So this gives you an idea of how much they spend on security. For example, BTC currently measures the hash rate of Exahashes. That’s tens of millions of hashes per second. That’s a step up from trillions of dollars.

Source: Buybitcoinworldwide

How much revenue does blockchain generate?

There are several ways blockchain can generate revenue. Here it is:

- We develop software solutions with a specific purpose.

- Provides one or more software services.

- Transaction fees drive revenue.

- contract agreement.

- Speculation about cryptocurrency.

Now, it’s debatable how useful that last point is. However, coins or tokens that gain value are generally good for the chain.

conclusion

Here are five good ways to find out if your Layer 1 blockchain will be successful: Blockchain must be secure and decentralized. We also need developers and chain users to build apps. Ultimately, blockchain must be profitable.

However, this depends on several factors, such as gas prices. But it’s an important question. Those who invest in this down market will be winners in the next up market.

⬆️Also, to check out more cryptocurrency news: Altcoin Buzz YouTube channel.

⬆️Above all, discover the most undervalued gems, latest research, and NFT purchases with Altcoin Buzz Access. Join now for $99 per month.