Ethereum is currently trading at $2,290, up slightly by $0.17 over the past week. Although it lacks much action and has been trading around $2,300 all week, on-chain data on the outflow has revealed the current sentiment among traders. According to data from on-chain analytics firm IntoTheBlock, $500 million worth of ETH was withdrawn from centralized exchanges this week, bringing total outflows over the past month to $1.2 billion.

Ethereum outflow from exchanges surges

Ethereum experienced an unexpected price increase After approval of spot Bitcoin exchange-traded fund in the United States. As a result, various on-chain data revealed strong bullish sentiments, which saw the second largest cryptocurrency exit the exchange since this period. According to IntoTheBlock, last week’s outflows were particularly bad, with a significant portion of ETH withdrawn from exchanges last month, amounting to $1.2 billion.

500 million dollars $ETH Withdrawals from CEX this week bring total outflows to more than $1.2 billion last month. pic.twitter.com/e8NFOGtrDV

— IntoTheBlock (@intotheblock) February 2, 2024

Ethereum currently trading at $2,308 on the daily chart: TradingView.com

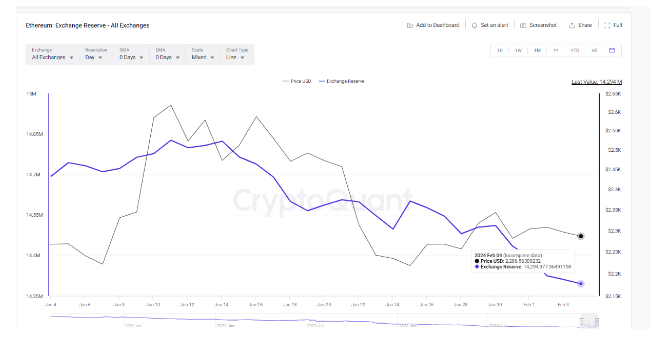

According to CryptoQuant, 1.622 million ETH was withdrawn from cryptocurrency exchanges last week. Similar indicators from analytics platforms show that ETH holdings on exchanges have been in free fall over the past year. As of January 4, the total amount of Ethereum deposited in various cryptocurrency exchanges was calculated to be 14.69 million. However, this figure has decreased by 397,012 ETH over the past month to an all-time low of 14.296 million ETH at the time of this writing.

How will this affect the price of ETH?

Cutting exchange reserves reduces the amount of ETH available for trading, increasing scarcity. Data from CryptoQuant and IntoTheBlock indicates that Ethereum is bracing for a price surge due to increased scarcity.

As of this writing, Ethereum is up 3.21% over the monthly period. However, it is important to note that the cryptocurrency has been trending downward since hitting a 23-month high of $2,706 on January 12. Some of the more significant of these drawbacks include: Successfully sold $1 billion Celsius Network as part of its plan to repay its creditors. At the same time, cryptocurrencies face ongoing competition from other blockchains. Solana recently overtook This is based on the daily trading volume of the decentralized exchange.

based on current price action, Ethereum has established a support level just above $2,280 and currently appears to be attempting a strong hike above this price range. According to cryptocurrency analysts, the current configuration is a clear replication of the 2021 price action, which led ETH to its current high of $4,878 in months.

$ETH It seems to be repeating the previous chart configuration.🚀#Ethereum #ETH #alt season pic.twitter.com/AA1PJiN24h

— Trader Tardigrade (@TATrader_Alan) February 3, 2024

Featured image from Adobe Stock, chart from TradingView