join us telegram A channel to stay up to date on breaking news coverage

The appeal of alternative digital currencies beyond Bitcoin is undeniable due to their unique proposition and potential for exponential growth. These coins offer investors several alternative opportunities to profit from the cryptocurrency market.

However, identifying promising altcoins to invest in can be a difficult task for investors. Therefore, Insidebitcoins has curated a list of the best altcoins to provide investors with opportunities for their investment portfolio.

7 Best Altcoins to Invest in Right Now

Last week Solana surpassed Ethereum. Decentralized Exchange (DEX) trading volume. SOL registered $10.1 billion, according to DefiLlama data. This surge in DEX activity on Solana can be attributed to its comparative advantage of lower gas fees than Ethereum, leading to growing interest in meme coin trading.

1. Pancake Swap (CAKE)

PancakeSwap recently proposed significantly reducing its native token supply. CAKE’s proposed reduction would increase the token supply from 750 million to 450 million. This move aims to control market dynamics more tightly and align with the platform’s growth goals. Likewise, this offering reflects PancakeSwap’s shift from its previous hyperinflationary model to a more sustainable tokenomics approach.

The platform also made feedback suggestions public before the voting phase. This move highlights PancakeSwap’s commitment to inclusive decision-making and transparent governance and emphasizes community engagement.

In particular, the recent improvements in CAKE Tokenomics v2.5 coincided with the introduction of the veCAKE gauge system. These projects laid the foundation for a new transformation of CAKE and set the stage for an even stronger ecosystem.

🐰 Pancake Swap family!

🥞 We are proposing to reduce the maximum token supply. $cake From 750M to 450M.

🔥 After a year of hard work and deflation, we are focusing on ultrasonic cakes.

🌟 By reducing the token supply by 300,000,000 $cakeCongratulations on the success of PancakeSwap… pic.twitter.com/PIk3SBEhiJ

— PancakeSwap🥞Everyone’s Favorite DEX (@PancakeSwap) December 21, 2023

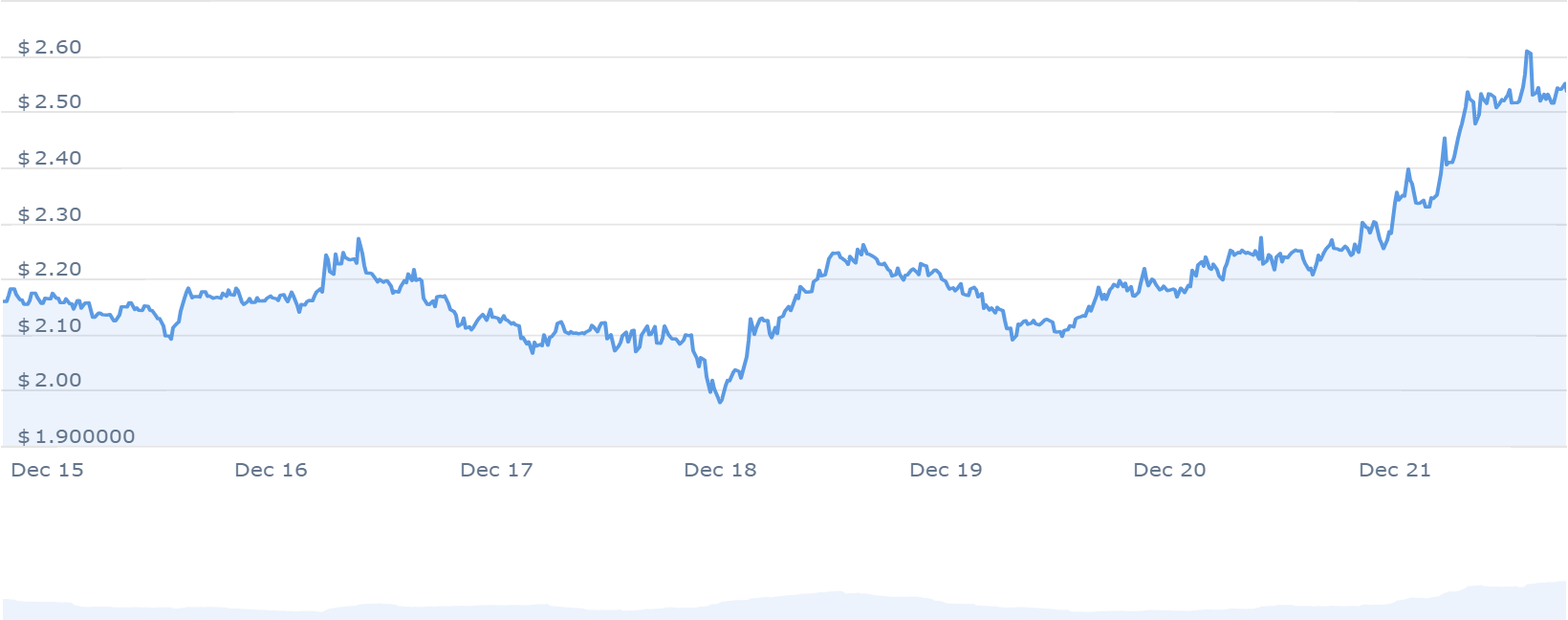

Likewise, the announcement sparked a notable market reaction, with the value of CAKE soaring 22% in three hours. This rally, coupled with increased trading volume, caused the price of the coin to skyrocket from approximately $2.22 to $2.718.

2. Optimism (OP)

Optimism, a layer 2 network, has seen a surge in daily transactions. This surge pushed operating profit to a new monthly high. Over the past 30 days, Optimism’s daily transactions have increased 42% to 512,770, according to Artemis data. This surge is primarily due to the rapid increase in user activity observed over the past week.

The number of unique addresses completing at least one transaction on Optimism has increased by 45% in the last seven days. This number totals 77,470 addresses as of December 19. However, this increase in demand has been accompanied by increased transaction fees on the network.

Driven by growing interest in layer 2 solutions, Optimism has seen an impressive 65% year-to-date (YTD) increase in TVL. The rise in transaction fees on the Optimism chain had a direct impact on revenue. Data from Token Terminal shows a 47% increase in network revenue from fees. So over the past 12 months, annual revenue has increased by almost 90%, totaling $53.95 million.

3. Phantom (FTM)

Phantom (FTM) has been on the rise recently and continues to favor buyers at higher price levels. Moreover, there has been a notable rally and increased buying volume in recent weeks. This activity suggests the participation of major investors interested in potential growth.

During short-term price declines, buyers have shown great interest in accumulating larger sums, indicating they are ready to buy when the decline occurs. The crossover of the exponential moving average (EMA) further strengthened investor confidence, promoting continued positive momentum.

Introducing the last of our four fantastic Sonic Labs mentors. @capitELList!

We asked Eli from the Fantom Foundation team a few questions about himself and what he contributes to the Sonic Labs team as a mentor 👇

Can you share a little about yourself?

The law was my middle child… pic.twitter.com/Y8ykbhZw4g

— The Phantom Foundation (@FantomFDN) December 21, 2023

Moreover, chart pattern analysis shows a continued bullish trend without any obvious bearish signs. This presents a lucrative strategy to follow the current upward trend for potential long-term profits.

4. EOS

Under the leadership of Yves La Rose and the EOS Network Foundation, EOS has made significant progress with the implementation of the EOS EVM. The move helped streamline fund transfers on Ethereum and foster DeFi applications on the platform.

Recent milestones include trustless USDT bridging on EOS EVM v6 and a strategic partnership with Spirit Blockchain Capital post-funding. Therefore, this hints at a promising trajectory for EOS, with the market surge leading to higher activity on the EVM chain.

MSIG passed today, evacuating 108,889 people. $EOS accumulation through #EOSEVM Gas fees for eosio.evm account.

108,889 EOS were used to purchase approximately 1.8GB. #EOS RAM provides additional memory storage space for EVM https://t.co/iRk3YCn0rO

— EOS Network Foundation (@EOSNetworkFDN) December 22, 2023

Several indicators also paint a nuanced picture. A relative strength index (RSI) just below 60 suggests a possible reversal to a bullish trend without reaching overbought levels. Additionally, a Stochastic %K of 89.47 suggests heightened market activity, while ADX’s low score of 15.4 indicates an evolving trend.

5. Chainlink (LINK)

Over the past year, Chainlink has slowly been catching the attention of investors with its positive performance. It is currently one of the leading assets in the DeFi coin sector and ranks second among Ethereum (ERC20) tokens.

Notably, the price surged from last cycle low to a cycle high of $17.31, indicating optimism about the price forecast. This positive outlook is also reflected in the Fear and Greed Index, which currently stands at 74 (greed).

In terms of performance, Chainlink has seen significant growth, with a 160% increase in price compared to last year. It also outperformed 72% of the top 100 cryptocurrency assets during this period. Technical analysis also shows market performance consistently trading above the 200-day simple moving average.

Accurate, reliable and decentralized. #Chainlink Pricing feeds showcase key use cases across the Web3 ecosystem.

CELO/USD price feed integration @CeloOrg Building a secure DeFi marketplace around the Celo token. https://t.co/v4SvWakKey

— Chainlink (@chainlink) December 22, 2023

The project’s recent performance appears promising, with 18 of the last 30 days marked as green days, indicating a 60% positive trend. It also boasts high liquidity, which attests to its significant market capitalization.

6. Bitcoin Minetrix (BTCMTX)

Bitcoin Minetrix Introducing a new way for users to stake BTCMTX tokens for cloud mining credits. The goal is to decentralize control and provide token holders with a secure mining experience.

To date, over 400,000 BTCMTX tokens have been locked in the staking pool, demonstrating significant interest from users. The project caught the attention of the cryptocurrency world, claiming an annual percentage yield (APY) of 103,225%. This growth is partly due to the successful BTCMTX pre-sale, which has made it one of the top-performing cryptocurrencies.

It was another huge success. #Bitcoin Metrics!

We have surpassed our goal of $5,600,000! 🔥 pic.twitter.com/NtuEkIuHA8

— Bitcoin Minetrix (@bitcoinminetrix) December 21, 2023

During the pre-sale period, Bitcoin Minetrix Selling tokens at $0.0123 each raised over $5,746,128, providing 70% of the total 4 billion token supply (2.8 billion BTCMTX). Investors can purchase these tokens using ETH or USDT.

7. Filecoin (FIL)

Filecoin has recently seen significant gains, increasing more than 20% in just two days. This surge pushed the token past its previous high price of $5,500. This momentum was supported by a significant surge in purchasing volume, indicating continued interest in the asset.

Over the past few weeks, Filecoin (FIL) has been consolidating within the $4,000-$5,500 range, setting the stage for price action. This consolidation phase represents a period in which buyers absorb selling pressure and solidify their short-term base on the asset.

https://x.com/Filecoin/status/1736766402994823307?s=20

Currently, Filecoin (FIL) is trading at $5.67 and is stabilizing from its recent uptrend. According to expert predictions, there is a possibility of a rise to $5.750 by the end of the year, which will depend on increased demand for the coin.

Learn more

A new cryptocurrency mining platform – Bitcoin Minetrix

- Thanks to Coinsult

- Decentralized, secure cloud mining

- Get free Bitcoin every day

- Native token currently in pre-sale – BTCMTX

- Staking Rewards – APY 100% or more

join us telegram A channel to stay up to date on breaking news coverage