Fantom (FTM), the Layer 1 (L1) protocol, and its native token, FTM, experienced significant gains and notable performance in the first quarter of 2024 (Q1).

According to comprehensive performance analyze Amid the emerging cryptocurrency bull market, Fantom by Messari has emerged as one of the major beneficiaries, showing significant growth in key indices and market capitalization.

FTM market capitalization surges 101% QoQ

By the numbers it looks like FTM is running around market capitalization It saw a 101% quarter-on-quarter (QoQ) increase, jumping from $1.3 billion to $2.6 billion, moving up 10 places to #48 (now #58) among all tokens. The token’s rally has extended for two consecutive quarters, quadrupling since the end of the third quarter of 2023.

Phantom’s FTM-based sales reached 1.8 million FTM, a 53% decrease compared to the previous quarter, but USD-based sales recorded $1.2 million, a 4% increase compared to the previous quarter.

According to Messari, the decline in revenue was primarily due to lower inscription activity across all smart contract platforms in the first quarter.

Nevertheless, the phantom upward trend Excluding inscription-related activity, the average number of daily transactions exceeded the third quarter average, reaching 247,000 daily transactions. Daily active addresses also rebounded, increasing 24% QoQ to 40,500.

In Q1, the staking requirement for Fantom validators was significantly reduced from 500,000 FTM to 500,000 FTM. 50,000FTM, which aims to increase accessibility. However, the number of active validators remained unchanged at 55.

In particular, the total FTM staking increased by 17% compared to the previous quarter from 1.1 billion FTM to 1.3 billion FTM, bringing the total dollar value of staked FTM to $1.2 billion, a 135% increase compared to the previous quarter. Among Proof-of-Stake (PoS) networks, Fantom ranked 22nd in dollar value of staked funds as of the end of the first quarter.

Memecoin Mania boosts phantom on-chain activity.

During the first quarter of this year, Total Value Locked (TVL) in USD increased 59% QoQ to $1.28 billion from $810.8 million in the fourth quarter.

On the other hand, FTM’s TVL denomination decreased 21% QoQ, indicating that the surge in USD-denominated TVL was partly due to the price increase of FTM.

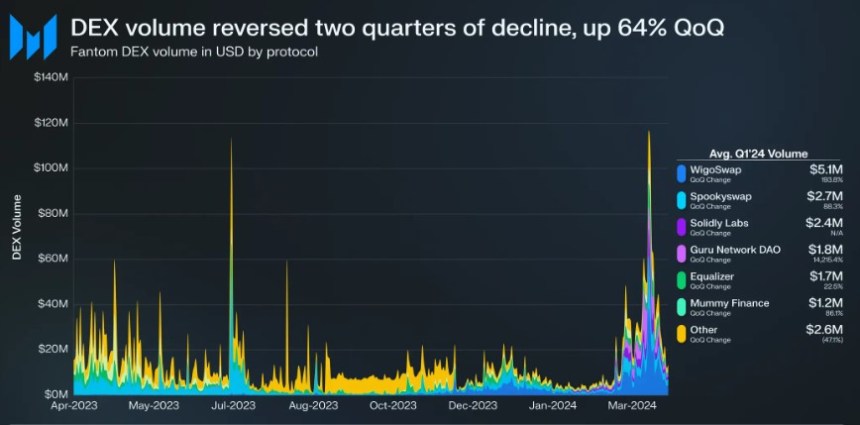

Phantom’s daily average Decentralized Exchange (DEX) trading volume increased 64% QoQ from $10.2 million to approximately $176.8 million. In the first quarter, the “Memecoin Mania” trend led to increased on-chain activity across various networks, including Fantom.

Last March, Fantom’s monthly DEX trading volume surpassed $1 billion, the first time since March 2023. Fantom’s DEX count grew to 31 by the end of the first quarter, with no single DEX accounting for more than 30% of the market share.

Finally, following the exploit: Multichain: Due to the Phantom Bridge, which affected Phantom’s stablecoins in the third quarter of 2023, the Phantom Foundation took steps to increase the liquidity of stablecoins.

As of Q1 2024, two independent third-party bridging solutions have emerged: Axelar (axlUSDC and axlUSDT) and LayerZero (lzUSDC and lzUSDT). USDC remains Fantom’s primary stablecoin, accounting for 98% of the stablecoin market capitalization. USDT also showed significant growth, increasing by 86% QoQ.

FTM token is currently trading at $0.7037, reflecting an 8.7% price increase over the past 7 days. However, there was a decline of almost 20% in the monthly period.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: This article is provided for educational purposes only. This does not represent NewsBTC’s opinion on whether to buy, sell or hold any investment, and of course investing carries risks. We recommend that you do your own research before making any investment decisions. Your use of the information provided on this website is entirely at your own risk.