Binance has revealed eight key stories that will shape the future of the cryptocurrency market in 2024.

Rooted in the past year’s robust growth and innovation, this outlook provides a glimpse into what lies ahead.

Cryptocurrency market trends that will dominate 2024

At the forefront, Bitcoin continues to assert its dominance. 2023 was a year of significant developments in Bitcoin’s journey, including the introduction of innovative technologies such as Ordinals and BRC-20 tokens, the establishment of a spot Bitcoin ETF, and the much-anticipated halving event in 2024.

Read more: Bitcoin Halving Cycle and Investment Strategy: What You Need to Know

According to Binance, these developments and the favorable SEC ruling will potentially increase activity and volatility in Bitcoin’s orbit. Digital assets such as Ordinals and BRC-20 tokens could potentially experience dramatic changes due to their memecoin-like qualities and smaller market caps.

Parallel to the rise of Bitcoin, the rise of ownership economies enabled by blockchain technology is reshaping user control over data and creative content. The previous year saw a surge in decentralized physical network infrastructure (DePin) and decentralized social media (DeSoc). In particular, platforms such as Friend.tech have driven significant growth at DeSoc.

“These protocols are considered to have high growth potential due to their broad total addressable markets and ability to scale rapidly through bottom-up growth strategies,” Binance wrote.

As these DePin and DeSoc projects continue to expand in 2024, they promise users increased control and monetization opportunities over their digital assets.

Integration of AI and cryptocurrency

Another story about cryptocurrency is the integration of artificial intelligence (AI) and cryptocurrency. Driven by the global traction of OpenAI ChatGPT in 2023, this synergy is opening new avenues in trading automation, predictive analytics, and data management.

AI has the potential to democratize AI model training as it becomes intertwined with the cryptocurrency ecosystem. There is also the potential to increase transparency and security through decentralized storage, which is becoming increasingly evident.

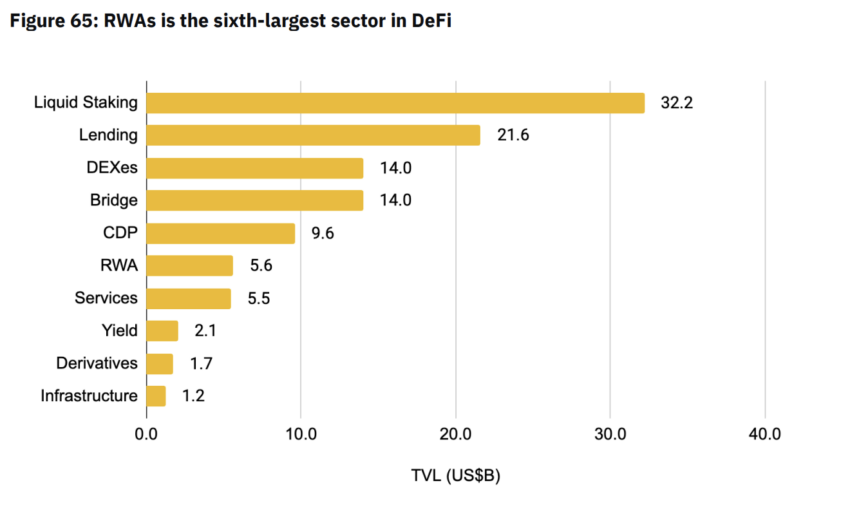

At the same time, tokenization of real-world assets (RWA) is revolutionizing blockchain utility. This process brings off-chain assets into the blockchain, improving transparency and efficiency of the process.

Read more: What are the implications of real world asset (RWA) tokenization?

As 2024 approaches, rising interest rates are making tokenized government bonds an attractive revenue source for cryptocurrency investors. Moreover, the accelerated institutional adoption of RWAs and the advancement of related infrastructures such as decentralized identities and oracles will further strengthen this trend.

Larry Fink, CEO of BlackRock, also highlighted tokenization as a groundbreaking technological advancement that could revolutionize asset management.

“We have the technology today to tokenize. If you have tokenized security and identity, it’s all created together the moment you buy or sell something in the general ledger. I would like to talk about issues related to money laundering. This eliminates all corruption through a tokenized system,” Fink explained.

Other cryptocurrency stories to watch out for

When it comes to on-chain liquidity, a fundamental component of the DeFi ecosystem, Binance believes that a significant evolution is underway. Sophisticated liquidity models, such as Uniswap V3’s Concentrated Liquidity Market Maker (CLMM) and Request for Quote (RFQ) system, are reshaping this market segment.

Designed to address issues such as impermanent loss and just-in-time liquidity, these models represent increasing sophistication and growing potential within on-chain transactions. Additionally, the scale and accessibility of on-chain financial activities are expected to increase.

Institutional adoption of cryptocurrencies is accelerating along with advances in on-chain liquidity. Additionally, the entry of large asset managers like BlackRock and Fidelity into the cryptocurrency market signals a firm belief in the long-term potential of the industry.

The upcoming Bitcoin halving is likely to attract more institutional players to the cryptocurrency industry. According to CoinShare research, the average production cost per Bitcoin halving is likely to rise to between $27,900 and $37,800. This will further impact the cryptocurrency market by ensuring that only a small number of miners can remain profitable.v

“After the 2024 halving, miners’ production costs and profitability structures will change… Most miners will face the challenge of needing to cut costs to remain profitable. If the Bitcoin price remains above $40,000, only a few miners are expected to be profitable,” analysts at CoinShares said.

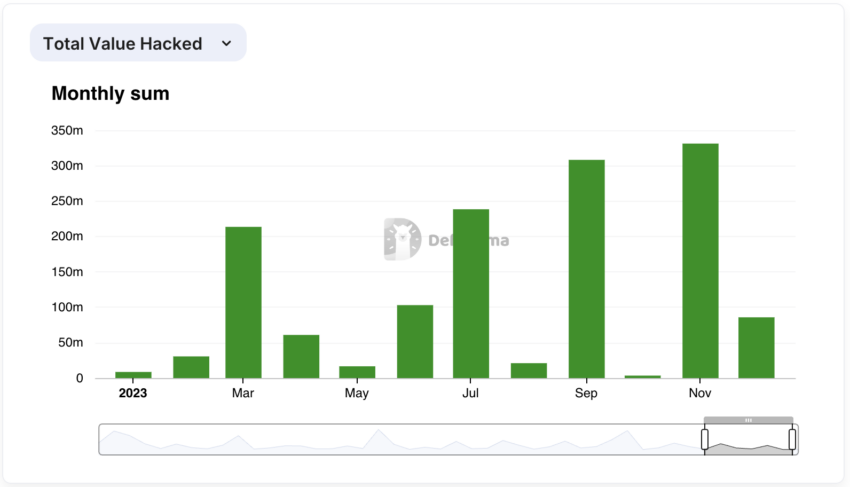

Amid these exciting developments, security remains a top concern. The industry has made commendable progress in strengthening security measures, as evidenced by the decline in DeFi exploits. But the focus on strengthening defenses remains unwavering.

Finally, the importance of account abstraction is emerging. This is an important step in making blockchain technology more accessible and inclusive. Innovations, particularly in the area of creating user-friendly smart contract wallets, will revolutionize the way users perform on-chain activities.

Read more: What is Account Abstraction?

Rapid development in this field is expected due to fierce competition among wallet providers. Lastly, the cryptocurrency community and developers believe that account abstraction could pave the way for the next billion users to participate in the Web3 sector.

disclaimer

In compliance with Trust Project guidelines, BeInCrypto is committed to unbiased and transparent reporting. These news articles aim to provide accurate and timely information. However, before making any decisions based on this content, readers are encouraged to check the facts and consult with experts. Our Terms of Use, Privacy Policy and Disclaimer have been updated.