- At press time, 68.4% of Binance’s top XRP traders held long positions.

- XRP could rise another 45% on the charts and reach the $4.5 level.

At the time of writing, XRP seemed poised to continue its upward trajectory thanks to strong interest and confidence from long-term holders and traders. This is despite the fact that the altcoin has been in consolidation mode over the past 48 hours and is experiencing a price correction after hitting a seven-year high on the charts.

Increased interest from long-term holders

On January 11, XRP posted a significant 30% rally after breaking away from bullish flags and polar price action patterns and entering a consolidation phase. During this rally, long-term holders who had purchased XRP at low prices began selling their holdings on exchanges.

On January 18, for the first time in the past five days, long-term holders showed renewed interest in the third-largest cryptocurrency, according to a report from on-chain analytics firm CoinGlass.

$84 Million XRP Leaked From Exchanges

In fact, spot inflow/outflow analysis data shows that there have been significant outflows of over $84.41 million into XRP from exchanges over the past 24 hours.

These amounts are significant, indicating potential accumulation. This also seemed to suggest an ideal buying opportunity that could potentially lead to a chart uptrend while creating massive buying pressure.

Source: Coinglass

68% of top XRP traders maintain long positions on Binance.

In addition to the continued accumulation of long-term holders, Binance traders have expressed strong support and confidence in XRP. At press time, Binance’s XRP/USDT long/short ratio was 2.17. This means there is 1 short position for every 2.17 long positions.

This showed strong interest from traders on the buy side. The data also shows that among the top XRP traders on Binance, 68.4% have long positions and 31.6% have sell positions.

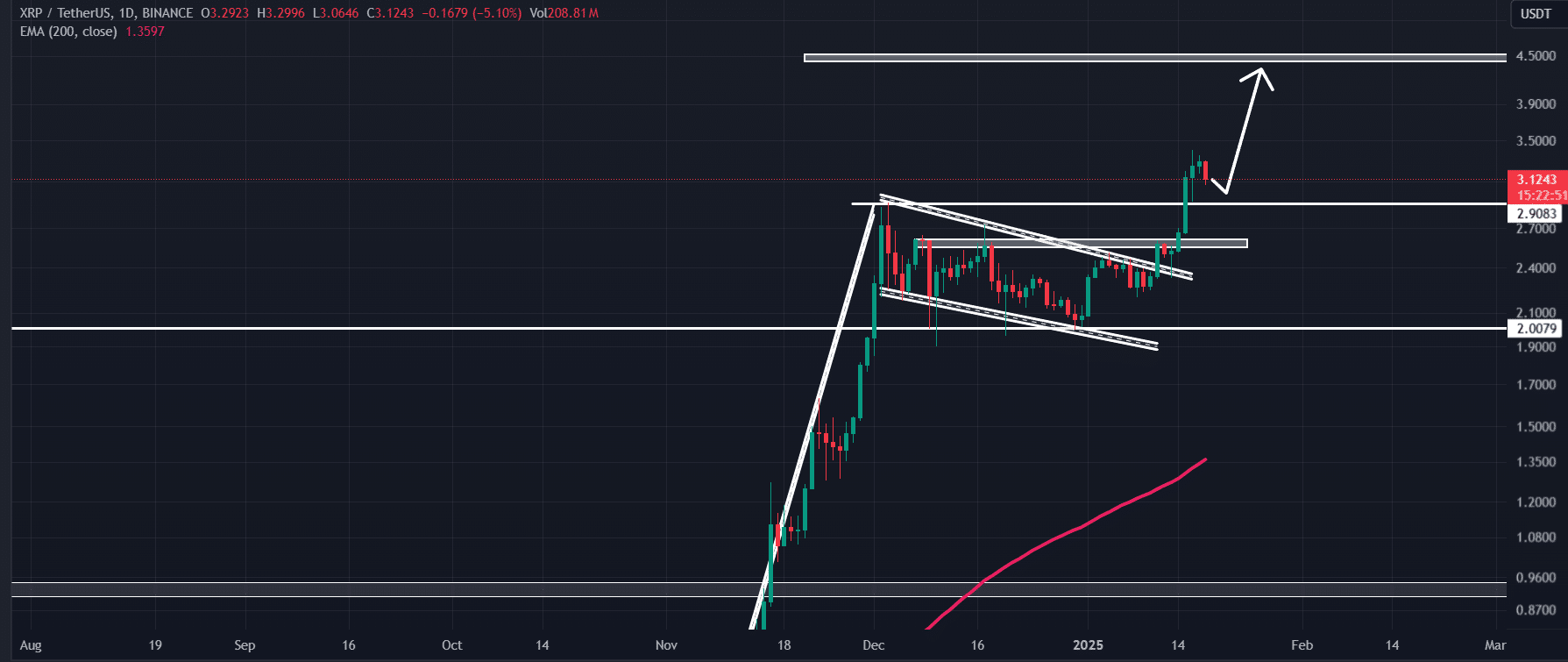

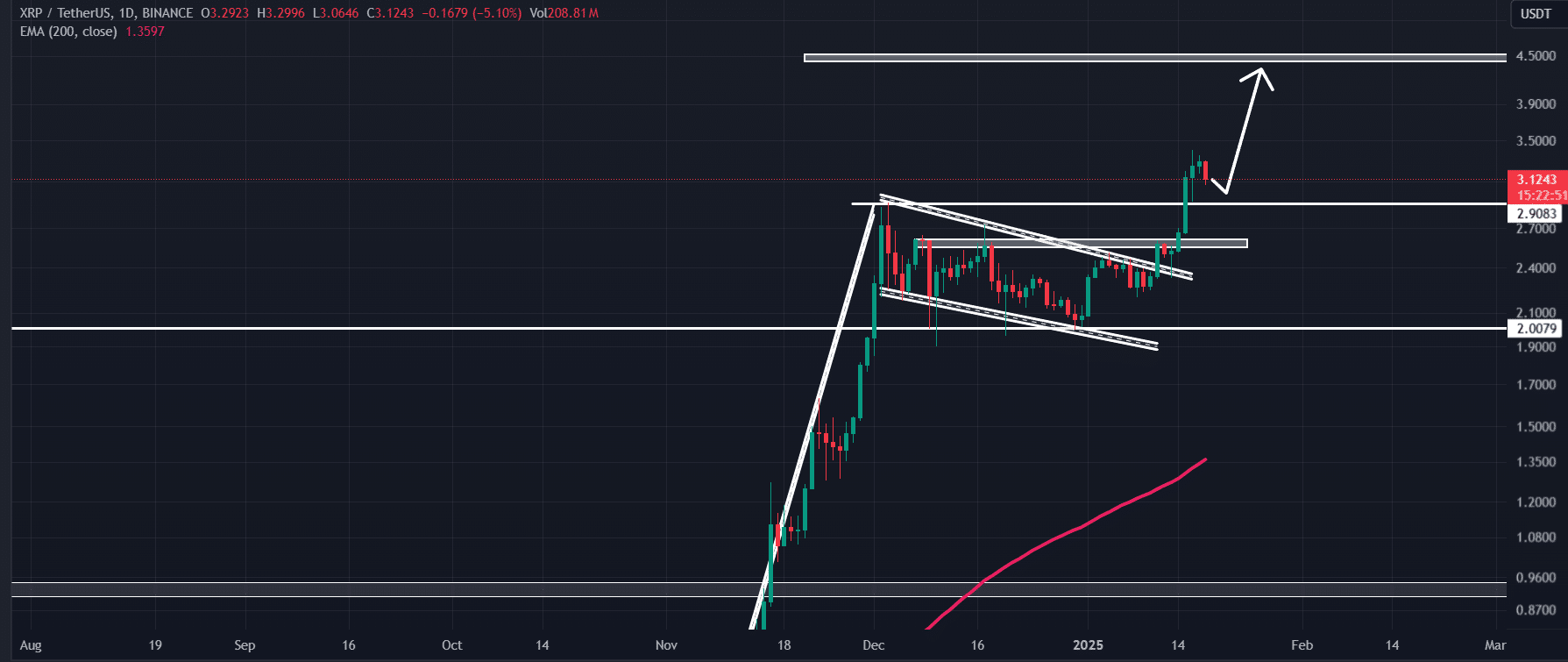

XRP’s price action and key levels

According to technical analysis by AMBCrypto, XRP is currently undergoing a slight price correction after posting a 30% rally. This follows a breakout of the bullish flag and fall pattern.

Source: TradingView

Based on recent price action, it is likely that XRP will surge another 45% and reach the $4.5 level.

Combining XRP’s press time price action with on-chain indicators, it looks like bulls are in strong control of the asset. This could help the altcoin reach predicted levels in the future.