On-chain analytics firm Santiment says more than 85% of all altcoins in the sector are currently in a historic “zone of opportunity.”

MVRV suggests that most altcoins are poised for a rebound.

new post In X, Santiment discussed what the altcoin market looks like based on the MVRV ratio model. “Market to Realized Value (MVRV) Ratio” is a popular on-chain metric that compares Bitcoin’s market capitalization to its realized value.

Here, market capitalization is the general total value of the circulating supply of an asset based on its current spot price. At the same time, the latter is an on-chain capitalization model that calculates asset value by assuming that the “real” value of all coins in circulation is the last price transmitted on the blockchain.

Considering that the last transaction for a coin is likely the last time it changed hands, its price at that time will act as a basis for its current cost. Therefore, the realized limit essentially adds up the cost basis of all tokens in circulating supply.

So one way to look at the model is as a measure of the total amount of capital an investor has invested in an asset. In contrast, market capitalization measures the value held by holders.

The MVRV ratio compares these two models, so its value tells you whether a Bitcoin investor is investing more or less than their total initial investment.

Historically, when investors have made high returns, highs are likely to occur because the risk of taking profits can soar. On the other hand, if losses dominate, this could lead to a bottom forming as selling pressure disappears from the market.

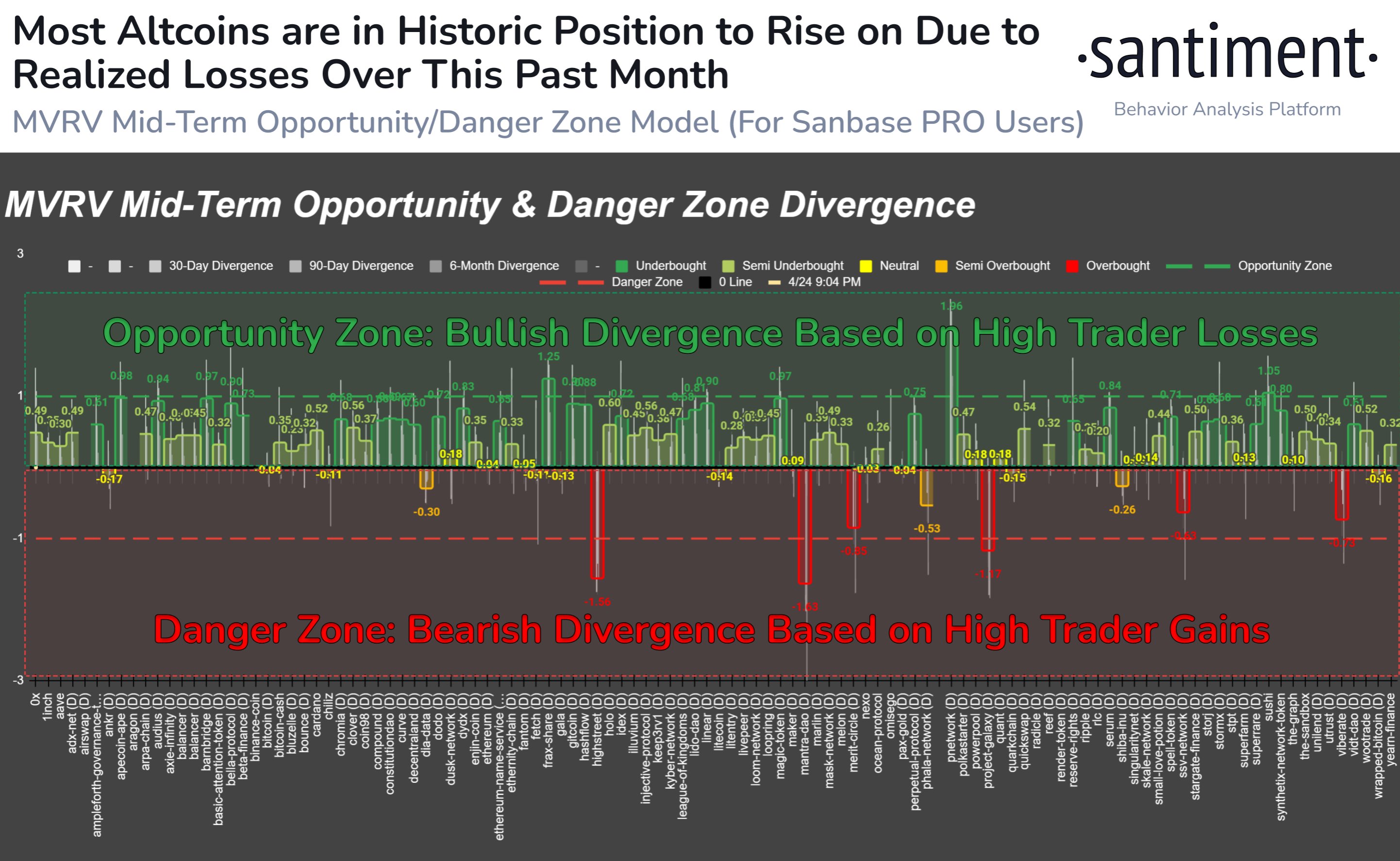

Based on these facts, Santiment defined a model of “opportunity” and “risk” zones for altcoins. The chart below shows what the market currently looks like from the perspective of this MVRV model.

The data for the MVRV divergence for the various altcoins | Source: Santiment on X

In this model, if the MVRV difference of an asset is higher than 1 in a given period, the coin is considered to be within a bullish opportunity zone. Likewise, anything less than -1 indicates it is in a bearish risk zone.

The chart shows that the MVRV gap for a significant portion of the market is currently in an opportunity zone. The analytics firm explains:

More than 85% of the assets we track are in historical opportunity zones when calculating market value to realized value of wallet collective returns (MVRV) over one-, three-, and six-month cycles.

So if the model is anything to go by, now may be the time to take a look at your altcoin shopping.

ETH price

Ethereum, the largest altcoin, surged 3% last week, reaching $3,150.

Looks like the price of the asset has gone up over the last few days | Source: ETHUSD on TradingView

Featured image from Shutterstock.com, Santiment.net, chart from TradingView.com

Disclaimer: This article is provided for educational purposes only. This does not represent NewsBTC’s opinion on whether to buy, sell or hold any investment, and of course investing carries risks. We recommend that you do your own research before making any investment decisions. Your use of the information provided on this website is entirely at your own risk.