Former Bitmex CEO and cryptocurrency market analyst Arthur Hayes weighed in on the success of the upcoming spot Bitcoin ETF and its implications for the future of Bitcoin. Hayes said the popularity of these ETF derivatives could centralize control of all Bitcoin in a few hands, causing miners to capitulate due to lack of activity on the blockchain.

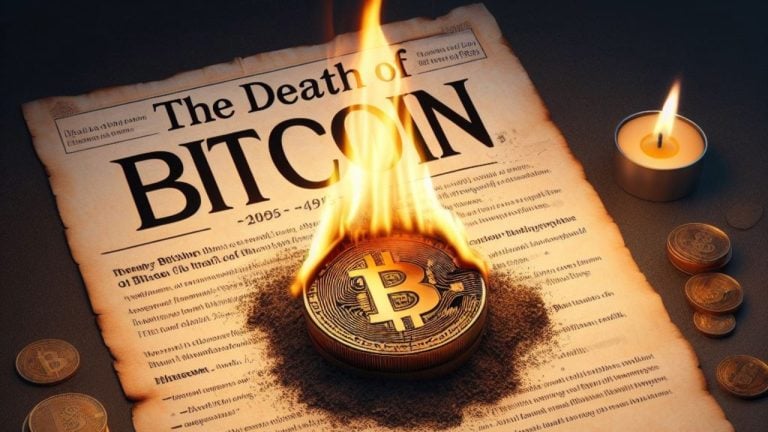

Arthur Hayes believes ETFs could spell the end of Bitcoin.

Former Bitmex CEO Arthur Hayes believes the success of the upcoming spot Bitcoin ETF could threaten the existence of the Bitcoin network. In his most recent blog post, “Expression,” Hayes presents a hypothetical situation where Bitcoin is all in the hands of a few financial firms, such as Blackrock.

If this happens, Hayes predicts it will destroy Bitcoin as a store of value because it is different from every asset traded on financial markets to date.

Hayes argued:

Bitcoin is the first monetary asset in human history that exists only through movement. However, without another Bitcoin transaction between two entities, miners will not be able to afford the energy it takes to secure the network.

As a result, after the subsidy ends around 2140, the entire Bitcoin network will be shut down due to starvation of miners who will only receive fees from Bitcoin transactions.

Hayes adds that this could happen if users value Bitcoin as a financial asset rather than a store of value and prefer to buy derivatives instead of cryptocurrencies. But if Bitcoin suffers this fate, Hayes foresees the creation of similar assets that would allow people to transact in a non-governmental financial system.

“Secondly, I hope we learn not to hand over our private keys to bald men,” he concluded.

What do you think about Hayes’ comments on the success of the spot Bitcoin ETF and its impact on Bitcoin? Let us know in the comments section below.

Source: Bitcoin.com