Wyckoff analysis (WA) aims to understand why prices of stocks and other market items move due to supply and demand dynamics. This generally applies to freely traded markets (commodities, bonds, currencies, etc.) where large or institutional traders are active. In this article, we will apply WA to the cryptocurrency Storj ($STORJ) to roughly predict future events.

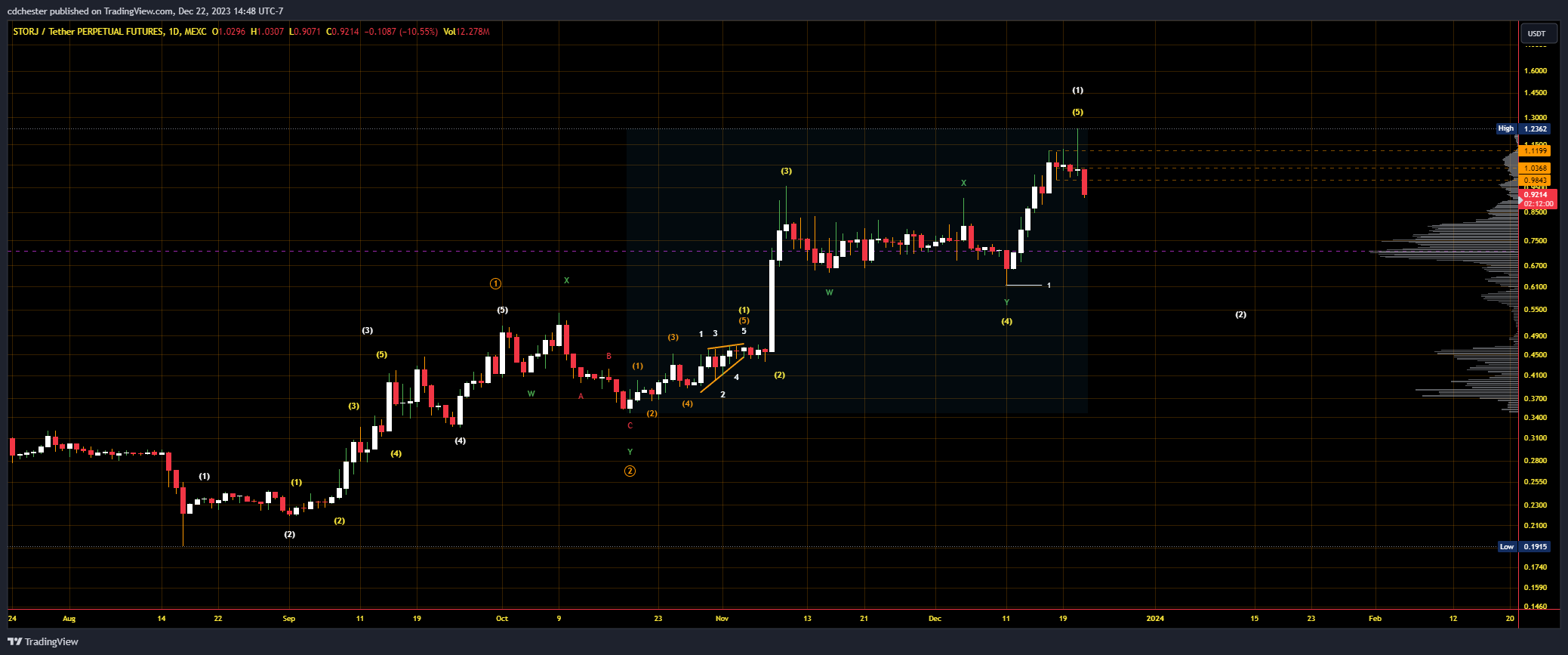

Storj Price Data from MEXC Futures | Source: STORJUSDT.P on tradingview.com.

Raw image link: https://www.tradingview.com/x/BGsOkzGM

Storj is currently in Phase E of the Wyckoff Deployment Scheme #1. StockCharts says this about Step E in their article about the Wyckoff method:

Stage E indicates the development of a downward trend. Inventory leaves TR and supply is controlled. When TR support breaks at a major SOW, this break is often tested through a rally that fails at or near support. This also means that short selling opportunities are high. Follow-up rallies during cuts are generally weak. Traders who take a short position can track stops as the price falls. After a significant downward movement, peak action may signal the beginning of TR redistribution or accumulation.

Storj’s trading range was $1 – $1.12 and specifically fell below that. The picture below provides a better indication that key SOWs have occurred and deployments have occurred. This is also consistent with analysts’ Elliott Wave (EWT) views on Storj. They predict a small rally as Storj continues to decline in the second wave. Most of the liquidity (depending on the relevant volume profile) is between 38.2% and 61.8% LFR at $0.56 and $0.76 respectively. In general, a cluster of liquidity is expected between these LFRs in EWT, leading us to believe that a Wave 2 correction is occurring. The cluster also falls within the EWT guideline Subwave 4 price range.

Storj Price Data from MEXC Futures | Source: STORJUSDT.P on tradingview.com.

Original image link: https://www.tradingview.com/x/dD8hv9Aj

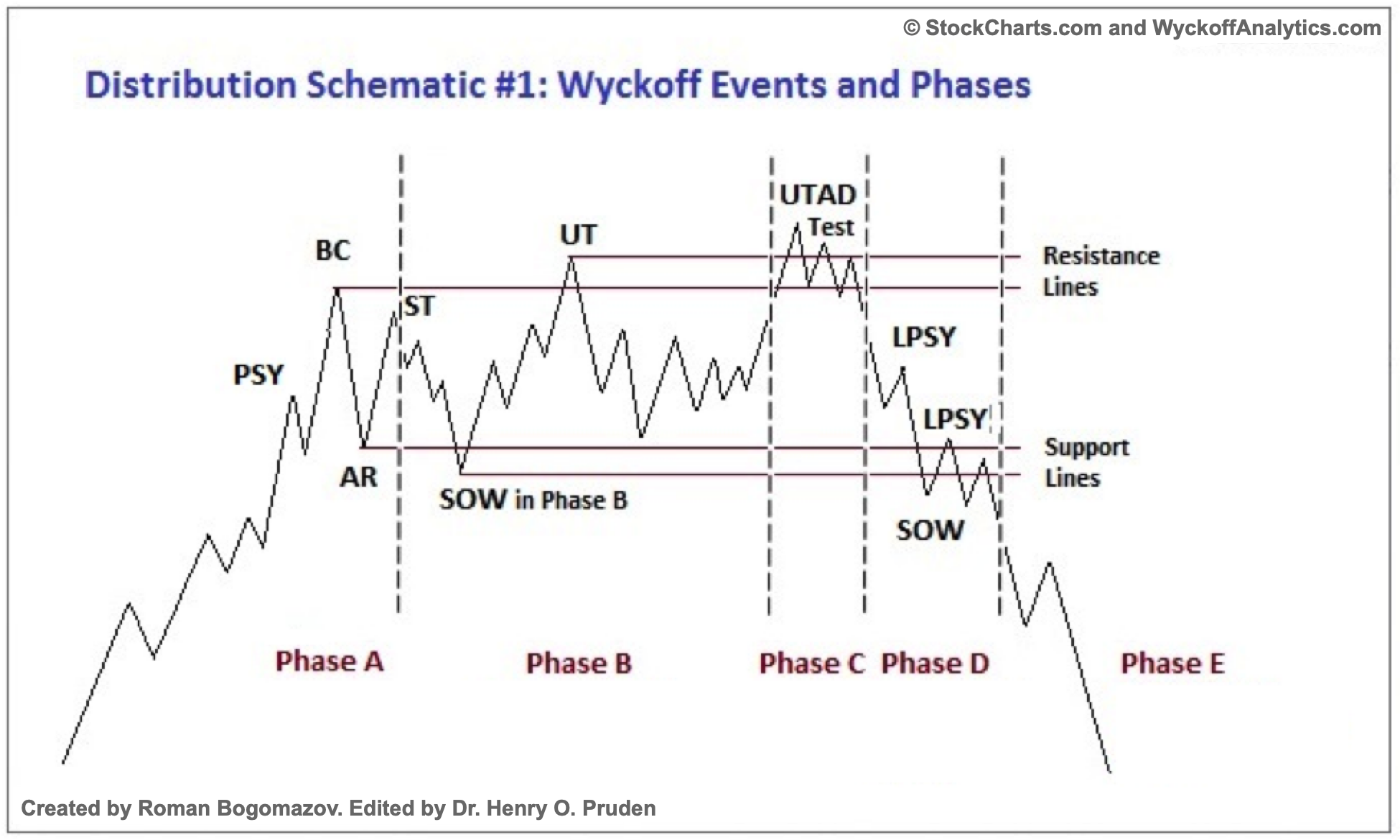

Below is a general schematic of Wyckoff distribution scheme #1.

Wyckoff Distribution Schematic #1 | Source: StockCharts.com

glossary of terms

All quotes are from the first link in the supplementary material.

Preliminary supply (Psy) – “Where, following a clear upward movement, large interests begin to sell stocks in large quantities.”

climax(B.C.) – Large operators sell their shares during periods of high demand while the public buys them at a premium.

Automatic response (arkansas) – “After BC, intensive buying decreases significantly and AR occurs as oversupply continues.”

2nd exam (castle) – “If price revisits SC territory to test supply/demand balance at this level”

Rising trend after distribution (out) – “A clear test of new demand after breaking TR resistance”

test – Where large traders “test the supply market across TR”

A sign of weakness (summary) – “A downward movement to (or slightly past) the lower boundary of the TR, which usually occurs when spreads and volume increase.”

Last supply point (LPSY) – “The last wave of distribution by large operators before demand exhausts and full-scale cuts occur.”

Elliott Wave Theory (E.W.T.)

“A technical analysis theory that attributes wavering price patterns identified at various scales to trader psychology and investor sentiment.”

Source: “Elliot Wave Theory: What It Is and How to Use It” by James Chen (2023)

Log Fibonacci retracement (LFR) – A correction measured at a specific Fibonacci ratio on a semilogarithmic scale.

Logarithmic Fibonacci expansion (L.F.E.) – A rally measured at a specific Fibonacci ratio on a semi-logarithmic scale.

Supplementary Materials

“Wyckoff Method: Tutorial” by Bogomazov & Lipsett

“Reviewing Re-accumulation” by Bruce Fraser (2018)

“Jumping the Creek: A Review” by Bruce Fraser (2018)

“Deployment Review” by Bruce Fraser (2018)

“Introducing Point and Figure Charts” by StockCharts

“P&F Price Target: Horizontal Count” on StockCharts.

“In-Depth Wyckoff Methodology” by Rubén Villahermosa (2019)

“Wyckoff 2.0: Structure, Volume Profile and Order Flow” by Rubén Villahermosa (2021)

“The Elliot Wave Principle – The Key to Market Behavior” by Frost & Prechter (2022)

Disclaimer: This article is provided for educational purposes only. This does not represent NewsBTC’s opinion on whether to buy, sell or hold any investment, and of course investing carries risks. We recommend that you do your own research before making any investment decisions. Your use of the information provided on this website is entirely at your own risk.