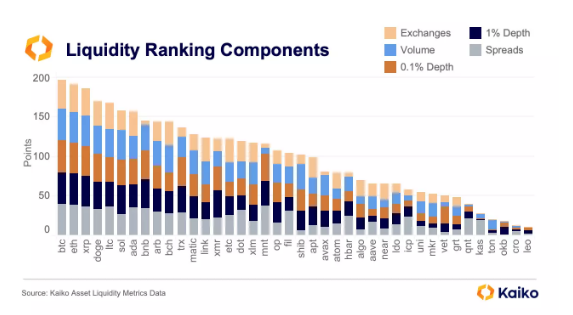

Blockchain analytics platform Kaiko conducted a study that revealed the complexities of liquidity across the largest cryptocurrency assets, with some lower market capitalization assets outperforming higher ones. According to it 3rd quarter liquidity ranking, XRP and Dogecoin (DOGE) beat Solana and Cardano in the liquidity rankings, falling behind only Bitcoin and Ethereum. There were some surprising numbers in the rankings, with BNB coming in 8th in terms of liquidity and Litecoin also performing better.

Kaiko Analysis Highlights Liquidity of Crypto Assets

The sheer number of cryptocurrency assets has always sparked the idea among investors to measure their valuation on some sort of scale, with market capitalization being the most adopted. However, according to Kaiko, liquidity, along with other indicators such as trading volume and market depth, is a better way to measure the actual value of a token independently of market capitalization. This is best demonstrated with FTX’s token, FTT. The market for FTTs has reached nearly $10 billion without sufficient liquidity to support it.

According to the latest rankings, Bitcoin took first place. liquidity. This is not surprising, as Bitcoin has always strongly dominated the cryptocurrency industry since its inception. Ethereum once again proved its status as the king of altcoins, ranking second in terms of liquidity. However, Kaiko’s liquidity ranking began to deviate from market capitalization in 3rd place, while BNB significantly underperformed and ended up in 8th place.

Instead of, XRP It ranked 4th on the trader-to-trade exchange, beating Solana and Cardano (the Ethereum killer). Improved liquidity for XRP This quarter was driven by assets Ensure regulatory clarity in America. Despite being 10th in market capitalization, Dogecoin ranked 5th, solidifying its position as a leader among memecoins. Litecoin ranked 5th, making it into the top 5 despite being ranked 18th by market capitalization.

Total crypto market cap at $1.59 trillion on the daily chart: TradingView.com

On the other hand, AVAX’s liquidity ranking fell 11 places compared to market capitalization, while TON ranked 37th despite being 9th in market capitalization for the quarter. Additionally, ATOM, UNI, APT, TON, SHIB, OKB, LEO, and CRO all fell by more than 5 places.

What does liquidity say about Dogecoin and cryptocurrency assets?

Kaiko’s liquidity measures included spreads on various exchanges and average daily trading volume. The analysis platform also included two different levels of market depth. 0.1% for frequent traders and 1% for long-term holders.

In terms of trading volume, BTC ranked first, followed by ETH and XRP. However, SOL outperformed DOGE on this metric by about $2 billion in the quarter.

The bottom line is that greater liquidity often precedes the long-term success of a cryptocurrency. The fourth quarter of 2023 will tell a strong story in terms of cryptocurrency liquidity, as most cryptocurrencies have hit new annual highs by market capitalization.

Featured image from Shutterstock

Disclaimer: This article is provided for educational purposes only. This does not represent NewsBTC’s opinion on whether to buy, sell or hold any investment, and of course investing carries risks. We recommend that you do your own research before making any investment decisions. Your use of the information provided on this website is entirely at your own risk.