There has been a notable surge in trading activity on major Ethereum Virtual Machine (EVM) chains recently. According to Etherscan, a blockchain analysis tool, approximately 95% of these transactions contain inscriptions.

Ordinal inscriptions have gained popularity as a direct means of creating non-fungible tokens (NFTs) on blockchains by inserting unique data into transaction call data.

Imagine a small capsule embedded within Bitcoin itself, holding images, text, and even video. These are Ordinals Inscriptions. In other words, it is a digital artifact permanently engraved on the Bitcoin blockchain. Each inscription is located on a single Satoshi, the smallest unit of Bitcoin, creating a unique and indestructible asset. Think of it as a counterfeit NFT within the Bitcoin network itself.

Decoding the drop-in inscription

These inscriptions boast the same durability and security as Bitcoin, while also offering exciting possibilities. Artists can upload their work directly to create verifiable digital art. Creating limited edition items and collectibles opens up new realms of digital ownership.

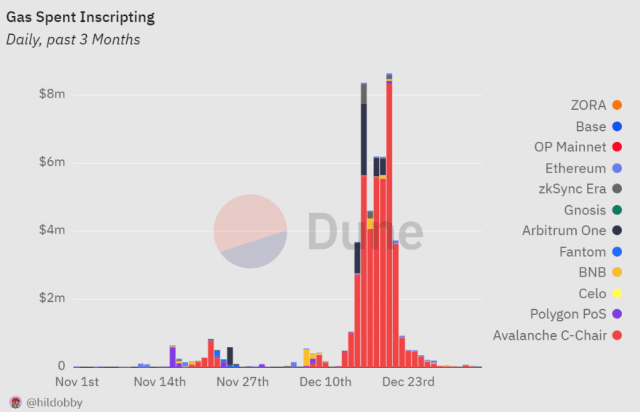

However, after a brief disruption a few weeks ago, the surge of inscription protocols around networks supporting EVM smart contracts has slowed.

Share of weekly transactions driven by inscriptions. Source: Dune Analytics.

According to data from Dune Analytics, the epitaph continues to account for disproportionate amounts of activity on Avalanche and Ethereum’s Goerli testnet, but has since declined on other popular layer 2 networks such as the Polygon PoS sidechain and BNB chain.

Recent chart analysis shows a notable decline in these transactions. According to the most recent data, the highest recorded number of inscriptions on the Avalanche network was approximately 370,000.

As of today, the market cap of cryptocurrencies stood at $1.596 trillion. Chart: TradingView.com

In terms of gas costs, some networks paid more than $1 million in gas fees in December at the height of the inscription craze. Notably, Avalanche and Arbitrum reported gas fees of more than $5 million and $2 million, respectively, on December 16.

The Avalanche maintained this pattern through December 21, although some networks are starting to see gas bills below $1 million. Gas prices have since fallen dramatically, and at the time of this writing, the highest recorded gas price was around $16,000.

Inscription accounted for 77% of Avalanche transactions, 67% of Goerli transactions, 10% of Base transactions, 7.5% of ZkSync Era transactions, less than 5% of BNB Chain and OP Mainnet transactions, and 1% of Polygon over the past seven days. PoS chain transactions.

Is the party over?

In contrast, in mid-December, Inscription accounted for more than 40% of transactions on the BNB chain and Polygon PoS chain, and 50-75% of transactions on Gnosis, Arbitrum, and ZkSync Era.

The decline in Inscription activity comes after a surge in recent weeks as the Inscription protocol spread across EVM-compatible networks.

Since the launch of the native inscription process in late November, activity has surged, with transaction fees for Near, Polygon, and Fantom rising by around 4,500%, 6,900%, and 9,000%, respectively.

These significant cuts suggest a sharp decline in contributions to network fees as the year ends. It remains unclear whether this signals a temporary lull in the popularity of inscriptions on EVMs or an ultimate demise.

Featured image from Shutterstock