Edward Snowden is a famous whistleblower. was attacked U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler made serious errors, including making deceptive statements, in connection with his approval of a Bitcoin exchange-traded fund (ETF). Gensler was accused of making the presentation in an inaccurate manner. This incident raised concerns not only about the legitimacy of the Securities and Exchange Commission (SEC), but also about market manipulation and cybersecurity within the regulator.

In the early stages of the dispute, the official Twitter account of the Securities and Exchange Commission (SEC) was hacked and false information was spread that the SEC had approved the listing and trading of Bitcoin spot ETFs. This illegal tweet, which was seen millions of times before being deleted, caused a major shift in the price of Bitcoin, which saw it surge for a short period of time before falling sharply.

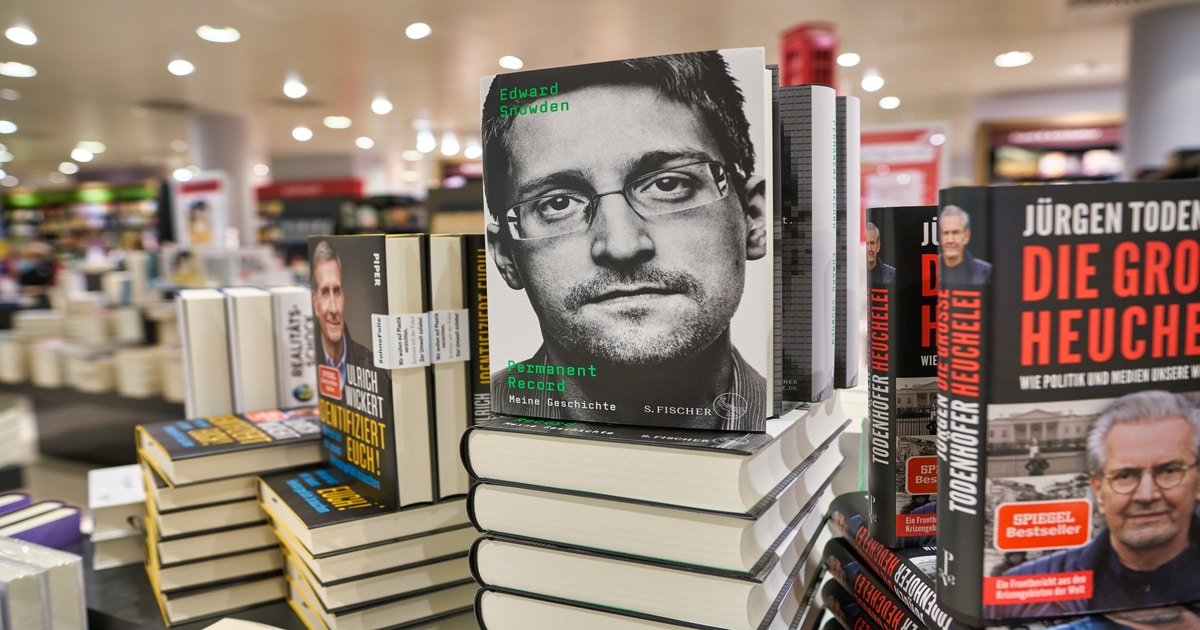

Snowden, who is currently in Russia and wanted in the United States on espionage charges, expressed his dissatisfaction with Gensler through his official account. He said, “Oh my God Gary, get over it” and “You only had one job.” His statement reflects a more widespread sentiment among cryptocurrency enthusiasts and Wall Street executives who have questioned Gensler’s approach to regulatory policy. Gensler is notorious for his strict approach to cryptocurrency regulation, which often goes beyond the scope of his legislative powers, according to many people familiar with the industry.

These incidents have exposed the problematic stance taken by the Securities and Exchange Commission (SEC) in the cryptocurrency business. Many have accused the SEC of exceeding its jurisdiction and blurring the boundaries of its authority. Moreover, the hacking incident has brought attention to the cybersecurity procedures put in place by the SEC, which were recently strengthened to force regulated companies to report significant cybersecurity incidents and tactics.

This was part of a larger story in which the Securities and Exchange Commission (SEC) is preparing to make a major announcement about approving a Bitcoin spot ETF. The fake statement about the Bitcoin ETF was part of this larger story. The authorization is an important step towards the development of the cryptocurrency market, which is already worth $1.7 trillion and has the potential to attract millions of retail investors. However, the timeline and certainty of this approval have been questioned by this incident and the SEC’s response.

Source: X

In general, this incident not only affected the price of Bitcoin in the market, but also raised significant concerns about the SEC’s ability to handle sensitive information and keep the markets stable. While the industry waits for the SEC to rule on spot Bitcoin exchange-traded funds (ETFs), scrutiny of the regulator’s legality and methodology continues.

As of this writing, Edward Snowden has deleted his tweets criticizing the SEC and Chairman Gary Gensler, adding another layer of complexity to the unfolding story about this cybersecurity breach and its impact on cryptocurrency markets.

Image source: Shutterstock