After the U.S. Securities and Exchange Commission (SEC) Twitter account was hacked on January 9, the Bitcoin (BTC) and Ethereum (ETH) derivatives markets experienced significant fluctuations. This erroneous announcement of the approval of a spot Bitcoin ETF set off a series of market reactions that wiped out more than $50 billion of Bitcoin’s market capitalization.

Derivatives markets have seen unprecedented volatility. CryptoSlate’s Total trading volume increased 8.52% to $79.02 billion, according to CoinGlass data analysis. This increase in trading activity likely reflects the market’s rapid response to fake news as traders seek to capitalize on volatility or mitigate risk.

However, open interest decreased by 2.78% to $19.69 billion. The decline in open interest, which measures the total number of outstanding derivative contracts, suggests that many traders are preferring to close positions amid uncertainty and reduce exposure rather than participate in volatile markets.

Bitcoin options trading volume decreased 39.73% to $625.97 million, while options open interest increased 2.18% to $10.24 billion. This indicates that options contract trading decreased while many traders maintained positions. This may be a strategy to wait out market movements or a belief in long-term trends that are unaffected by short-term volatility.

The market clearing amount was $95.41 million, with long positions at $59.39 million and short positions at $36.02 million. High liquidation of long positions indicates a bearish market reaction, and traders who had bet on price increases were caught off guard when prices fell after the ETF news was revealed.

If we look at Binance and Bybit, the two largest exchanges by open interest, we can see that both platforms have seen an increase in activity with increased trading volumes. The decline in open interest on these platforms further confirms the trend of traders choosing to liquidate positions in volatile environments.

| symbol | price | Price (24 hours%) | Volume (24 hours) | Volume (24 hours%) | market capitalization | Open Interest | Open interest (24 hours%) | Liquidation (24 hours) |

|---|---|---|---|---|---|---|---|---|

| BTC | $44911.2 | -4.01% | 77.66 billion dollars | +5.23% | $8849.7B | $196.6B | -3.59% | $94.36M |

| ETH | $2375.65 | +4.47% | $411.8B | +77.57% | $2858.2B | $77.8B | +10.67% | $49.30M |

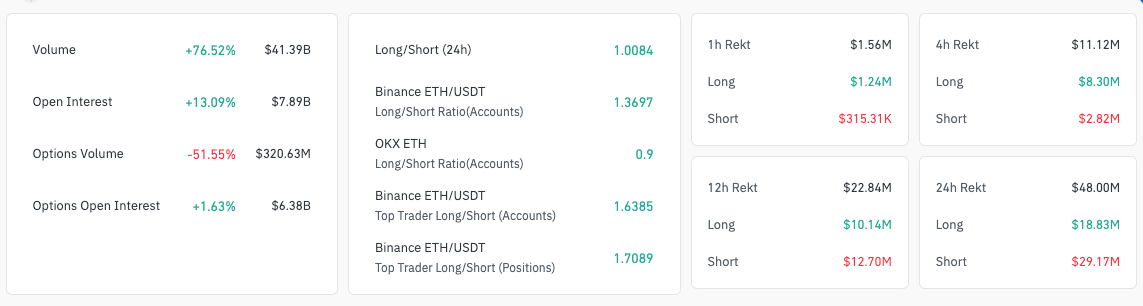

Turning to the Ethereum derivatives market, a different picture emerges. Total trading volume of Ethereum derivatives increased 79.85% to $41.3 billion. This significant increase in trading volume may be due to traders turning to Ethereum amid the Bitcoin turmoil or perceiving Ethereum as a safer or more profitable option during this period of heightened market sensitivity.

Interestingly, despite the surge in overall trading volume, options trading volume for Ethereum derivatives fell 51.55% to $320.63 million. This gap suggests that trading activity has increased overall while the options market has pulled back.

Traders may have been more inclined to engage in futures contracts as a more direct way to capitalize on or hedge against market volatility rather than dealing with the complexities of options trading under these uncertain circumstances.

Open interest on Ethereum also increased by 11.52% to $7.81 billion, contrasting with the pattern observed in Bitcoin. This, combined with an increase in trading volume, means that new positions have been opened, which suggests a more optimistic sentiment in the Ethereum market, or at least that Ethereum is perceived as a more stable asset in the face of market shocks.

The post Ethereum surpasses Bitcoin in derivatives trading volume appeared first on CryptoSlate.