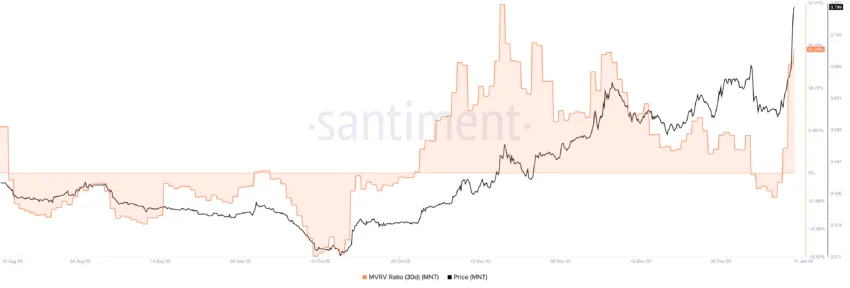

Smart investors keenly monitor market indicators to proactively gauge potential changes. One such metric is MVRV. (realized value compared to market value) The ratio recently highlighted an interesting trend among five altcoins.

These digital assets, which are currently showing high MVRV values, may experience a price correction due to a surge in profit-taking activity.

Most overbought altcoins

The MVRV ratio, which compares an asset’s market capitalization to its realized capitalization, provides a window into whether an altcoin’s price is in line with its “fair value.”

When market capitalization exceeds realized capitalization, it is a sign that unrealized profits have reached a peak. This scenario typically suggests an imminent sell-off as investors look to capitalize on profits. Conversely, a low market capitalization relative to realized market capitalization may be a sign of undervaluation or weak demand.

Read more: Top 10 Cheapest Cryptocurrencies to Invest in January 2024

Currently, these five altcoins are showing high 30-day MVRV values, which means they are trading in overbought territory.

These numbers indicate that a significant portion of these asset holdings are generating returns, a typical indicator of market vitality. This environment often tempts investors to liquidate their holdings with the goal of maximizing returns.

Is it time to sell your cryptocurrency?

The decision to sell should not be taken lightly. In fact, cryptocurrency markets are notoriously volatile, and assets that currently appear to be overbought may continue to rise in value.

The MVRV ratio is insightful, but it is not the only factor investors should consider. Broader market trends, global economic conditions, and cryptocurrency-specific news also play a pivotal role in shaping the future value of an asset. For example, technological updates, regulatory changes, or changes in investor sentiment can cause significant changes in cryptocurrency prices.

Read more: 7 cryptocurrencies you need in your portfolio before the next bull market

Ethereum Name Service, Arbitrum, Mantle, Maker, and Ethereum each have their own unique characteristics and narratives that influence their market position. For this reason, investors should consider these factors along with the MVRV ratio to form an overall market view. This balanced approach, tailored to your individual investment strategy and risk tolerance, is critical to navigating the markets.

The current scenario, indicated by the high MVRV values of these altcoins, represents a critical moment for investors. Cashing in on price increases may seem appropriate, but a hasty decision could result in missed opportunities if asset values rise further.

The volatility inherent in cryptocurrency markets requires a cautious approach that combines analytical insight with a sound understanding of market dynamics.

disclaimer

In accordance with Trust Project guidelines, this price analysis article is provided for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate and unbiased reporting, but market conditions may change without notice. Always do your own research and consult with a professional before making any financial decisions. Our Terms of Use, Privacy Policy and Disclaimer have been updated.