Cardano price wavered below the crucial $0.50 level in the early hours of January 19, with tracking on-chain data revealing key details surrounding the downward price trend.

Cardano price saw significant gains in the first 10 days of January as investors increasingly shifted their focus from Bitcoin (BTC) to altcoin markets. However, bearish headwinds and widespread market clearing caused the ADA price to fall below $0.50 on January 19th.

What is driving the current ADA price downtrend and what can traders expect going forward?

A Cardano whale was discovered this week offloading $120 million in ADA.

Cardano’s price fell below $0.50 on January 19, down 25% from its high of $0.62 on January 11. However, looking at the price chart, tracking on-chain data suggests that the recent price decline could be due to significant selling. Among Cardano whale investors.

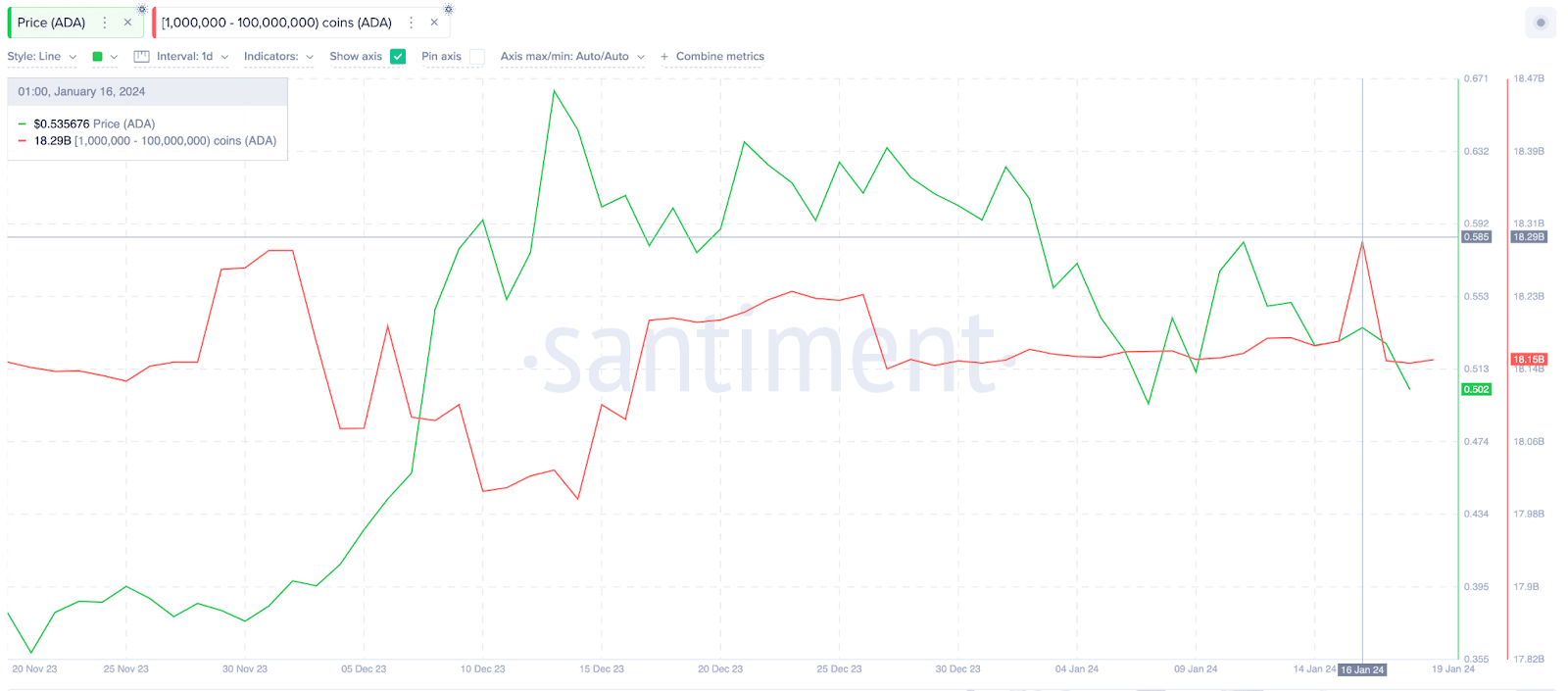

Santiment whales’ wallet balance chart tracks the real-time balance of wallets holding at least $100,000 worth of cryptocurrency.

Cardano whales holding 1 million and 100 million coins have a cumulative balance of 18.3 billion ADA as of January 16. Afterwards, the selling trend continued. Between January 17 and January 19, they sold 240 million ADA, reducing their balance to 8.1 billion ADA.

Currently valued at $0.50, Cardano whales have sold $120 million worth of LINK tokens over the past three days. Unusually, a decline in whale investors’ holdings is interpreted as a bearish signal.

When $120,000 worth of ADA hit the market, the price of Cardano plummeted. If this continues, massive sell orders from whales could crowd out bullish retail traders and put the ADA price under extreme downward pressure.

Cardano Price Prediction: Bears Target $0.45

From an on-chain perspective, the whale selling frenzy appears to be the main driving force behind the ongoing Cardano price downward trend. Unless there is a significant surge in market demand, ADA prices are expected to shrink further.

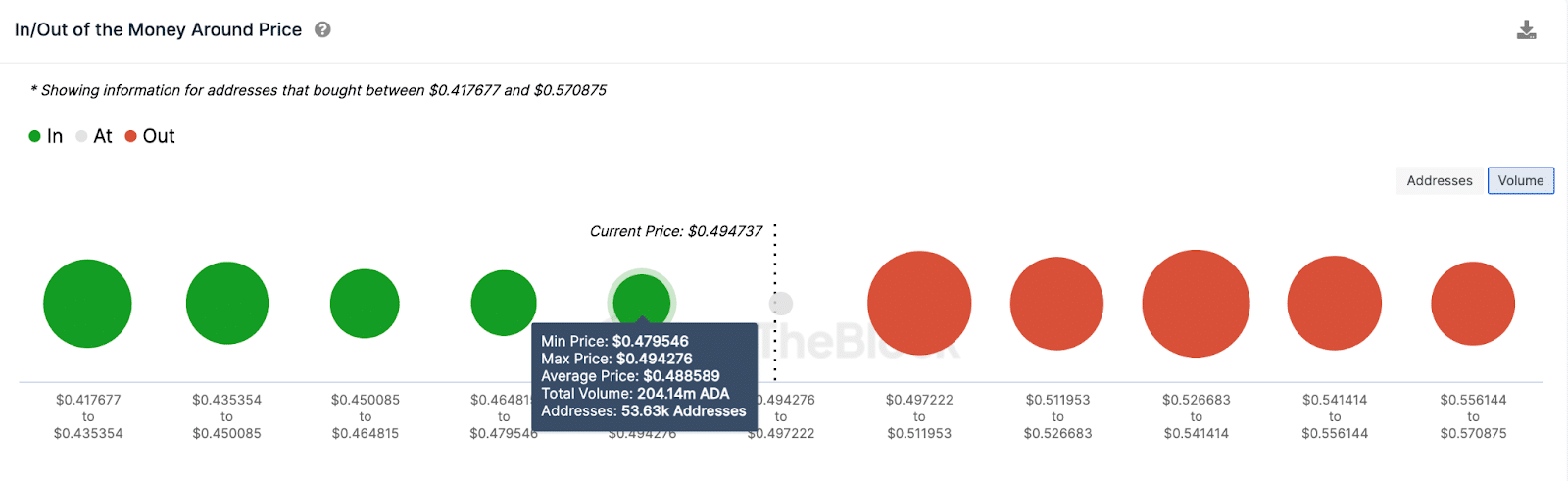

However, the bulls could put up a significant buying wall in the $0.48 area. According to IntoTheBlock’s IOMAP data, 53,600 addresses acquired 204 million ADA at a price of at least $0.48.

However, if the bears are able to break down the initial buying wall, it could trigger another panic selling and push the price as high as $0.45.

Conversely, if the Cardano price can break above $0.60 again, the bulls could invalidate this negative prediction. However, the looming selling wall in the $0.51 area could prove to be threatening, as depicted above.