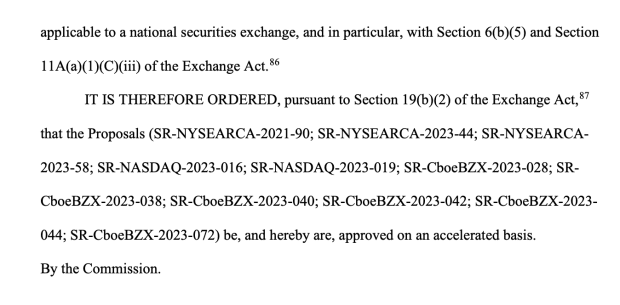

Today, the U.S. Securities and Exchange Commission (SEC) officially approved the listing of the first-ever Bitcoin exchange-traded fund (ETF). This move marks a historic milestone in the evolution of Bitcoin adoption within traditional financial markets.

“Today, the Commission approved the listing and trading of a number of Bitcoin spot exchange-traded product (ETP) shares,” said SEC Chairman Gary Gensler. “We today approved the listing and trading of certain spot Bitcoin ETP shares, but do not endorse or endorse Bitcoin. Investors should be cautious about the numerous risks associated with Bitcoin and products whose value is tied to cryptocurrencies. do.”

The approval comes after extensive deliberation and anticipation surrounding the introduction of a spot Bitcoin ETF, which is expected to provide investors with direct exposure to BTC.

The introduction of spot Bitcoin ETFs in the United States is expected to open up unprecedented opportunities for both institutional and retail investors, providing a more accessible and regulated way to participate in the rapidly growing Bitcoin market. .

Industry analysts predict that the approval of these ETFs will spur a surge of institutional capital inflows into Bitcoin, potentially pushing BTC’s value to all-time highs and solidifying its position as a legitimate asset class.

The exact launch date of the ETF is expected to be tomorrow, Thursday, January 11th. Investors and Bitcoin enthusiasts alike are eagerly anticipating the ETF’s debut on major stock exchanges and are looking forward to its impact on market dynamics and investor sentiment.

The SEC’s decision marks a significant shift in the regulatory stance toward embracing Bitcoin, and is a sign of increased acceptance and awareness of Bitcoin within the traditional financial realm. This approval is expected to pave the way for the future development of Bitcoin-related investment products, potentially opening the door to a wider variety of BTC-based financial products for investors.

As the SEC finalizes preparations for listing the first spot Bitcoin ETF, market participants await a new era in the investment landscape shaped by the integration of Bitcoin into mainstream portfolios.