As user demand for new ways to spend, exchange, and store cryptocurrencies continues to grow, numerous exchanges and wallet providers have entered the market. This has given cryptocurrency users a variety of options when it comes to managing their holdings.

However, with so many different types of cryptocurrency wallets on the market, it can be difficult to decide which combination of properties best suits your personal cryptocurrency usage style. Ahead, we will analyze the different types of wallets currently available to help you make a more informed decision.

Cryptocurrency wallets securely store the private keys needed to access your funds on the blockchain. There are two main types: “hot” wallets, which remain connected to the internet, and “cold” wallets, which operate primarily offline.

Managed cryptocurrency wallets require you to protect your private keys, while self-managed (non-custodial) wallets leave that security to a third party (usually a cryptocurrency exchange).

Wallets come in many forms: web, desktop, hardware, and paper. Which one is right for you depends on your cryptocurrency goals and usage habits. However, it is advantageous to use multiple wallets for different purposes (e.g. a hardware wallet for savings and a mobile wallet for regular spending).

In this article

What is a cryptocurrency wallet? How do cryptocurrency wallets work?

The purpose of a cryptocurrency wallet is to allow users to interact with the blockchain using software or special hardware devices. The name wallet may be a bit of a misnomer considering that it is not actually used to store cryptocurrency. Instead, the wallet acts as an intermediary between users and their holdings “living” on the blockchain.

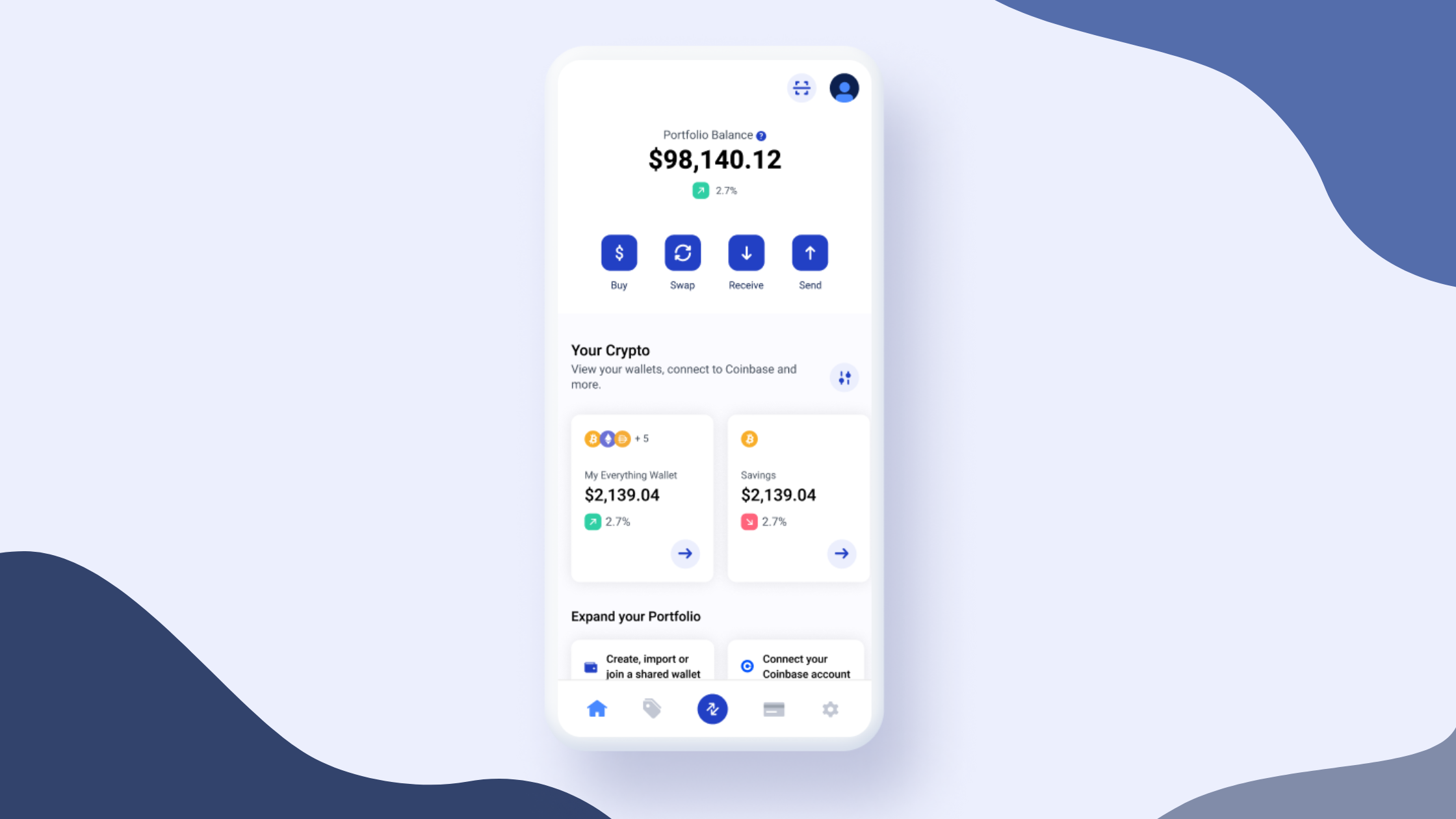

The wallet allows users to view and manage their cryptocurrencies as well as initiate transactions. They come in many forms, from easy-to-use online web wallets offered by major cryptocurrency exchanges to more technically complex and secure offline hardware-based wallets.

What all wallets have in common is the key needed to access the user’s cryptocurrency assets. When a wallet is created, a public and private key pair is generated. These long alphanumeric sequences may look similar, but their functions are significantly different.

Your public key is like your bank account number. This is similar to how your account number appears at the bottom of a paper check, so you can freely share it with anyone who wants to send you cryptocurrency. On the other hand, your private key can be considered a PIN code for your bank account and must be protected carefully. Anyone with access to those private keys has full control of your cryptocurrency assets.

If a user wants to send cryptocurrency to pay for an upcoming trip or buy a new watch, they enter the public key of the destination wallet and the amount of cryptocurrency they want to send. If the user wishes to receive cryptocurrency on their behalf, the process is reversed. Every time your cryptocurrency moves out of your wallet, you must “sign” the transaction using your private key. How this important step works depends on the type of wallet you use.

The best self-managed wallet for buying, storing, exchanging and spending cryptocurrency

Get the BitPay Wallet App

Cold Wallet and Hot Wallet

Taking a quick step back, before we dive into the different types of cryptocurrency wallets and how they work, it’s important to understand that wallets fall into two categories: “hot” wallets and “cold” wallets.

A hot wallet is simply any cryptocurrency wallet connected to the internet. Most cryptocurrency wallet types are the “hot” variety because they are generally easy to use. The always-on nature of hot wallets offers great convenience. However, those same characteristics make them more vulnerable to hackers. Therefore, it is not recommended to store large amounts of cryptocurrency in hot wallets.

As you might guess, cold wallets include any type of wallet that is offline or not connected to the internet. Because the only way to interact with the blockchain is through the internet, cold wallets are considered very secure and virtually impervious to hacking. Cold wallets tend to require more technical know-how and are therefore generally suitable for more experienced users or those with large amounts of assets.

Types of hot wallets

Hot wallets are usually chosen for users who always have their cryptocurrencies at their side and ready to spend. There are several different types of hot wallets, each with potential advantages and disadvantages depending on your needs.

desktop wallet

Desktop wallets utilize encryption to securely store users’ private keys on their computer’s hard drive. Read our in-depth analysis of desktop wallets.

Advantages

- Excellent for safely conducting small cryptocurrency transactions using your computer

- It’s free and easy to use.

- No third party holds your private keys.

- Some can be used offline for refrigerated storage.

disadvantage

- Most computers are online at any time.

- Potentially vulnerable to malware or computer viruses

- Anyone with access to your computer can potentially access your cryptocurrency.

Recommended desktop wallets: bit pay, Exodus, Electrum

web wallet

A web wallet is a wallet provided by a third party (usually a cryptocurrency exchange) that provides seamless access to a user’s holdings using a web browser.

Advantages

- Easy to use; It is generally preferred by most cryptocurrency newcomers.

- Various transaction support (buy, sell, swap, etc.)

- Outsource account security to a trusted third party (exchanges, etc.)

disadvantage

- You must trust a third party to protect your private keys.

- Potentially vulnerable to hackers

- Computers used to access web wallets may also be exposed to threats such as viruses, malware, and keyloggers.

Recommended web wallets: Coinbase, Metamask, Guarda

mobile wallet

Mobile wallets allow users to quickly and securely spend or receive cryptocurrency anywhere they have a mobile phone and an internet connection. Read our extended guide to mobile cryptocurrency wallets.

Advantages

- Easily send and receive cryptocurrency payments on the go.

- Very convenient and easy to use.

- One of the easiest ways to use cryptocurrency

disadvantage

- Your assets are as safe as your phone

- If your device is lost or stolen, your account may be compromised.

- Just like your computer, your phone is potentially vulnerable to viruses and malware.

Recommended mobile wallets: bit pay, Edge, Trust, Electrum, Blockchain.com

Managed and non-custodial wallets

Before we dive into the types of cold wallets, another key difference we need to talk about is custodial and non-custodial cryptocurrency wallets. The main difference between these options lies less in convenience than in security and who is responsible for securing your wallet’s private keys.

A custodial wallet allows a third party, such as a cryptocurrency exchange, to hold the user’s private keys and use them to “sign” transactions initiated on behalf of the owner. Managed wallets are ideal for users who don’t want to worry too much about security and aren’t too concerned about entrusting their private keys to a third party. It is generally not recommended to store large amounts of cryptocurrency in custodial wallets due to risks such as hacks or exchange failures (which have happened before).

For advanced cryptocurrency users or those who want complete control over their private keys, non-custodial wallets are often preferred. These wallets are also known as “self-storage” wallets. With a self-managed wallet, the owner is solely responsible for keeping private keys safe. Non-custodial wallets do not require users to trust a third party to secure their accounts, but they do require a significant amount of self-trust. Please remember that if your private keys are lost or compromised, your funds may become depleted or unrecoverable.

Related Article: All About Bitcoin Wallets

Types of cold wallets

People who want to manage their account security themselves usually choose cold wallets. The two most popular types of cold wallets, hardware and paper, are on opposite ends of the tech spectrum. Paper wallets are as low-tech a solution as possible, while hardware wallets often contain sophisticated, high-tech components. Both are considered very secure ways to secure your cryptocurrency.

paper wallet

As the name suggests, a paper wallet is an offline wallet solution that records or prints your private keys and keeps them safe.

Advantages

- Hacking is impossible when you are completely offline.

- No third party has control of your private keys.

- Optional inclusion of a QR code makes it easier to access.

disadvantage

- Paper can easily be lost, stolen, incinerated, or otherwise disposed of.

- Moving cryptocurrencies between wallets requires more time and effort.

- Requires more technical know-how

Recommended paper wallets: While some people may prefer the traditional method of using paper and pen, it’s also very simple to create your own secure, printable paper wallet. In fact, there are dedicated websites such as WalletGenerator.Net and BitcoinPaperWallet.com.

hardware wallet

For those who prefer a more high-tech solution, hardware wallets offer secure private key storage in a variety of formats. These physical devices, often similar to USB thumbdrives, are offline unless connected to a computer or mobile device. Learn how to use a hardware wallet like a whale.

Advantages

- One of the safest ways to store cryptocurrency

- Offline, you use your private key to sign transactions, and only online do you upload transactions to the blockchain.

- Available at most major electronics stores

disadvantage

- It’s not free. Price ranges from $30-$200

- Cryptocurrency can be difficult for beginners

Recommended hardware wallets: Ledger Nano S, Treasure Model One, Ledger Nano

Which cryptocurrency wallet should I choose?

Before deciding on a cryptocurrency wallet option, look at your priorities and ask yourself how important you value factors like ease of use and security. Think about how easily you want access to your cryptocurrency, and how much security you are willing to trade for that convenience. This is the formula most people evaluate when choosing the right wallet for them.

BitPay is a self-custodial wallet that can be used on mobile devices or desktops. Its intuitive UI and advanced features make it a safe option for both new and advanced cryptocurrency users.

BitPay offers cryptocurrency enthusiasts a safe, simple, and fast way to purchase Bitcoin and other cryptocurrencies. Buy at competitive prices with no hidden fees. BitPay also offers convenient payment methods for cryptocurrency purchases, including credit cards, debit cards, bank transfers, Google Pay, Apple Pay, and other local banking methods.

After purchasing Bitcoin, manage your assets with the all-in-one BitPay Wallet app with industry-leading security features.

It also includes the best features to help you pay with cryptocurrency, including a list of merchants that accept cryptocurrency, an easy option to purchase gift cards with cryptocurrency right from your wallet, and a free cryptocurrency debit card.

The best self-managed wallet for buying, storing, exchanging and spending cryptocurrency

Download the app