Ethereum, the core of the decentralized application ecosystem, found itself on a precarious path this week. The cryptocurrency’s value has breached the crucial $2,250 support level and now stands on the edge of a crucial crossroads between prospects of a revival and the looming threat of a more pronounced recession.

Analyzing the technical environment reveals a cautious narrative, as an ominous bearish trend line appears on the hourly chart of the Kraken exchange and elastic resistance at $2,240 presents a formidable obstacle.

Ethereum: Uphill Battle and Key Levels to Watch

The journey to regain lost ground will require a Herculean effort from Ethereum, which will have to overcome the initial hurdle of $2,240 and engage in a fierce battle against resistance at $2,280. The fate of digital assets hangs in the balance, and the outcome will likely shape its trajectory in the coming days.

ETH price action in the last week. Source: Coingecko

However, if Ethereum goes uphill, a safety net at $2,200 awaits, providing a temporary buffer against further declines to $2,000.

But amid the technological chaos, a ray of sunlight breaks through the clouds. Market sentiment surrounding Ethereum is surprisingly optimistic. Despite the price decline, the amount of net profit captured by ETH investors is at a multi-year high, suggesting a shift in focus from short-term profits to long-term holding.

Ethereum’s High-Wire Act: Key Indicators

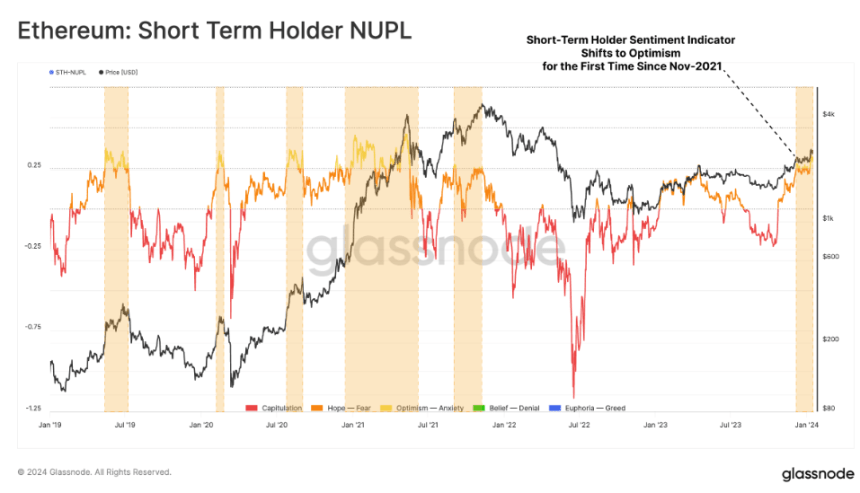

This new-found patience is further confirmed by the soaring Net Unrealized Profit/Loss (NUPL) indicator for short-term token holders. This measure, which reflects an investor’s potential profitability based on the purchase price, rose above 0.25 for the first time since the all-time high in November 2021, signaling a surge in confidence among those who have recently acquired ETH.

Ethereum currently trading at $2,220 on the daily chart: TradingView.com

The current scenario is similar to a high-wire act, except the risks are significantly higher. There are warning signs on the technical charts, but market sentiment does not whisper any signs of optimism. It is not yet known whether Ethereum will gain ground and rise, or make a mistake and plummet.

At a glance

- Ethereum is facing near-term technical challenges with resistance points at $2,240 and $2,280.

- The support amounts are $2,200 and $2,165, with a possible violation of less than $2,000.

- Despite the price drop, market sentiment surrounding Ethereum remains positive.

- Record high net income pegged and rising NUPL for short-term holders suggests long-term optimism.

Ethereum’s direction of development is still shrouded in uncertainty, but the technical situation presents a potentially bleak outlook. As resistance levels grow and support thins, a slide towards the psychologically important $2,000 mark cannot be ruled out. However, resilient optimism among investors, evidenced by rising fixed profits and NUPL, suggests hidden strengths that could fuel an unexpected recovery.

Featured image from Pixabay, chart from TradingView

Disclaimer: This article is provided for educational purposes only. This does not represent NewsBTC’s opinion on whether to buy, sell or hold any investment, and of course investing carries risks. We recommend that you do your own research before making any investment decisions. Your use of the information provided on this website is entirely at your own risk.