Dogecoin and Shiba Inu recorded identical price performance in January, with the two largest meme coins down 17% as of January 26.

Positive speculation about the proposed XPayments platform has been the main driver for both the Shiba Inu (SHIB) and Dogecoin (DOGE) communities for a month, but as bearish headwinds sweep the broader cryptocurrency markets, the megacap memecoin has also succumbed to downward pressure. I did.

In particular, recent trading activity by Dogecoin miners could cause DOGE price to fall below SHIB in the coming weeks.

DOGE and SHIB recorded identical performance in January.

With market capitalizations of $11.4 billion and $5.3 billion respectively, Dogecoin and Shiba Inu are the two largest memecoins. The fortunes of the two ecosystems have been closely interconnected from the beginning.

In January 2024, DOGE and SHIB recorded surprisingly identical price performance. The chart above shows that both assets lost 17% in value in the month ending January 26th.

However, the current trading propensity of Dogecoin miners could see the price correlation with SHIB decoupling in February.

Dogecoin miners offload $22 million worth of DOGE in 3 months.

Dogecoin posted double-digit price gains in the fourth quarter of 2023 as the cryptocurrency market rebounded on the back of positive sentiment surrounding the approval of a Bitcoin spot ETF. However, as investors got in on the hype, on-chain data showed that Dogecoin miners took advantage of the cryptocurrency market rally to record profits.

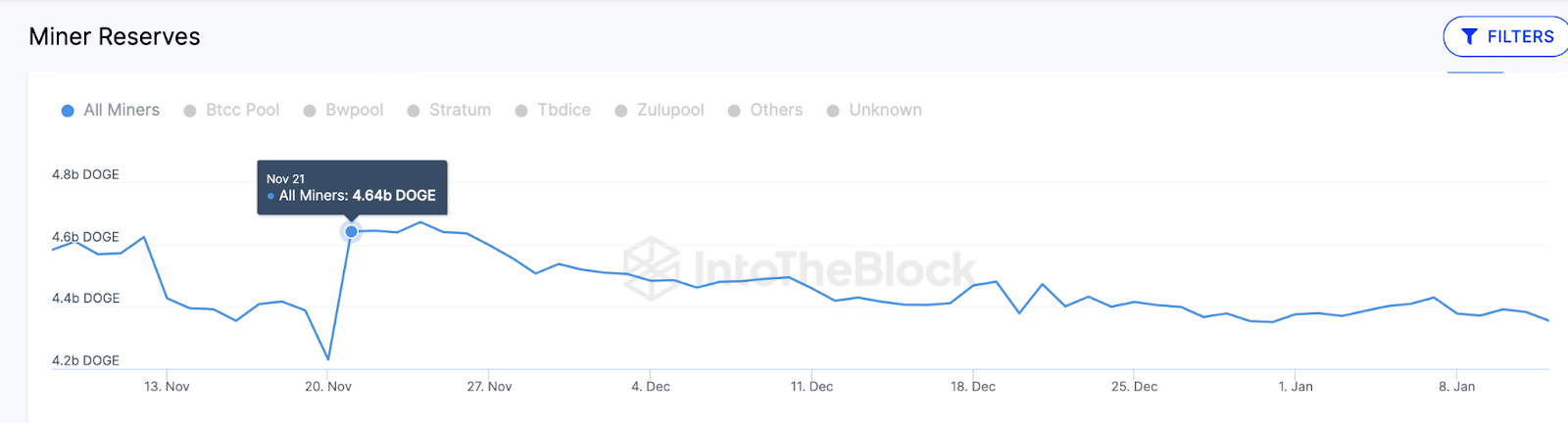

IntoTheBlock’s Miner Reserve Chart tracks real-time balances maintained by recognized mining companies and mining pools.

Dogecoin miners held a cumulative balance of 4.6 billion DOGE as of November 21, at the height of the cryptocurrency market rally. However, as of January 26, the balance had decreased to 4.3 billion DOGE.

This means that miners have offloaded 290 million DOGE, worth approximately $22.6 million, over the past three months.

Miners are key stakeholders in the Proof-of-Work (PoF) cryptocurrency ecosystem. They use computing resources to verify transactions in return for block rewards denominated in native coins.

A selling trend is interpreted as a bearish signal for the underlying asset. As miners unload more of their newly mined DOGE coins, market supply is diluted and downward pressure on prices increases.

As market demand weakens, a selling trend from miners could have a more pronounced impact on the price of DOGE in February 2024, opening the door for SHIB to potentially overtake its pioneer memecoin.

DOGE Price Prediction: Loss of $0.007 support could lead to bigger losses.

Like the rest of the cryptocurrency market, DOGE price has experienced significant declines over the past month. However, inferring based on the $22.6 selling trend of miners analyzed above, the bears are likely to gain more ground in the coming weeks. The Bears would need to extend their initial support buy wall to around $0.07 to validate this outlook.

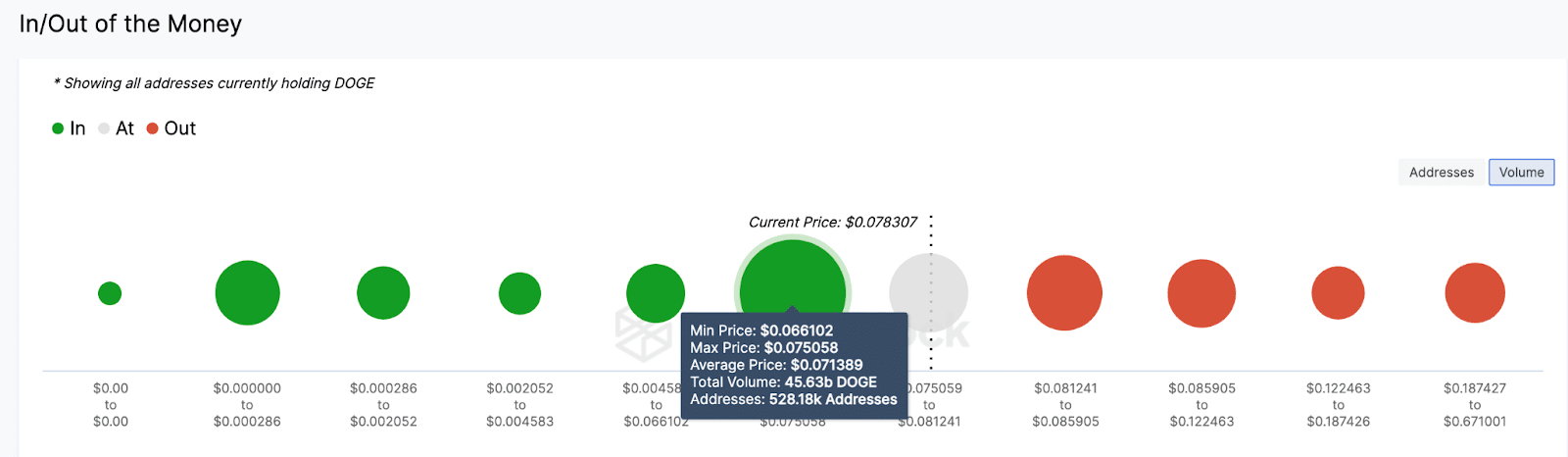

IntoTheBlock’s Global GIOM (Global in/out of the Money) data groups current DOGE holder wallets by historical entry price.

The tool shows that 528,180 addresses acquired 45.6 billion DOGE at an average price of $0.071. Notably, this is currently the largest cluster of Dogecoin holders. If you buy like crazy to defend your position, you can reverse the bearish trend.

However, a drop below the $0.07 support level could trigger a margin call and open the door for a $0.06 retest.

On the other hand, if DOGE price can move above $0.10, the bulls could regain momentum. However, in the short term, there may be significant resistance with 786,930 addresses acquiring 14.1 billion DOGE at an average price of $0.095.