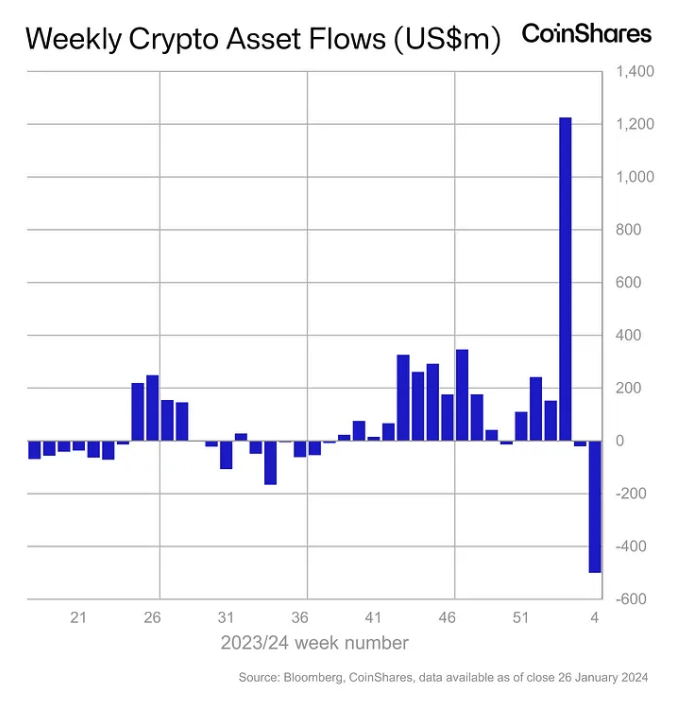

Cryptocurrency funds from asset managers such as BlackRock, Bitwise, Fidelity, Grayscale, ProShares and 21Shares recorded net outflows totaling $500 million globally last week, according to a recent report from CoinShares.

Grayscale’s high-fee convertible spot Bitcoin exchange-traded fund (GBTC) continued to dominate outflows, with $2.2 billion leaving the exchange-traded fund. But the most recent data shows the impact is starting to wane, with daily outflows declining for one week in a row, wrote James Butterfill, head of research at CoinShares.

GBTC leak. Image: CoinShares.

GBTC’s strong outflows contrast with inflows from nine new spot Bitcoin ETFs totaling $1.8 billion last week, led by $744.7 million from BlackRock’s IBIT and $643.2 million from Fidelity’s FBTC . Since their launch on January 11, the nine new ETFs have collectively seen inflows of approximately $5.8 billion and GBTC outflows of $5 billion, for total net inflows of $759.4 million.

Bitcoin  BTC

BTC

+0.04%

According to The Block’s, the spot Bitcoin ETF has fallen about 14% from its launch day high of $49,000 to its current price of $42,252. Pricing page. “Despite these positive trends, we believe most of the price decline is due to Bitcoin seed capital being secured prior to January 11,” Butterfill said.

Weekly cryptocurrency asset flows. Image: CoinShares.

Bitcoin dominates the US market

Not surprisingly, Bitcoin investment products dominated, with net outflows of $479 million. Short Bitcoin funds received an additional inflow of $10.6 million.

Most altcoin-based funds also recorded outflows. Last week, Ethereum investment products experienced an outflow of $39 million, with Polkadot and Chainlink funds losing $700,000 and $600,000 respectively.

However, Solana products bucked the trend with $3 million worth of inflows, while blockchain stocks added $17 million, continuing their 10th consecutive week of inflows.

Regionally, US-based funds recorded net outflows of $409 million, while Switzerland and Germany saw outflows of $60 million and $32 million, respectively. Brazil recorded the largest net inflow at $10.3 million.

“The recent price decline triggered by significant outflows totaling $5 billion from an existing ETF issuer in the U.S. (Grayscale) is likely to have triggered additional outflows in other regions as well,” Butterfill said.

Disclaimer: The Block is an independent media outlet delivering news, research and data. As of November 2023, Foresight Ventures is a majority investor in The Block. Foresight Ventures invests in other companies in the cryptocurrency space. Cryptocurrency exchange Bitget is an anchor LP of Foresight Ventures. The Block continues to operate independently to provide objective, impactful and timely information about the cryptocurrency industry. Below are our current financial disclosures.

© 2023 The Block. All rights reserved. This article is provided for informational purposes only. It is not provided or intended to be used as legal, tax, investment, financial or other advice.