NEAR Protocol, a blockchain operating system (BOS), has seen significant growth in the following areas: key indicators NEAR, the protocol’s native token, has seen a remarkable 16% year-to-date growth and rapid adoption.

Circulating market cap surges 245%

According to Messari reportThe overall cryptocurrency market capitalization increased in the fourth quarter of 2023, largely driven by expectations surrounding the introduction of spot Bitcoin exchange-traded funds (ETFs).

NEAR actively participated in the overall market rally and made further gains due to strengthening network activity and important announcements. As a result, NEAR’s Circulating Market Capitalization By the end of 2023, revenue would reach $3.7 billion, up 245% quarter-over-quarter (QoQ) and 246% year-over-year (YoY).

Moreover, NEAR’s fully diluted market capitalization reached $4.3 billion. The protocol’s market capitalization ranking also soared, rising 10 places and reaching around 30th place by the end of 2023.

In the fourth quarter of 2023, NEAR’s revenue increased significantly, reaching $750,000, primarily generated from network transaction fees. The increase in revenue was due to increased activity resulting from projects such as KAIKAINOW and NEAR Inscriptions.

The surge in transactions during the Inscriptions craze led to a surge in revenue, driving up transaction fees. In particular, NEAR uses a fee burning mechanism where 70% of the total fees are burned and the remaining 30% is transferred to the contract in which the transaction was initiated.

NEAR user base surges

Another key indicator of the protocol’s growth in Q4 2023 is that NEAR has experienced significant growth in its user base.

Average daily active addresses increased 1,250% year over year, reaching 870,000 in Q4 2023. New address every day In the fourth quarter of 2023, we recorded 170,000 cases, a remarkable 550% growth compared to the same period last year.

According to Messari, this expansion follows the successful launch and adoption of projects such as KAIKAINOW and contributions from Sweat Economy, Aurora and Playember, further supporting this positive trend.

NEAR’s daily active addresses were noticeably higher than other major blockchain networks. For example, Optimism averaged 72,000 daily active addresses, 150,000 Arbitrum, 375,000 Polygon PoS, and 60,000 Aptos in Q4 2023.

NEAR Inscriptions significantly boosted network activity, reaching a yearly high of 14 million transactions in December. Despite this significant increase, transaction fees remained stable, remaining below $0.01 during the quarter.

Top 25 Blockchains by TVL, Q4 2023

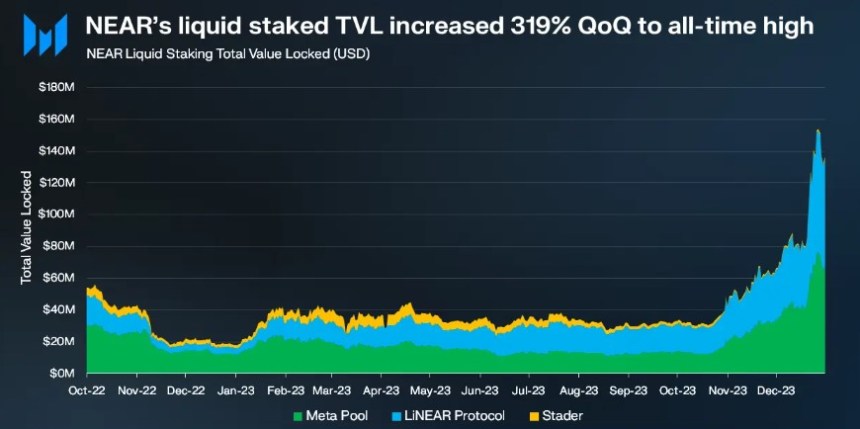

NEAR’s Total Value Locked (TVL) will reach $128 million by the end of the fourth quarter of 2023, recording an impressive 147% increase over the previous quarter. Among blockchains, NEAR ranks around 25th in terms of TVL.

Within NEAR Network’s TVLs, NEAR contributed $59 million, representing nearly 46% of the network’s total TVLs. The remaining TVL was distributed across various decentralized finance (DeFi). applicationIncludes Aurora, Ref, Berry Club and Flux.

NEAR also announced partnerships with projects such as Chainlink and decentralized exchange (DEX) SushiSwap.

According to Messari, Chainlink’s integration with decentralization will oracle network NEAR enhances the functionality and usability of NEAR-based applications by providing developers with access to real-world data and external application programming interfaces (APIs).

Meanwhile, our collaboration with SushiSwap will give NEAR users access to a wide range of token swaps, liquidity pools, and yield farming opportunities, enabling increased developer adoption and usage within the ecosystem.

Ultimately, looking ahead to 2024, Messari said the protocol’s vision is to iterate on its technology roadmap, attract more developers, and attract more leading protocols.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: This article is provided for educational purposes only. This does not represent NewsBTC’s opinion on whether to buy, sell or hold any investment, and of course investing carries risks. We recommend that you do your own research before making any investment decisions. Your use of the information provided on this website is entirely at your own risk.