Bitcoin has failed to maintain its bullish momentum and looks set to extend its current downtrend. However, the long-term is still positive and BTC could reach all-time highs next month, but in a different way than previous rallies, according to large investors.

As of this writing, Bitcoin is trading at $42,000, having lost 1% over the past 24 hours. Last week, the cryptocurrency still recorded a 5% gain.

Bitcoin Whale Makes Optimistic Forecasts

According to Bitcoin Whale, pseudonym “Joe007” social media x, the cryptocurrency is poised for a bullish run. Institutions trading U.S. spot Bitcoin exchange-traded funds (ETFs) will drive this bullish momentum.

In that sense, these institutions are likely to absorb Bitcoin’s volatility by pursuing transactions similar to traditional assets. Joe007 therefore argues that this cycle’s rally will lack the excitement of 2017 and 2021, when BTC hit $20,000 and $69,000 respectively, creating euphoria among investors.

Bitcoin Whale said:

I think we are about to witness the most boring rally in Bitcoin history. There are no retail-driven parabolic swings that excite consumers and grab headlines. Rather, it is slowly and constantly lifted to higher heights by specialized accumulators that pull out the paper holders layer by layer.

When asked whether a “systemic crisis” in the universe could cause traditional institutions to fail to “tame” BTC, Whale dismissed the possibility. Joe007 also dismissed the possibility that the cryptocurrency might not rise higher in the long run.

The only thing that could stand between Bitcoin and a rally is a “low probability” scenario where the traditional financial sector experiences a collapse similar to 2008. BTC Whale added:

(…) Unless there is a sudden complete traffic collapse (2008 style or worse). If so, we could see Bitcoin going into a general panic, at least initially. It’s certainly possible, but it’s difficult to assign a realistic probability.

BTC price in the short term

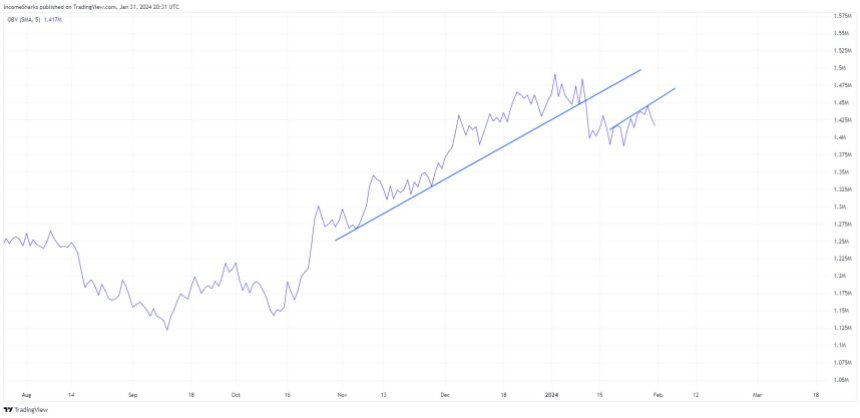

In a short period of time, analysts pointed In terms of daily balance volume (OBV), this suggests further decline for BTC. The chart below shows that this indicator broke out of its trend channel during Bitcoin’s recent crash.

OBV has been rejected at critical levels and looks set to trend upward along with BTC price. The analyst said:

Daily OBV still looks like it wants more downside. I think it was a lower high than what I just entered.

Cover image by Unsplash, chart by Tradingview

Disclaimer: This article is provided for educational purposes only. This does not represent NewsBTC’s opinion on whether to buy, sell or hold any investment, and of course investing carries risks. We recommend that you do your own research before making any investment decisions. Your use of the information provided on this website is entirely at your own risk.