Hong Kong, Hong Kong, February 2, 2024, Chainwire

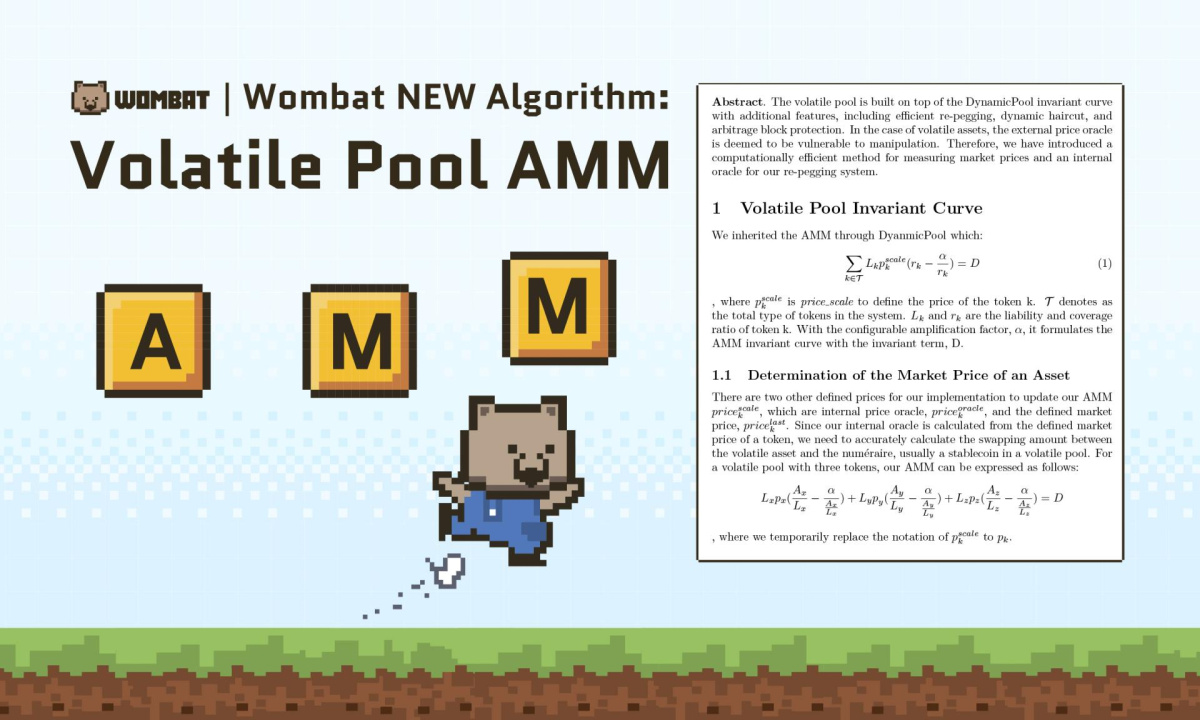

Wombat Exchange, a leading multi-chain and cross-chain single-sided stablecoin swap, has announced the first single-sided volatile pool Automated Market Maker (AMM) algorithm in the decentralized finance (DeFi) space. This groundbreaking development ushers in a new era in DeFi and delivers the first oracle-free, user-friendly, single-asset deposit and capital-efficient trading environment for all asset classes, including GameFi assets. Early last month, Wombat unveiled its new Gamified Bribe Market 2.0 announcement and plans to expand GameFi through future collaborations with Animoca portfolio games.

This white paper was released following the remarkable performance of Wombat Exchange, which has achieved over $3 billion in trading volume to date using only fixed assets such as stablecoins, LST, and LRT. The new unilateral volatility asset pool is expected to transform Wombat Exchange into a full-service multi-chain and cross-chain decentralized exchange (DEX), expanding the platform’s trading reach, significantly increasing the platform’s TVL and trading volume. – Fixed volatility assets including crypto assets and GameFi assets.

The team has long been committed to capital efficiency and has focused on improving proprietary algorithms that support high trading volumes with minimal Total Value Locked (TVL) to provide users with sustainable, long-term returns. Because of this dedication, the platform has achieved notable results. In just two months since launch, Wombat Exchange has quickly established itself in the DefiLlama top 7 in terms of cumulative trading volume, outperforming industry giants such as SushiSwap on Optimism without any trading incentives.

Early last month, Wombat Exchange’s cross-chain swap functionality, built on Wormhole technology and supporting six blockchains: Ethereum, BNB Chain, Arbitrum, Optimism, Base, and Avalanche, moved from Alpha to Beta. With new volatility asset extensions of the battle-tested ultra-cap efficient Wombat algorithm, the platform is transforming into a full-service one-way deposit DEX and bridge with a variety of ultra-cap efficient algorithms for a variety of asset classes.

Introduction to Wombat Exchange

Wombat Exchange is the only single-side deposit, multi-chain and cross-chain DEX. Our proprietary ultra-capital efficiency algorithm provides (i) a full range of concentrated liquidity for fixed assets and (ii) oracle-free, single-sided LP for highly volatile assets. Backed by industry giants like Binance Labs, Animoca, Shima, and Jump Crypto, Wombat is here to bring sustainable DeFi to the masses.

Telegram | discord | Twitter

InquiryMarketingKWOMWombatmarketing@wombat.exchange

Disclaimer: This is a sponsored press release and is provided for informational purposes only. It does not reflect the views of Crypto Daily and is not intended to be used as legal, tax, investment, or financial advice.