The decentralized finance (DeFi) ecosystem marked a significant milestone as the total value of locked assets (TVL) surpassed $60 billion, returning to levels last seen in August 2022.

According to data from DeFiLlama, the sector surged 68% to $60.72 billion compared to November 2023, when TVL was around $36 billion.

TVL’s upward trajectory signals strong investor confidence as more users deposit their assets to participate in decentralized finance activities.

Market analysts attribute this growth to the recent surge in the price of the cryptocurrency asset, fueled by rumors surrounding a Bitcoin exchange-traded fund (ETF). The rally, which has captured the attention of both retail and institutional investors, has boosted Bitcoin to nearly $50,000 and pushed Ethereum, the leading DeFi blockchain network, past $2,000.

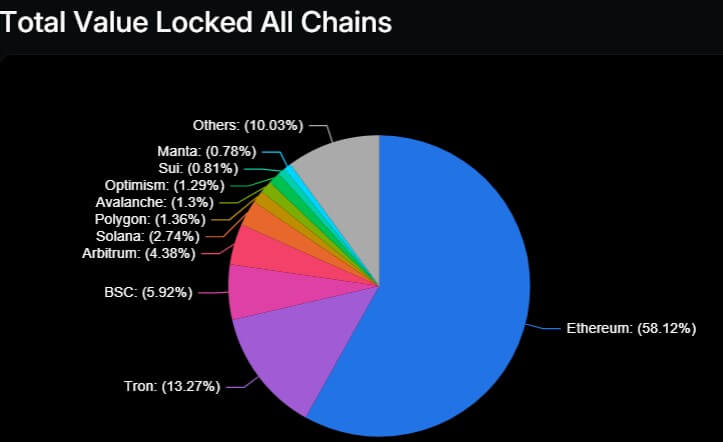

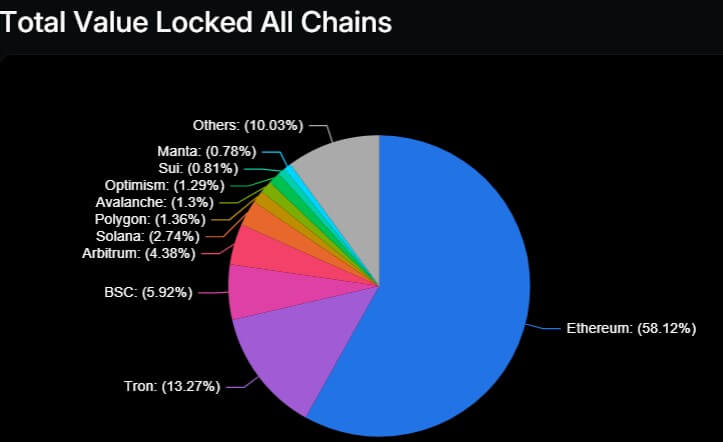

Ethereum Lead

Ethereum remains the dominant force in DeFi, boasting a TVL of $35.3 billion and accounting for over 58% of the overall blockchain market share. Tron blockchain is in second place, with a TVL of $8 billion and a 13% market share.

In addition to Ethereum and Tron, other blockchain networks such as Solana, Binance Smart Chain, Polygon, and Arbitrum have also had significant influence, hosting many projects and boasting respectable TVL figures.

Meanwhile, the emergence of the Sui blockchain is noteworthy as it has rapidly risen up the ranks in the DeFi space, breaking into the top 10 in TVL and outperforming established competitors such as Cardano and Bitcoin.

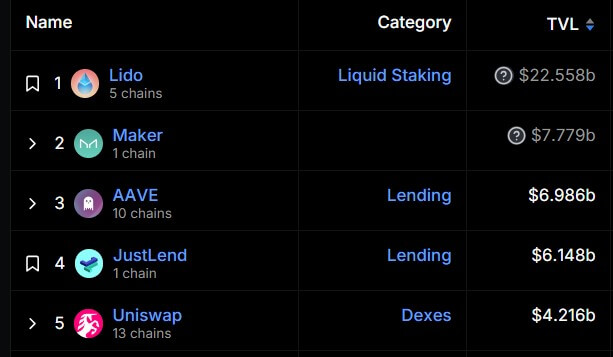

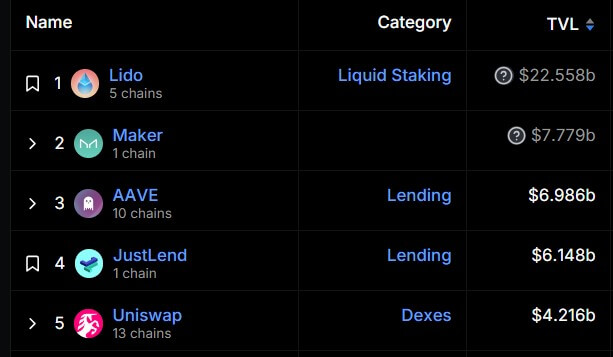

Lido dominates the protocol

Lido Finance, the leading liquid staking protocol, boasts a TVL of $22.58 billion and a significant market share of 37%.

Lido is poised to exceed 10 million ETH staked through its platform operating on major blockchain networks such as Ethereum, Solana, Moonbeam, and Moonriver.

Other top five protocols include notable players such as DAI stablecoin issuer Maker, lending platforms Aave and Justlend, and decentralized exchange Uniswap. Collectively, these protocols have TVLs of $7.7 billion, $6.98 billion, $6.14 billion, and $4.21 billion, respectively.

deal revival

At the same time, decentralized exchanges (DEXs) have seen a surge in daily trading volume, up 3.29% in the past week alone, facilitating about $22 billion worth of transactions, according to DeFillama data.

Additionally, the Dune Analytics dashboard curated by rchen8 shows a resurgence in the sector’s user base, with more than 3 million users returning to previous highs. Over the past two months, the ecosystem has added 3.6 million new addresses, bringing the total number of users close to 50 million.