Ethereum is gaining attention again as bullish momentum returns to the scene, with the price targeting the $2,500 level. The recent move signals a bearish-to-bullish turn, with ETH finding solid support near the important 100-day moving average. About 5 days ago we expected $BTC to return to the 45,000 level and it has reached that level. Today we will look at $ETH.

Let’s break it down in simple terms.

Ethereum price daily chart vibes

Looking at Ethereum’s daily chart, things are looking up. The 100-day moving average, a key indicator, remained strong at $2,225, giving Ethereum a much-needed boost. Currently, ETH is watching an important resistance area at the bottom of an expanding wedge pattern and the static $2.6K area.

Overcoming this resistance could mean a lot for Ethereum and lead to more activity and excitement in the market. So watch how Ethereum behaves in this important area to get a hint as to where it may be headed next.

What does onchain mean?

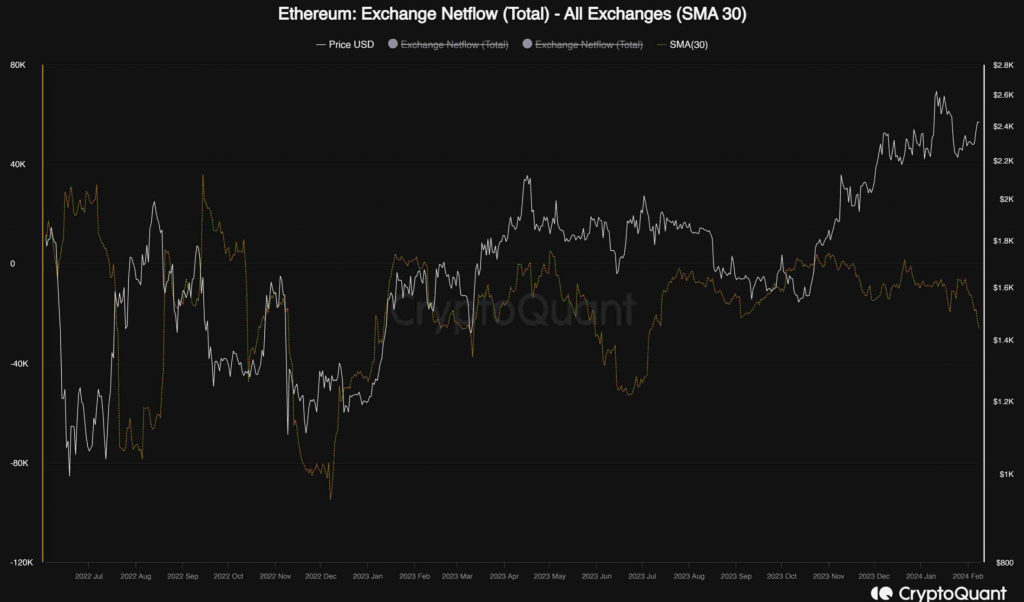

Now let’s see what the on-chain analysis tells us. We are looking at Ethereum’s exchange netflow metrics, which basically tracks the movement of coins in and out of the exchange. A positive indicator means more coins are entering the exchange and could be a sign of increased selling pressure. Conversely, a negative value suggests coins are leaving the exchange and suggests accumulation.

What is interesting here is that any sustained upward trend in Ethereum price coincides with the netflow indicator falling into negative territory. The indicator is currently falling after a period of consolidation, once again hinting at a potential buildup.

summary

Simply put, Ethereum is moving towards the $2500 milestone. The medium-term outlook looks promising, with renewed optimism and signs of accumulation. Keep an eye on Ethereum’s behavior around important resistance areas for clues about its next move!

If you like our content, you can support us by signing up for a Bybit account through our referral link. Don’t forget to claim your bonus if you buy/sell or trade cryptocurrencies.

You might also like our other trading content: