A prominent cryptocurrency analytics firm has warned that the digital asset market may be on the verge of witnessing a corrective move.

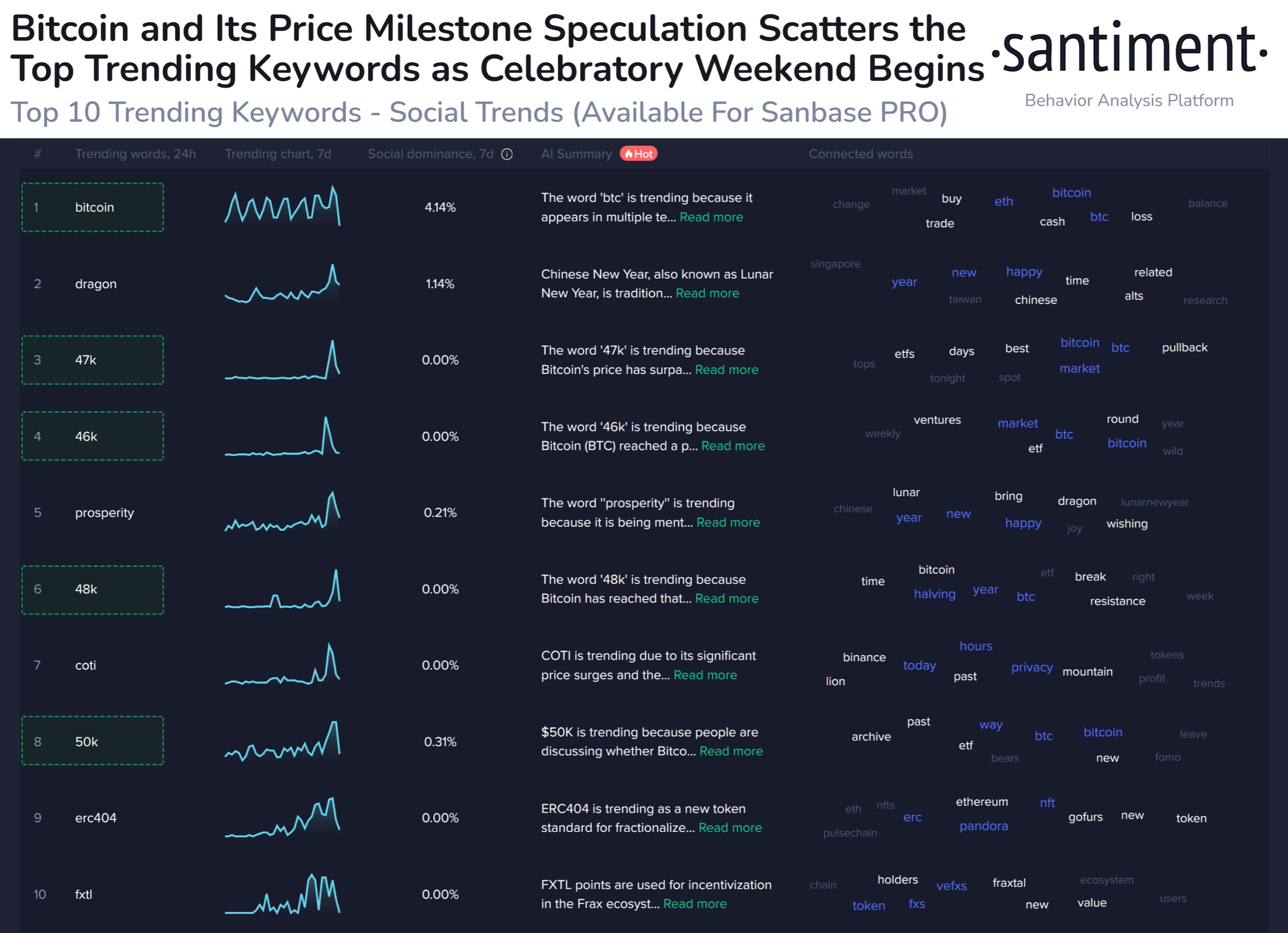

Santiment said on social media platform

By the end of last week, mentions of the terms “alt,” “altcoin,” and “altcoin” had suddenly increased in social media chatter, suggesting traders were energized, according to the analytics firm.

“This week, as the overall market capitalization of cryptocurrencies soared (+5.9%) and trading volume surged (+65.4% compared to last week), interest in altcoins also increased. “If this happens while prices are rising, it could be a sign of greed.”

The analytics firm also noted that the broader cryptocurrency market appears to be following a bullish trend that began in October, the month Bitcoin (BTC) and altcoins began to see gains.

With signs of greed flashing in the market, Santiment warns that a retracement period for Bitcoin and altcoins could be just around the corner.

“Bitcoin’s +13% price rise last week has traders speculating on numerous new support and resistance milestones, with $50,000 widely expected. Ironically, as these price levels were exceeded, the altcoin flipped the script in the opening hours of the weekend as the crowd became hyper-focused on the BTC price. Here are the trends throughout the upcycle that started in October:

- Bitcoin enjoys isolated pumps. The crowd rules BTC.

- Profits are distributed to altcoins, and the crowd becomes greedy.

- Bitcoin retraces slightly, altseason ends much more sharply.

Monitor how the crowd reacts to the second phase of the cycle this weekend and whether open interest levels on speculative alternatives start to rise. If so, it is highly likely that stage 3 will take place quickly.”

As of this writing, Bitcoin is trading at $48,196, up 1.41% over the last 24 hours.

Don’t miss a beat – subscribe to get email alerts delivered straight to your inbox

Check Price Action

follow us TwitterFacebook, Telegram

Daily Hodl Mix Surfing

Disclaimer: Opinions expressed on The Daily Hodl do not constitute investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrencies, or digital assets. Please note that your transfers and transactions are entirely at your own risk and that you are responsible for any losses that may occur. The Daily Hodl does not recommend the purchase or sale of any cryptocurrency or digital asset, and The Daily Hodl is not investment advice. The Daily Hodl engages in affiliate marketing.

Featured Image: Shutterstock/LongQuattro/BAYU SODIKIN