My analysis of the price action of BTC and ETH last week was accurate. Today I’m here to take a look at SOL prices. Amid the bullish wave sweeping the cryptocurrency market, many top altcoins are seeing a noticeable rise in value. Solana (SOL) is particularly noteworthy, with its price surging more than 7.25% in just one day, breaking a key resistance level.

SOL price rises

For a short period of time, SOL price traded in a narrow range between $90 and $100, indicating poor market performance. However, as market volatility increased, the bullish momentum weakened and the chart collapsed.

Nonetheless, SOL managed to stay above the $80.19 support level, sparking a rebound in value. This rebound caused prices to surge by about 35%. SOL faced resistance at $108.18 but found support at the Cross EMA 200-day level, resulting in a period of consolidation.

While we were on the road, we jumped into a few deals like we did yesterday. We entered 108 in case resistance broke, which it did. In these scenarios, I prefer to use a strict stop loss.

In its recent attempt to break through the resistance level, SOL encountered bearish resistance, resulting in a temporary decline. Nonetheless, with the EMA 50-day support coming into play, the price rebounded, rising over 7.5% in the last 24 hours. This surge represents a significant rise in buying sentiment across the cryptocurrency industry.

The most important question now is whether the price of SOL will fall again.

Technical indicators such as MACD suggest continued upward momentum, while the histogram shows a steady upward trend and the averages are converging to the upside. This indicates that significant price movements are likely in the near future.

If the market momentum continues and SOL breaks the resistance level of $117, it could test higher resistance at $125 by the end of the week. Holding at this price level could pave the way for further upward movement, with the price likely to reach $135 in the coming weeks.

However, if the bears regain control, SOL may pull back to test support at $108.18. Additional downward pressure could push it towards this month’s support level of $100.

Farm Dex airdrop while trading

Now if you are looking for trading moves. While you’re at it, you should consider farming Dex airdrops. Here’s the full list.

Just yesterday, we were longing for Solana trading on Bybit. We also added a small position in LogX to secure future airdrops. If you decide to use this Dex, please use my referral code F9AE028E To get bonus points.

If you buy $100 with 20x leverage, you will have a $2,000 opening position and a $2,000 closing position, resulting in a trading volume of $4,000. If you make 13 such transactions and reach 50,000 volume, you can add an appropriately sized airdrop.

Current Solana Transactions

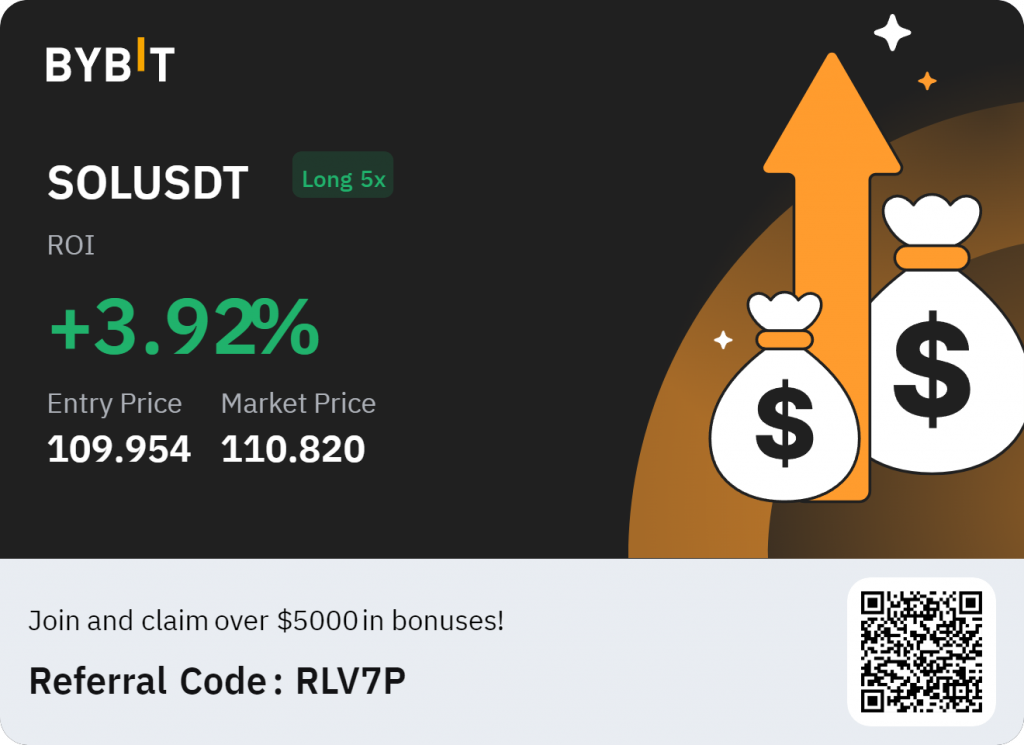

After closing yesterday’s trading at $113.61, I reopened my buy order at 109.95.

The previous resistance level between 108 and 110 was difficult to break. And we were eager to test that level again. Our stoploss is set at $107. A drop below could lead to a retest of the $100 bottom.

Here, Take Profit is set at $121.

final thoughts

In conclusion, while the recent surge in SOL price is promising, the cryptocurrency market remains volatile and price movements can change direction quickly. Investors should closely watch key support and resistance levels to gauge the future trajectory of SOL price.

If you like our content, you can support us by signing up for a Bybit account through our referral link. Don’t forget to claim your bonus if you buy/sell or trade cryptocurrencies.

You might also like our other trading content: