Ethereum (ETH), the global number two in the cryptocurrency ring, is making serious moves this week as it approaches the coveted $3,000 mark. Could this be the opening bell for a February knockout and send it skyrocketing towards a massive $4,000 finish by the end of the month?

Ethereum Staking and ETFs Surging: Bullish Momentum

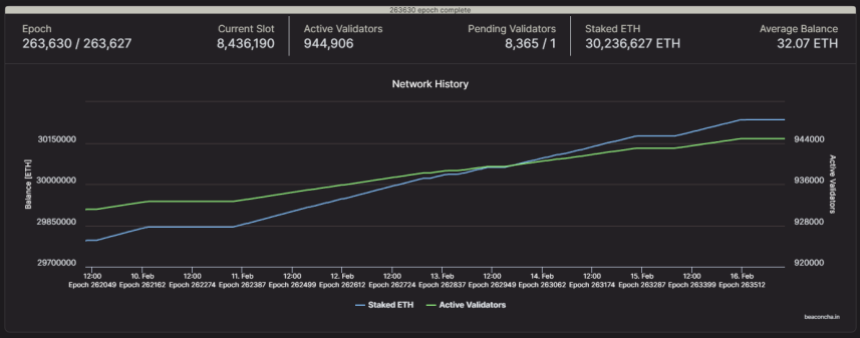

Several factors are fueling this optimism, starting with the soaring popularity of ETH staking. As Ethereum 2.0 gains momentum, more investors are locking in ETH in staking contracts to earn passive income while reducing the immediately available supply on the market. This “induced market scarcity,” as experts call it, puts upward pressure on prices.

Ethereum price up today. Source: Coingecko

Those numbers are impressive. A whopping 25% of all circulating ETH, or 30.2 million coins, are currently locked up in staking contracts. This represents a significant surge of 600,000 ETH deposited between February 1st and 15th. And with a reward rate of 4% per year, the incentive to join the staking party is only getting stronger.

Source: BeaconChain

However, staking is not the only driving force driving ETH forward. The possibility of approval of an Ethereum exchange-traded fund (ETF) also brought optimism to the market. These products could make it easier for institutional investors to enter the cryptocurrency space, potentially leading to significant inflows and price appreciation.

Ethereum currently trading at $2,839 on the 24-hour chart: TradingView.com

Additionally, the recent Dencun upgrade of the Sepolia testnet, which promises improved network performance and lower transaction costs, has received a positive response from stakeholders. This could attract more developers and users to the Ethereum DeFi ecosystem, increasing its utility and ultimately driving demand for ETH.

Obstacles Ahead: ETH’s Journey to $4,000

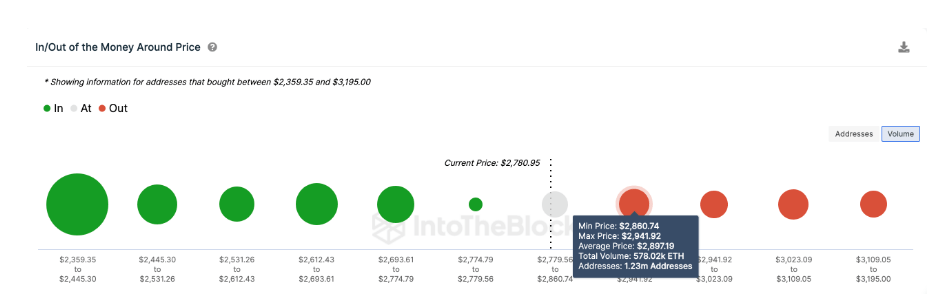

However, reaching $4,000 is not without obstacles. The main resistance level is expected to be $2,850, with approximately 1.23 million addresses buying a total of 578,000 ETH. These holders may be tempted to take profits when the price approaches the breakeven point, which can be a temporary obstacle.

Additionally, if the price falls below $2,500, there could be panic selling among investors who bought at higher prices. This highlights the volatility inherent in the cryptocurrency market, although some experts suggest this scenario could be mitigated by “frantic last-minute buying” to avoid losses.

ETH price forecast. Source: IntoTheBlock

IntoTheBlock’s global GIOM (cash in and out) data further highlights this point. This data groups all existing ETH holders based on their past purchase prices. According to GIOM, a cluster of holders around the $2,850 resistance level indicates potential selling pressure. However, if the bulls can overcome this hurdle, the chances of another rally above $3,000 increase.

Ultimately, the near-term outlook for ETH looks promising, but caution is still important. Investors should carefully consider their risk tolerance and conduct thorough research before making any investment decisions. As with all markets, past performance is not necessarily indicative of future results.

The next few days and weeks will be critical in determining whether ETH can break the $2,850 resistance and continue its rise towards $3,000 and above.

Featured image from Adobe Stock, chart from TradingView

Disclaimer: This article is provided for educational purposes only. This does not represent NewsBTC’s opinion on whether to buy, sell or hold any investment, and of course investing carries risks. We recommend that you do your own research before making any investment decisions. Your use of the information provided on this website is entirely at your own risk.