After a poor performance in January, Bitcoin gained momentum in February and rose about 22%, indicating aggressive buying by the bulls. The CoinShares Digital Asset Fund Flows Weekly Report shows $2.45 billion in weekly inflows into digital asset investment products last week. This brings total inflows year-to-date to $5.2 billion.

Bigger whales with between 1,000 and 10,000 bitcoins in their wallets, according to data from market intelligence platform Santiment. purchased The value of Bitcoin in 2024 is $12.95 billion. However, during the same period, smaller whales with 100 to 1,000 Bitcoins in their wallets were sellers worth $7.89 billion.

In addition to strong Bitcoin ETF inflows, the market is excited about the halving scheduled for April 19th. Historical data shows that Bitcoin rose about 32% in the 60 days before the halving. If history repeats itself, Bitcoin, which is trading near $52,000, could soar to all-time highs following the halving.

Analysts at AllianceBernstein also sent an optimistic note to clients. They believe the market has priced in the launch of a spot Bitcoin ETF, but the halving supply shortage has yet to be explained. Analysts said ETF inflows are mainly driven by retail investors who believe in Bitcoin. However, “in the future” ETFs will likely see investments from new Bitcoin enthusiasts. This will lead to fear of missing out (FOMO), which will push Bitcoin to new all-time highs in 2024.

Along with the long-term bullish outlook, the medium-term story also looks positive. Bitcoin rose for four consecutive weeks through February 18th. Over the past five years, each four-week rally in Bitcoin has been followed by an average gain of 49% over the next three months, according to Bloomberg data.

Will Bitcoin continue its upward trend and reach $60,000 in the next few days? Will altcoins continue their upward trend? Let’s study the chart to find out.

BTC/USD market analysis

We said in our previous analysis that Bitcoin could gain momentum after crossing $45,000, and that is exactly what happened. The BTC/USD pair reached its expected target of $52,000 on February 14th.

The bears are trying to halt the rally at $52,000, but a positive sign is that the bulls have not given up much ground. This means that buyers are not in a hurry to liquidate their positions because they expect the price to be a notch higher.

If the price breaks through and closes above $53,000, the pair could begin the next phase of its upward trend. The pair could then rise to $60,000, which is likely to act as a stiff hurdle.

A rising 20-day exponential moving average (EMA) favors buyers, while the relative strength index (RSI) in overbought territory suggests some correction or consolidation is possible.

If the price falls below $50,500, the next stop will be the 20-day EMA. Bears would need to take the price below the 20-day EMA to signal a near-term high. The pair could then plummet to $45,000.

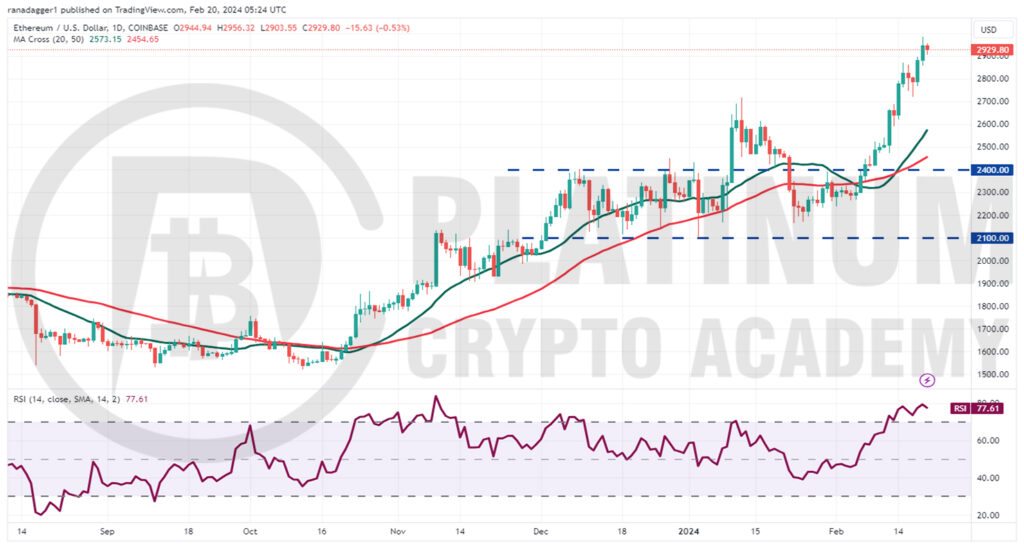

ETH/USD market analysis

We highlighted in our previous analysis that Ether’s bearish momentum is slowing. He also said that if the ETH/USD pair breaks above its moving average, it could rise to $2,400 and then to $2,700. All of these levels played as we expected.

Positive momentum broke the $2,700 resistance level on February 14, and the pair began its journey towards the psychologically important $3,000 level.

If the price falls from $3,000 but rebounds from $2,700, it is a sign that the uptrend has reversed to support. That would increase the chances of a rally to $3,500.

A further upside risk is overbought levels in RSI. If the price declines and falls below the 20-day EMA, it indicates that the bulls are rushing for the exit. This could initiate a further decline towards strong support at $2,400.

BNB/USD market analysis

In our previous analysis, we expected Binance Coin to bounce to $338 if the bulls pushed the price above the downtrend line of the descending triangle pattern, and that is exactly what it did.

The bears were expected to see strong resistance at $338, but buyers pushed on. The BNB/USD pair faces resistance near $360, but the bulls are not giving in to the bears. This means that buyers are expecting the upward trend to continue.

If the price rises from the current level and goes above $367, it would mean a resumption of the uptrend. The pair could then surge to $400. The rising 20-day EMA and RSI in the overbought zone indicate that the bulls are still in control.

This positive view is invalidated if the price declines sharply and falls below the 50-day simple moving average (SMA). Such a move would suggest that the bulls are back in the game.

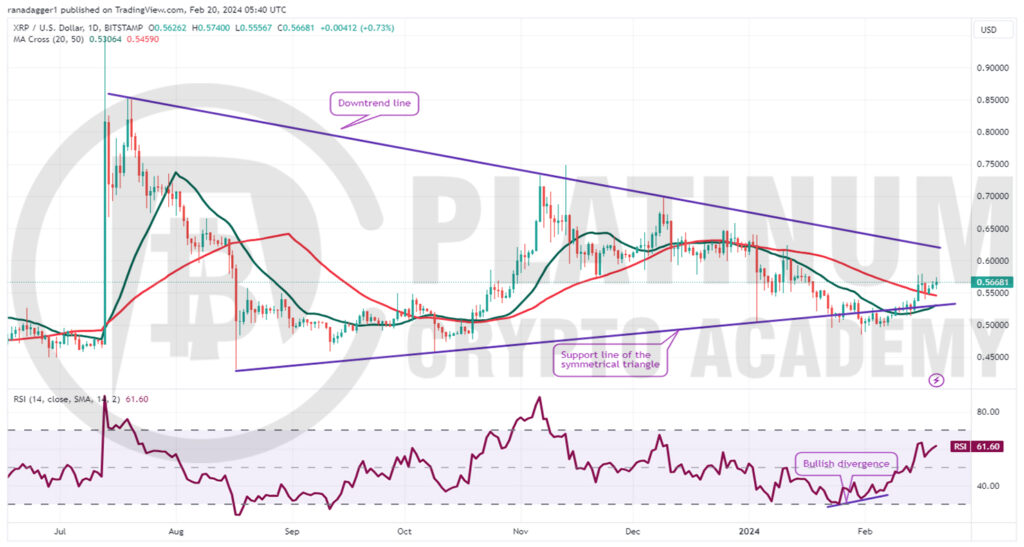

XRP/USD market analysis

We warned traders in our previous analysis that the bullish differential on XRP’s RSI indicates that selling pressure is waning. We also said that a move above the 20-day EMA could open the door for a rally to the 50-day SMA, and that is what happened.

The 20-day EMA has started to rise gradually and the RSI is in positive territory, indicating a slight advantage for buyers. If the price rises above $0.58, the pair may reach a downtrend line.

A breakout and close above the downtrend line signals the start of the next uptrend. The pair could then try to rally to $0.70 and later to $0.75.

Conversely, if the price moves below the downtrend line, it is a sign that the bears are continuing to actively defend it. The pair could then become trapped in a triangle for some time.

The downside is that if a breakout and close below the triangle occurs, it could fall to the intraday low of $0.48 on January 31st.

ADA/USD market analysis

We said a breakout and close above the downtrend line could push Cardano into its 50-day SMA and then push it up to $0.62, and that’s what happened.

The moving averages have completed a bullish crossover and the RSI is rising near the overbought zone, indicating that the bulls are in control.

But the bears won’t give up easily. They will attempt to mount a strong challenge in the area between $0.64 and $0.70. If the bulls don’t give up a lot of space in the overhead area, their chances of breaking above it increase. If that happens, the ADA/USD pair could reach $0.90.

The 20-day EMA is an important support level to watch out for on the downside. A break and close below the 20-day EMA could indicate that the pair could fluctuate between $0.46 and $0.70 over the coming days.

Hopefully, you enjoyed reading today’s article. Check out our cryptocurrencies. blog page. Thanks for reading! Have a fantastic day! It will be live on the Platinum Crypto Trading Floor.

Import Disclaimer: The information found in this article is provided for educational purposes only. We do not promise or guarantee any earnings or profits. You should do some homework, use your best judgment, and conduct due diligence before using any of the information in this document. Your success still depends on you. Nothing in this document is intended to provide professional, legal, financial and/or accounting advice. Always seek competent advice from a professional on these matters. If you violate city or other local laws, we will not be liable for any damages incurred by you.