- Ethereum was above $3,200 at press time.

- ETH deposits from FTX and Alameda have raised questions about their potential impact on the price.

Ethereum (ETH) recently surged past $3,200, instilling optimism among holders.

But beneath this positive momentum lurked potential challenges. The data reveals interesting moves by key players that could cast a shadow on ETH’s future.

Whales carry their belongings.

Despite the upward trend, concerns grew when 2,000 ETH (equivalent to $6.45 million) was deposited from FTX and Alameda’s accounts to Coinbase following the price surge.

The deposits to Coinbase could be interpreted as a move by these companies to capitalize on recent price increases.

If these whales decide to sell their ETH holdings on the open market, it could create selling pressure and cause the price of Ethereum to fall.

A large sell-off triggered by a major player can cause market volatility and trigger a chain selling reaction from other market participants, potentially resulting in a bearish trend.

The timing of these deposits added another element of uncertainty.

Source: X

Perpetual trading volume, a key indicator, also hit an all-time high amid Ethereum’s strong resurgence.

The performance and valuation of related projects such as Muxprotocol boasted a massive volume exceeding $1.9 billion last week, resulting in an impressive return of 93%.

This increase highlighted the growing interest in Ethereum-based projects.

Source: X

How is ETH performing?

At the time of writing, ETH is trading at $3,227.00, up 3.81% in the last 24 hours.

Consistent growth showing multiple highs and lows indicates a bullish trend in the ETH price.

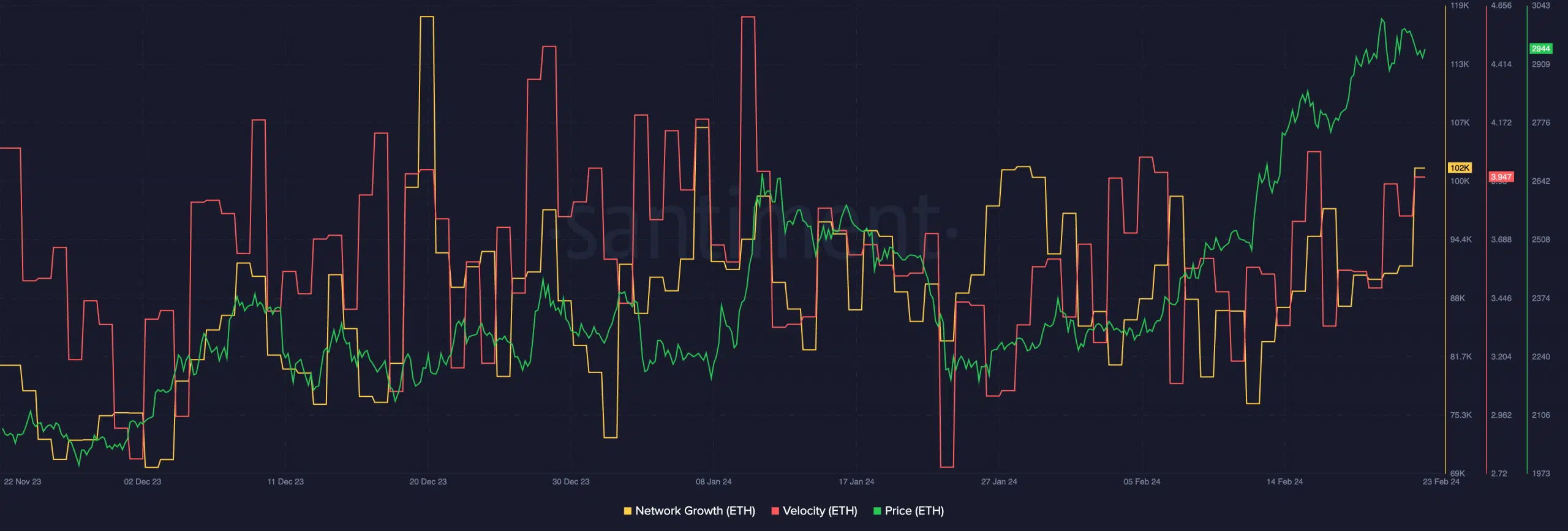

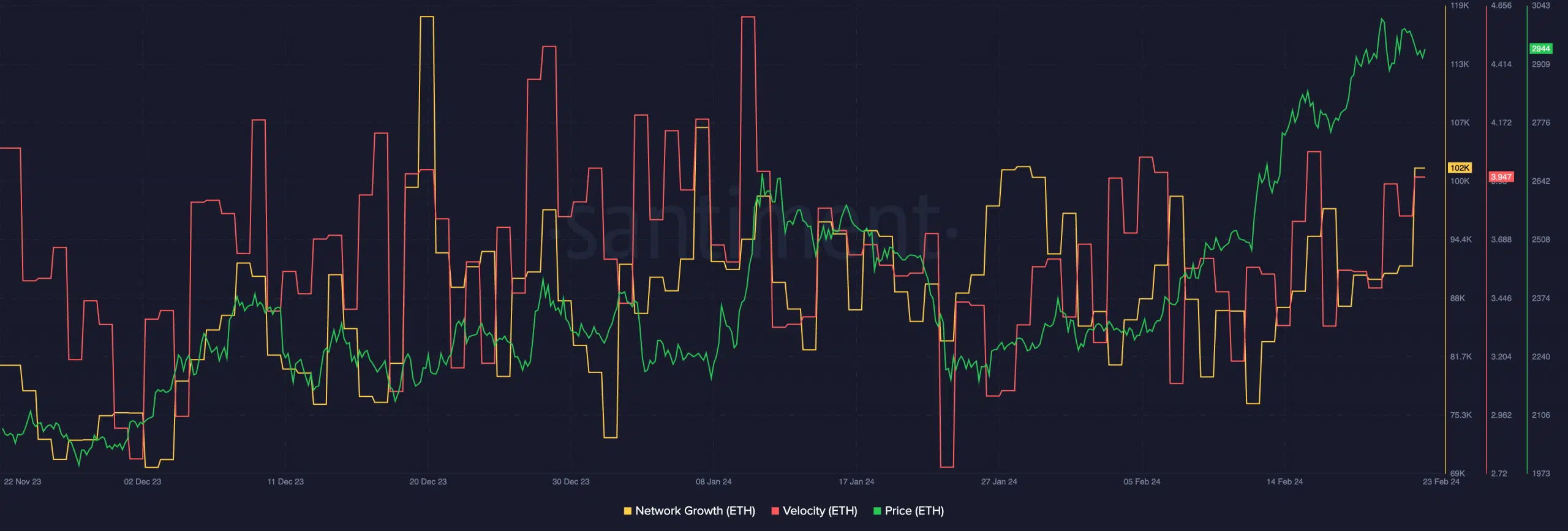

AMBCrypto’s investigation of the Ethereum network also revealed positive patterns. In particular, the surge in network growth suggested a significant influx of new users accumulating ETH.

At the same time, the increasing speed indicates an increased frequency of ETH transfers, which indicates heightened activity and participation within the network.

Source: Santiment

Is your portfolio green? Check out our ETH Profit Calculator

Trader sentiment is very important in understanding the potential trajectory of ETH price. At press time, the proportion of short positions had decreased, reflecting a shift in sentiment towards a more optimistic outlook.

This reduction in bearish positions is consistent with the overall positive trend observed in Ethereum’s recent price movements.

Source: Coinglass