- XRP was the worst-performing large-cap cryptocurrency last month.

- Addresses belonging to groups of whales have declined steadily since the beginning of the year.

A broad market rally has seen the price of Ripple (

At the time of writing, the sixth-largest cryptocurrency was trading at $0.56, and the bulls’ previous attempts to break through the aforementioned barrier proved unsuccessful.

Source: CoinMarketCap

Only time will tell whether altcoins will succeed, but recent price movements do not inspire much optimism.

XRP disappoints investors

AMBCrypto’s examination of market data from CoinMarketCap found that XRP was the worst-performing large cryptocurrency last month, with a total return of just over 4%.

On the other hand, market indicators such as Bitcoin (BTC) and Ethereum (ETH) simultaneously rose up to the low 20% range along with Solana (SOL) and Binance Coin (BNB).

Crypto analyst Benjamin Cowen highlighted the declining influence of XRP.

He noted that the dominance of payments-focused cryptocurrencies in the market has fallen from over 31% in 2017 to 1.48% as of February 2024.

In fact, XRP has lost nearly three-quarters of its market value since peaking in January 2018.

Along with the 2022 bear market, lawsuits filed by the U.S. Securities and Exchange Commission (SEC) played a large role in the decline.

While the legal victory in last year’s case had XRP supporters cheering, the story since then has been less encouraging.

Have whales abandoned XRP?

AMBCrypto’s analysis of data from Santiment shows that XRP supply as a percentage of revenue has fallen from nearly 90% in November 2023 to less than 84% at the time of this writing.

Source: Santiment

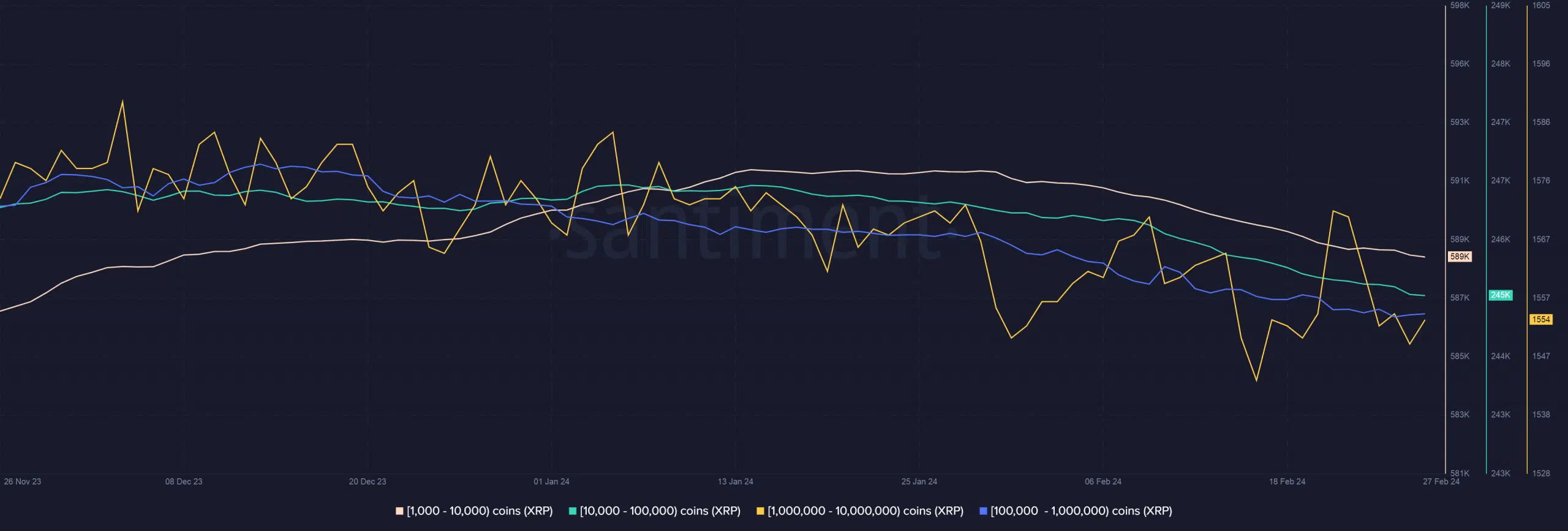

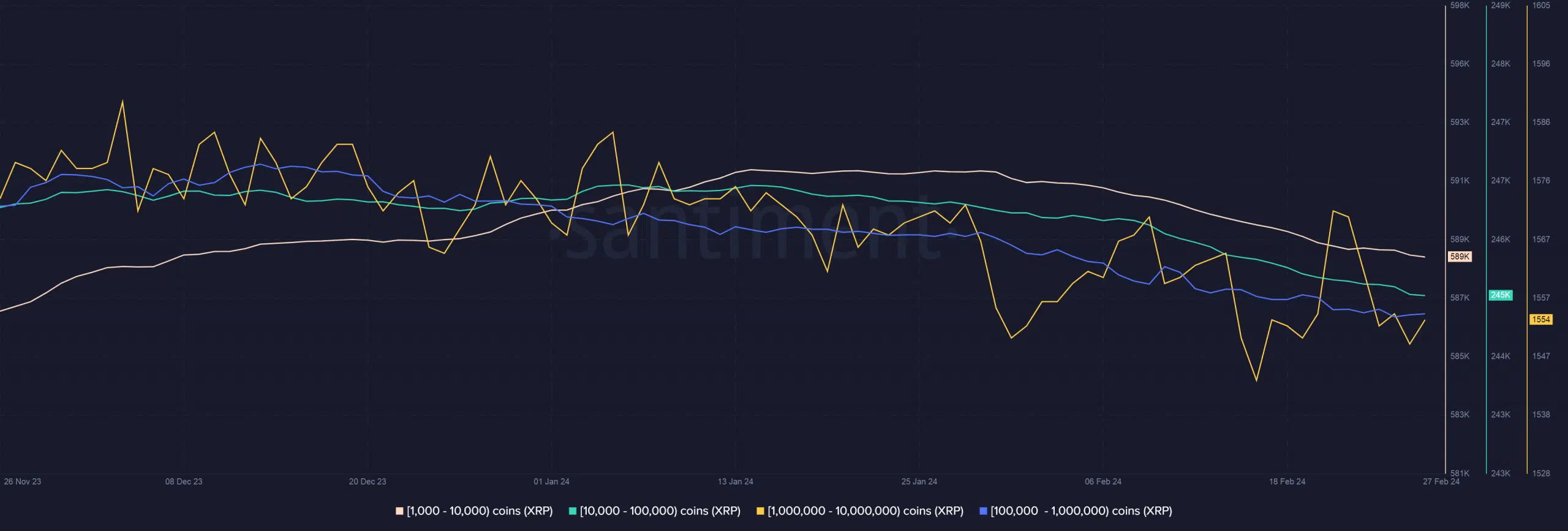

Now, one might think that XRP whales can take advantage of the quiet phase to accumulate. But that wasn’t the case.

Addresses belonging to the major group of whales have steadily declined since the beginning of the year, indicating a lack of urgency to buy XRP and HODL XRP.

Source: Santiment

Is your portfolio green? Check out our XRP Profit Calculator

XRP whales also have lower long-term exposure compared to retail investors, according to AMBCrypto’s examination of data from Hyblock Capital.

This was a strong bearish signal because, by convention, whales are considered more likely to be correct in their holdings.

Source: Hiblock Capital