Bitcoin Cash (BCH) price surged 58% in one day, leaving many investors wondering if this was the beginning of a sustained or temporary rise. While this surge is undeniably impressive, market signals are calling for caution, suggesting a strong correction is imminent.

The balance of Bitcoin Cash holdings has shifted, with traders now holding more medium-term holders. This could mean that volatility will increase in the near future as traders are likely to buy and sell quickly based on short-term price movements.

BCH RSI value is rising rapidly

Bitcoin Cash (BCH) has seen a significant increase in its relative strength index (RSI) over the past seven days. RSI, a technical analysis indicator used to measure the momentum of price movements, rose from 60 to 78.28. This now places BCH in overbought territory, which could indicate potential selling pressure in the near future.

To be clear, RSI oscillates between 0 and 100. Readings above 70 typically indicate overbought conditions, meaning prices are rising too quickly and a correction may be needed. Conversely, anything below 30 indicates oversold conditions and a possible price rebound.

Interestingly, the last time the BCH 7-day RSI was above 78 in June 2023, there was a significant price correction of around 26% over the following 15 days. This historical precedent suggests that BCH’s current RSI reading warrants close observation by market participants.

Read More: Bitcoin Cash (BCH) Price Prediction for 2024/2025/2030

BCH traders flipped medium-term holders.

Recent developments in the BCH market warrant close attention from investors and analysts. There has been a notable and significant change in ownership structure, with traders taking on a dominant role.

A trader in this context is defined as anyone who holds BCH for a period of less than one month. This particular group recently surpassed cruisers who hold BCH between 1 and 12 months in terms of the total amount of BCH they manage.

The scale of this change cannot be underestimated. According to data obtained on February 4, traders hold 2.53 million BCH. However, this number increased significantly on March 10th, reaching 4.36 million BCH. As short-term traders’ holdings increase rapidly, it is necessary to review historical precedent.

Traditionally, large supplies of BCH controlled by short-term holders have been associated with increased market price volatility. Therefore, these recent trends imply the possibility of higher price volatility for BCH in the near future.

BCH Price Prediction: Weak Support and Strong Resistance

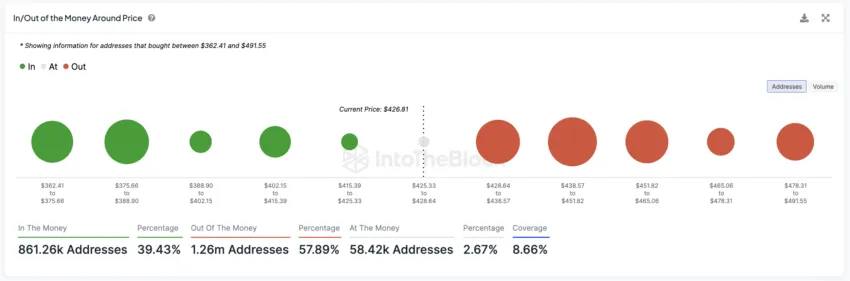

Analyzing BCH’s In/Out of the Money Around Price (IOMAP) indicator reveals important support and resistance areas that could influence the near-term price trajectory.

IOMAP analysis highlights potential weakness in the current BCH market around support around $415 and $402. If BCH price fails to maintain these support levels, it could experience a downward correction to $388 or even $375. This scenario translates to a potential price decline for BCH of approximately 13.60%.

The IOMAP indicator visually identifies areas on the price chart where there are many addresses that have previously purchased BCH. Depending on the current price movement, this area may represent a potential support or resistance level.

Read more: 8 Best Bitcoin Cash (BCH) Wallets for 2024

A bullish breakout for BCH could occur if the price exceeds the identified resistance levels of $428 and $438. This breakout could push the price of BCH to $465, representing a potential growth of 9.18%.

Therefore, closely monitoring these IOMAP-derived support and resistance areas is important to understand the potential price movements of BCH in the future.

disclaimer

In accordance with Trust Project guidelines, this price analysis article is provided for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate and unbiased reporting, but market conditions may change without notice. Always do your own research and consult with a professional before making any financial decisions. Our Terms of Use, Privacy Policy and Disclaimer have been updated.