Chainlink price has been trending upward for the past few weeks and the momentum appears to be slowing over the past 48 hours.

But what’s more interesting is that the whales have been signaling for a long time already an impending adjustment that may arrive soon.

Chainlink Whales Could Be Bearish

Chainlink price recently hit a 25-month high by hitting a resistance level of $21.69. The Oracle token was down 5.66% as of today, before correcting soon after. At the time of this writing, we see LINK trading at $20.47.

From the looks of it, a decline is likely coming, and investors may see the same behavior. In particular, whale investors have been predicting a downtrend for some time. Addresses holding 10,000 to 100,000 LINKs have been selling steadily since early February. In just a month and a half, supply was reduced by nearly 2 million LINK units, worth over $40 million.

These whale addresses have historically proven to be a sure sign of a trend reversal. This is because the price increase was followed by an accumulation of whale addresses, followed by a correction due to selling. This makes their recent sales an indicator of things to come.

Read more: Chainlink (LINK) price prediction for 2024/2025/2030

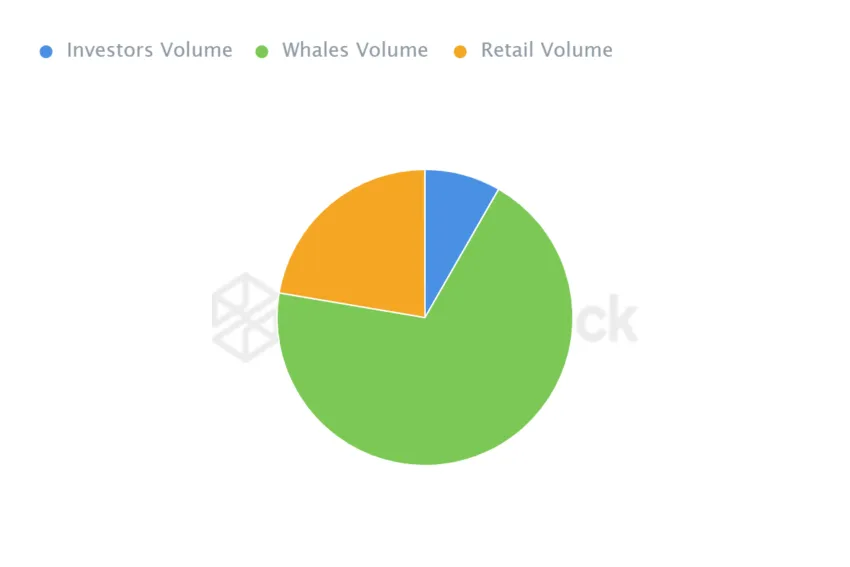

Whales also have a significant impact on LINK’s price action, especially since this group’s wallets account for approximately 69% of the total LINK circulating supply. The remaining 31% of the supply is divided between fish and small wallet holders.

A price drop is now expected, but it hasn’t arrived yet as sales are not as significant and sudden as they were in the past. This has resulted in a bearish divergence, which will be corrected once LINK records a downward trend.

LINK Price Prediction: All Is in Favor of Whales

While the price of Chainlink is slowly rising, we can see the altcoin losing its bullish momentum in a shorter period of time. This is further evidenced by the negative signal presented by the Moving Average Convergence Divergence (MACD) indicator.

MACD tracks the relationship between two moving averages of security prices. It measures the difference between short-term (indicator lines) and long-term moving averages (signal lines) to help identify trend direction, momentum, and potential buy or sell signals.

At the time of writing, the indicator records a bearish crossover with a red candle registered on the histogram. The 50-day exponential moving average (red) is also currently above the candle. This is considered a near-term bearish signal, suggesting that LINK could fall to $20.12.

If bearish sentiment has a significant impact on Chainlink’s price, it may fall further to test the $19.22 support level.

Read more: What is Chainlink (LINK)?

However, the 100-day EMA (green) is acting as support for LINK. Oracle tokens can stay above $20.12 if they avoid a significant decline. Additional support from retail investors could reverse a potential downturn. This would nullify the bearish argument by pushing the altcoin above $21.

disclaimer

In accordance with Trust Project guidelines, this price analysis article is provided for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate and unbiased reporting, but market conditions may change without notice. Always do your own research and consult with a professional before making any financial decisions. Our Terms of Use, Privacy Policy and Disclaimer have been updated.