- The founder noted that Cardano will use stake pools to test nodes.

- Some holders disposed of their ADA for self-administration, while others liquidated it.

On March 12, Cardano (ADA) founder Charles Hoskinson posted on X that the project would be testing out Hyperfledge Firefly. Hyperfledge Firefly is an open source node designed to scale blockchains.

But Hoskinson said the test: Not a guarantee Cardano will adopt supernodes. According to him, the project will test compatibility with the Stake Pool Operator (SPO), which is responsible for running nodes on the network.

Scaling Cardano could enable more off-chain transactions and increase user demand. However, even after many years, the project did not reach the desired level. This also affected the native token, ADA.

ADA suffers from traction issues.

For example, AMBCrypto used Santiment to evaluate ADA’s on-chain data. As of this writing, the total number of ADA holders has decreased over the past 30 days from 4.49 million to 4.46 million.

This decline can be attributed to price/performance ratio. Last month, ADA price rose 42.39%.

Therefore, the decline in the number of holders may be due to some investors taking profits. At the same time, it may decline as some investors no longer trust its long-term potential.

However, if Cardano moves forward with its expansion plans, more investors may be attracted to the token. However, that alone may not convince market participants to become part of the ADA cohort.

Regarding development activities, AMBCrypto observed a decrease in metrics. As of December 2023, the metric was 96.11. However, data at press time showed the reading was 57.11.

Source: Santiment

Hope for those who trust the project

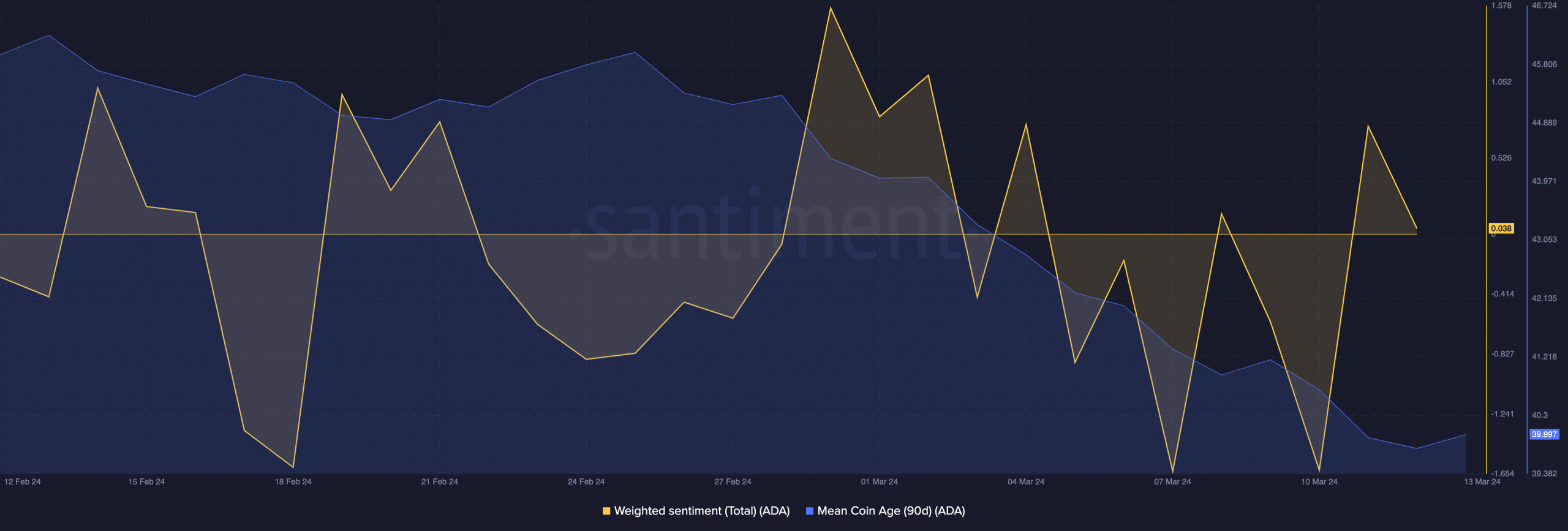

In terms of sentiment, the data shows that the bullish bias of market participants is decreasing. At press time, Weighted Sentiment was on the verge of falling into negative territory.

If this happens, it will serve to confirm that the perception has turned bearish. If the broader market for Cardano’s native token weakens, demand may decline further and prices may fall.

However, another indicator that suggests a good long-term view for ADA is MCA (Mean Coin Age). This indicator indicates the relative activity between HODLers and short-term profit accounts.

The surge in MCA represents a surge in movement of older tokens, which could indicate a possible sell-off. However, the 90-day MCA plummeted.

Source: Santiment

This decline means that some long-term holders are accumulating their tokens in cold wallets and dumping them.

Read Cardano (ADA) price prediction for 2024-2025

Self-stored tokens may reduce the possibility of sale. However, this does not mean that the price of ADA will rise overnight.

If holders later decide to send their tokens to an exchange, the price may plummet. On the other hand, increased cold storage may increase the potential for exponential growth.