- Liquidation increases when Avalanche’s price reaches $61.4.

- Market indicators were bearish for the token.

Avalanche (AVAX) The split from the overall cryptocurrency market has caught investors off guard over the past few days. So, let’s take a closer look at the token’s metrics and see what makes AVAX perform differently from the rest.

Avalanche bull is here

While most cryptocurrencies have suffered losses due to recent bearish market conditions, AVAX has moved in the opposite direction. According to CoinMarketCapAVAX is up more than 40% over the past seven days.

In fact, in the last 24 hours alone, the token’s value has surged by more than 22%. At the time of this writing, AVAX was trading at $60.18, with a market capitalization of over $22 billion. The good news is that the token’s trading volume has also surged by 35% in the last 24 hours, providing the basis for the price increase.

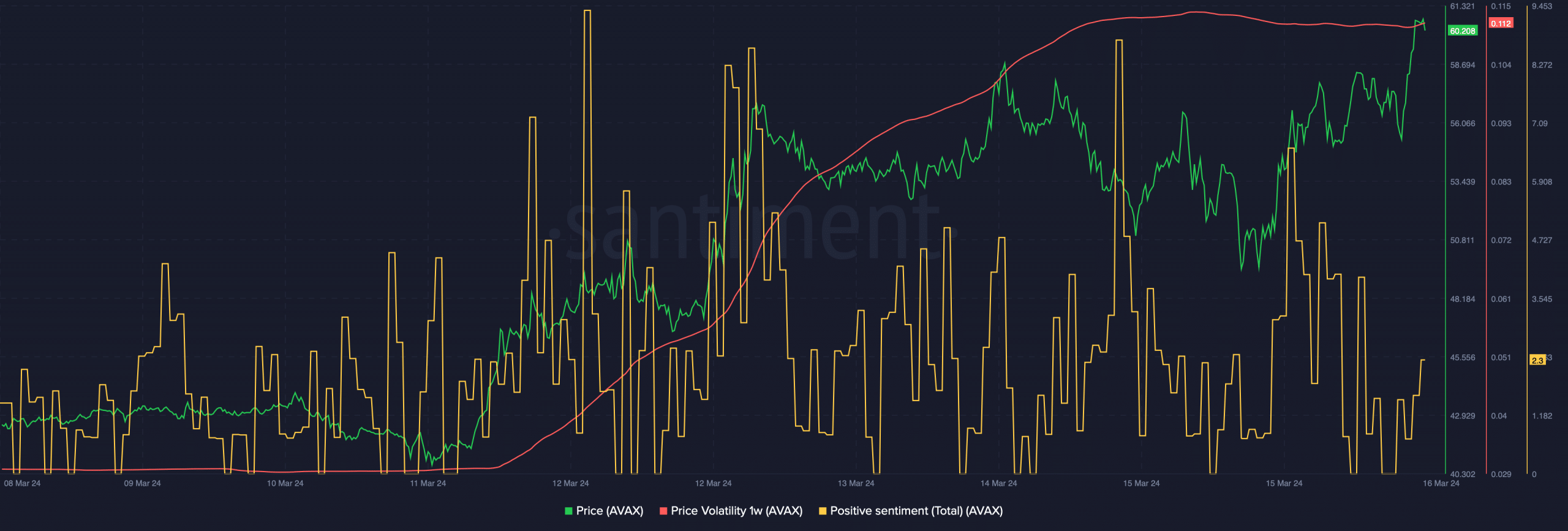

Thanks to the rally, Avalanche’s one-week price volatility has spiked significantly. Moreover, positive sentiment towards the token was also high, meaning investors were confident of a bullish rally for AVAX and expected its value to surge further.

Source: Santiment

Derivatives market conditions also looked quite optimistic. Coinglass Analysis by AMBCrypto data AVAX’s funding ratio was found to have increased, suggesting that derivatives investors are actively purchasing the token.

Additionally, open interest also rose along with the price. Each time the indicator rises, the likelihood that the current price trend will continue increases.

Source: Coinglass

high clearing ahead

Although the aforementioned indicators look optimistic, AVAX will witness high liquidations if rice prices rise.

To be precise, an analysis of Hyblock Capital’s data shows that liquidations will increase when Avalanche’s price reaches $61.5 and $62.

High liquidation means increased selling pressure, which could end the bull market for the token.

Source: Hiblock Capital

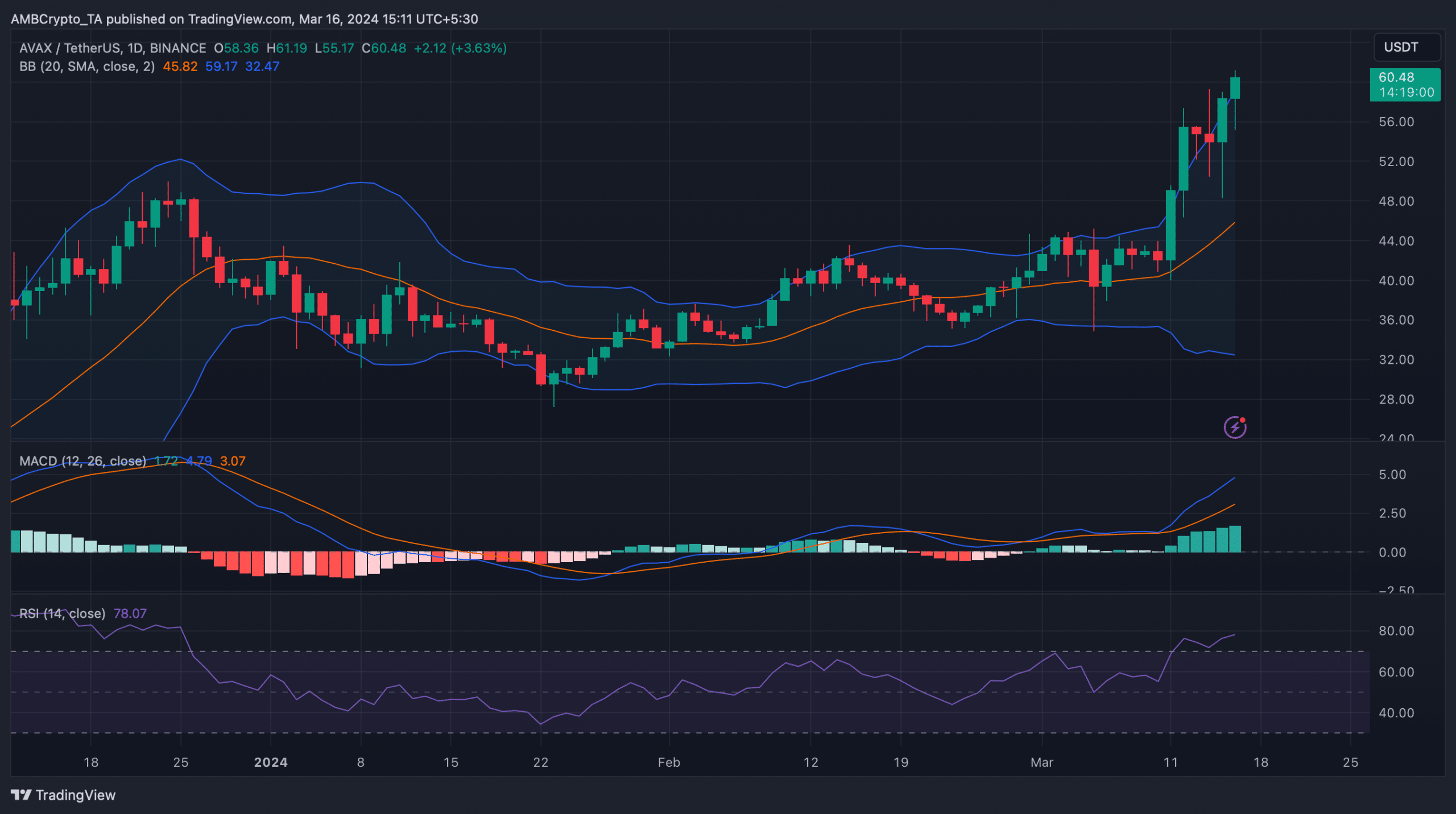

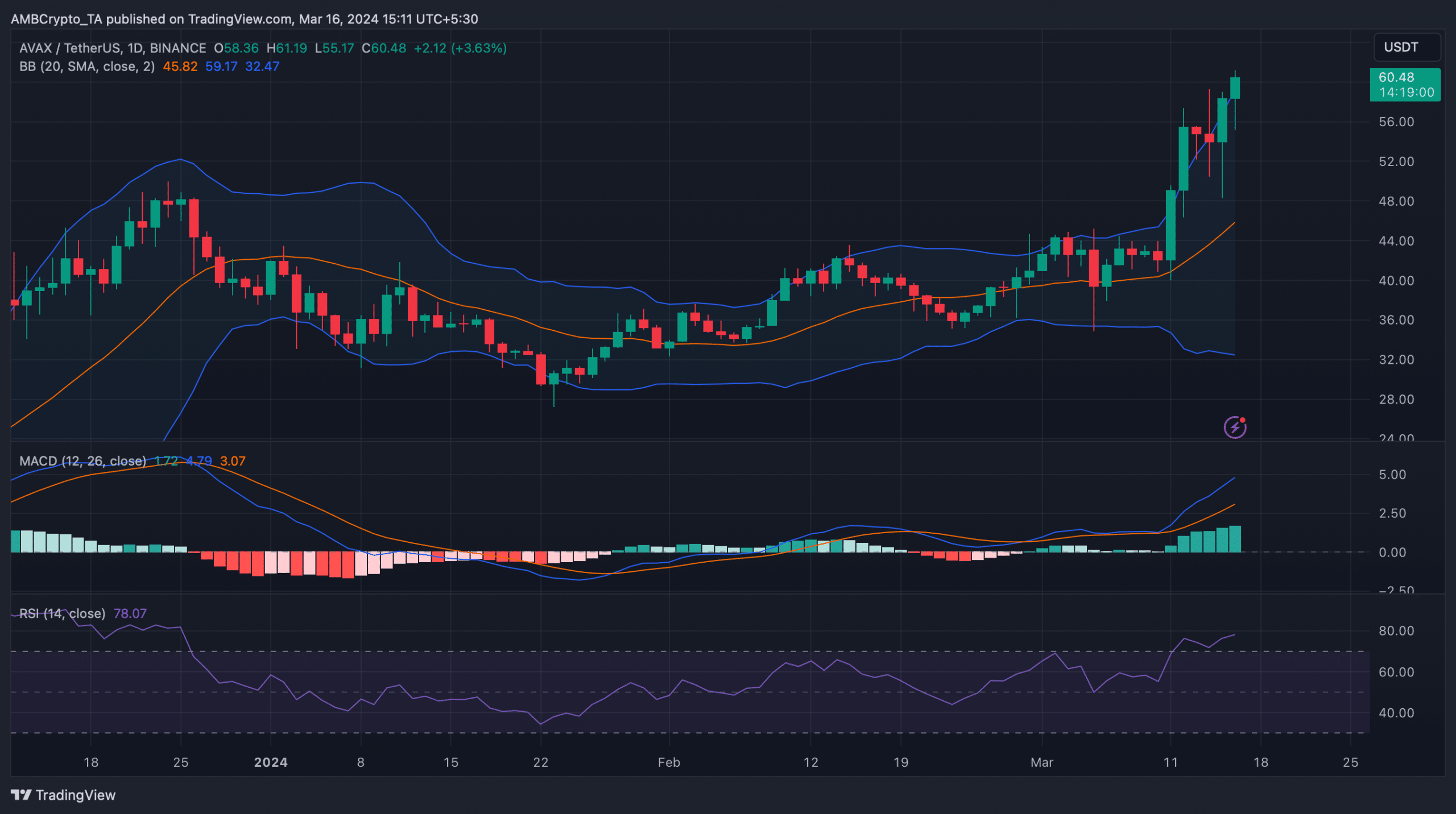

To better understand whether AVAX can maintain its upward trend, AMBCrypto took a look at the daily chart. We found that the price of the token touched the upper limit of the Bollinger Band.

read Avalanche (AVAX) Price Prediction 2024-25

Additionally, the Avalanche’s Relative Strength Index (RSI) has entered overbought territory. Both of these indicators indicate increased selling pressure on AVAX, which could lead to a price correction in the near term.

Nonetheless, MACD still remained favored by buyers as it showed a bullish edge in the market.

Source: TradingView