- Anything above $1 is very important for FTM.

- Selling pressure on Fantom was high and indicators looked bearish.

The ongoing bear market has had a major impact on Phantom (FTM), with the token recording double-digit declines over the past few days.

However, at the time of press, the token price was in a consolidation phase. If a breakout occurs, the price of FTM could soon reach new highs.

Phantom sets a new goal

FTM surged on March 16th, but the trend soon reversed, offsetting the weekly gains. According to CoinMarketCapIn the last 24 hours alone, FTM is down 10%.

At the time of this writing, FTM was trading at $0.7912, with a market capitalization of over $2.2 billion.

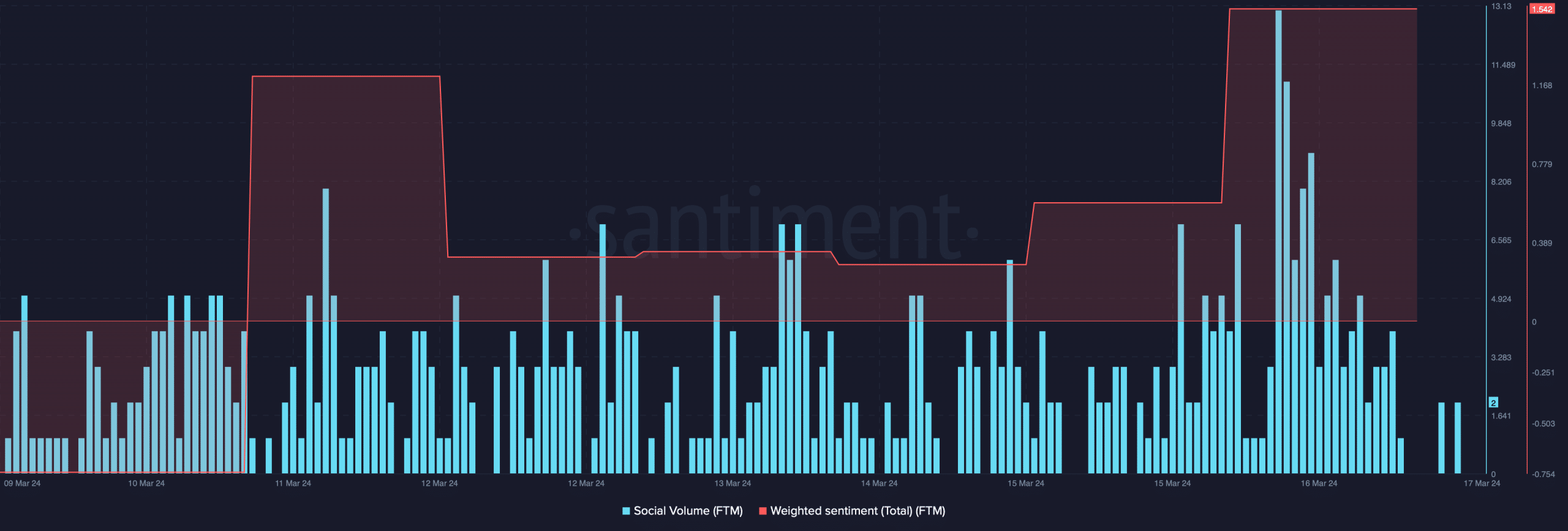

As the price of the token became more volatile, people started talking about FTM, which led to increased social volume.

Interestingly, despite the price decline, FTM’s Weighted Sentiment increased. This means that bullish sentiment towards the token is dominant in the market.

Source: Santiment

On March 16, cryptocurrency analyst Ali posted the following: Twitter We highlight the fact that the price of FTM is in a consolidation phase. If the trend changes, FTM’s next target could be $1.44.

Since the target seemed ambitious, AMBCrypto looked at FTM’s liquidation levels to see if there was a hurdle before $1.44.

We found that FTM would have a high liquidation rate close to $1. High liquidation often limits price appreciation. Therefore, it is very important for FTM to cross the $1 barrier without any obstacles.

Source: Hiblock Capital

For Fantom, trouble lies ahead.

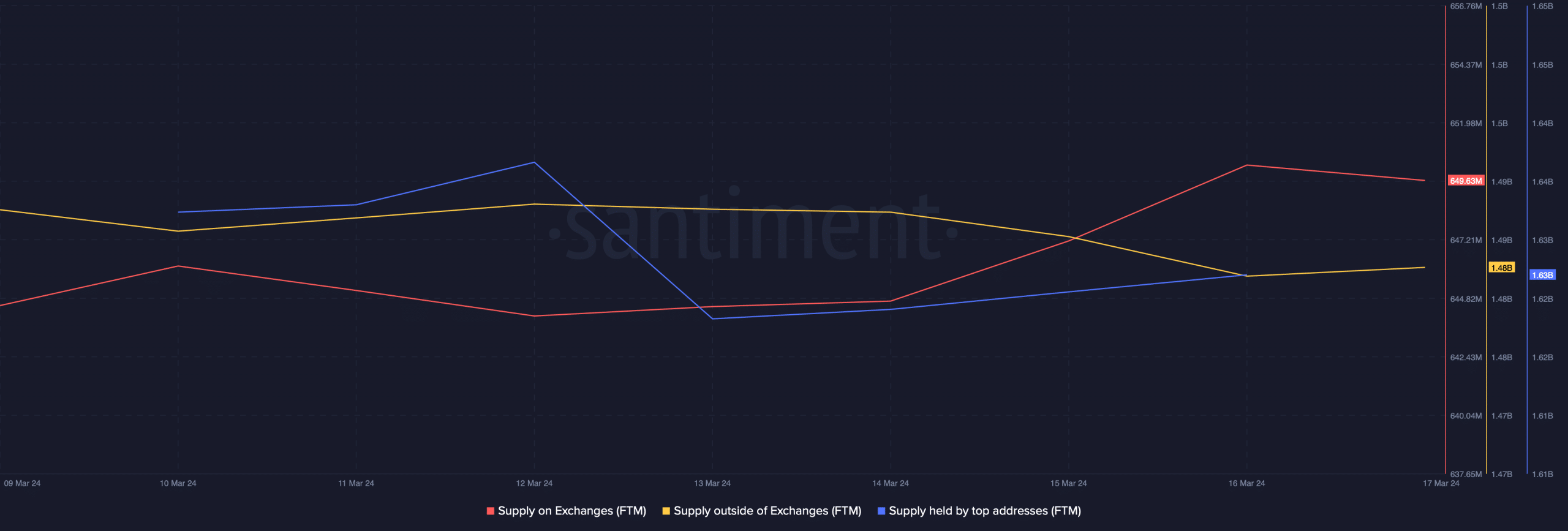

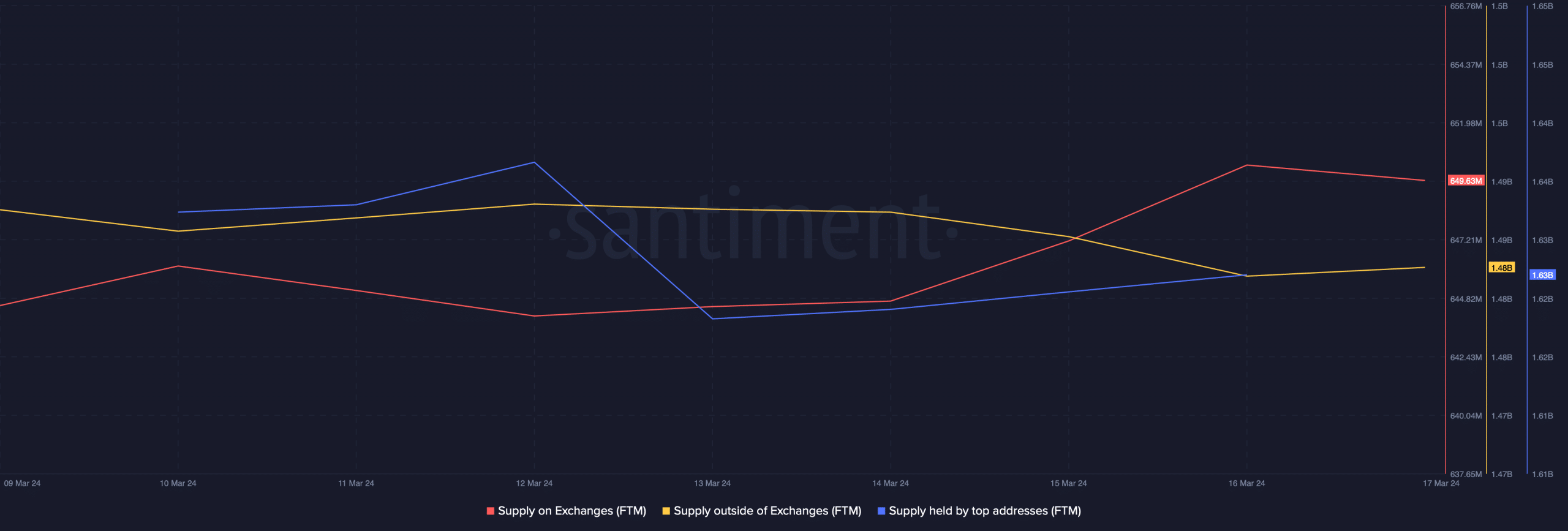

AMBCrypto’s analysis of Santiment’s data revealed several bearish indicators. For example, exchange supply of FTM has increased while off-exchange supply has decreased.

This suggests that token selling pressure was high at press time.

During this period, the supply held by the top addresses decreased slightly, meaning that whales also sold FTM.

Source: Santiment

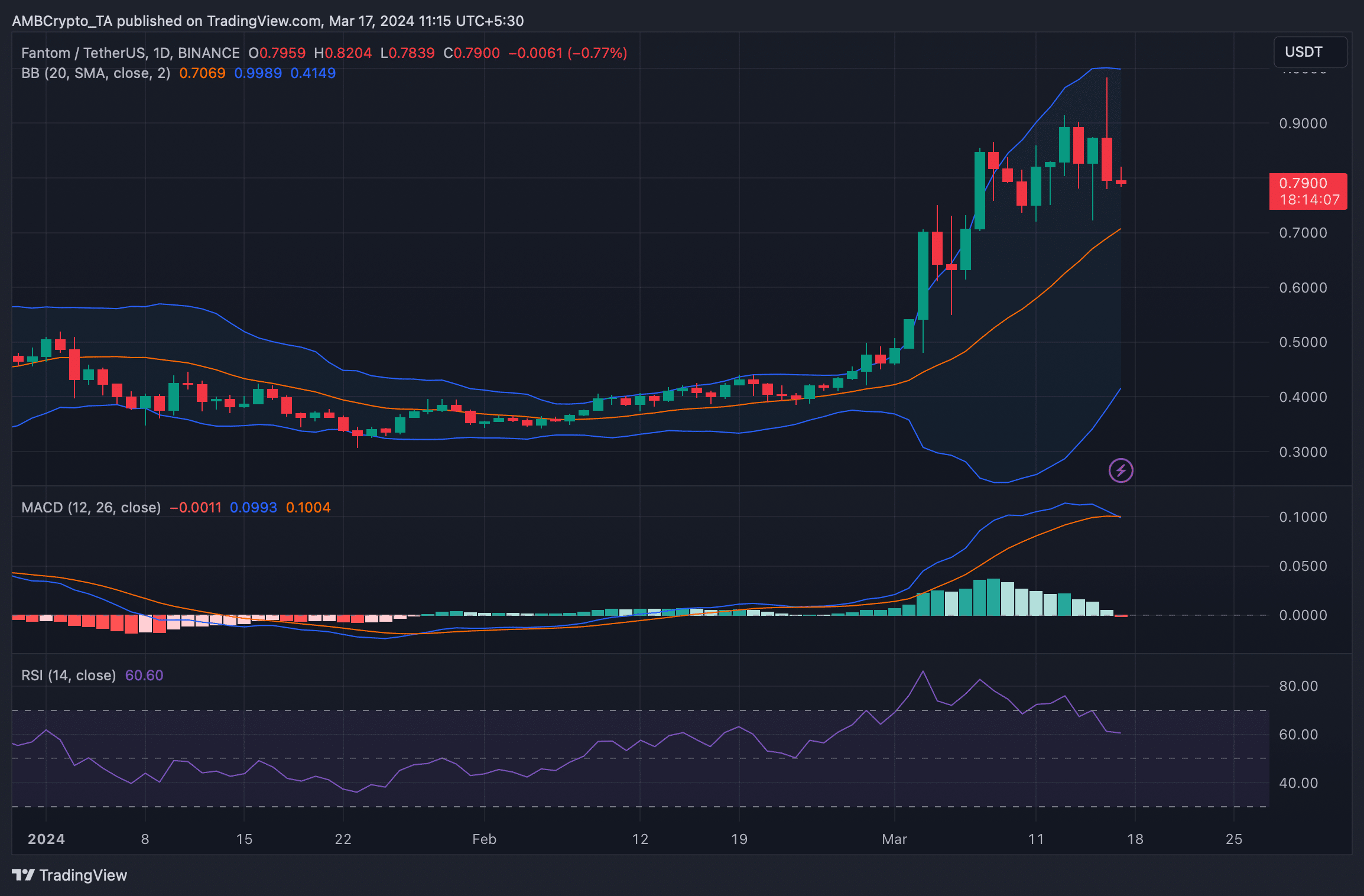

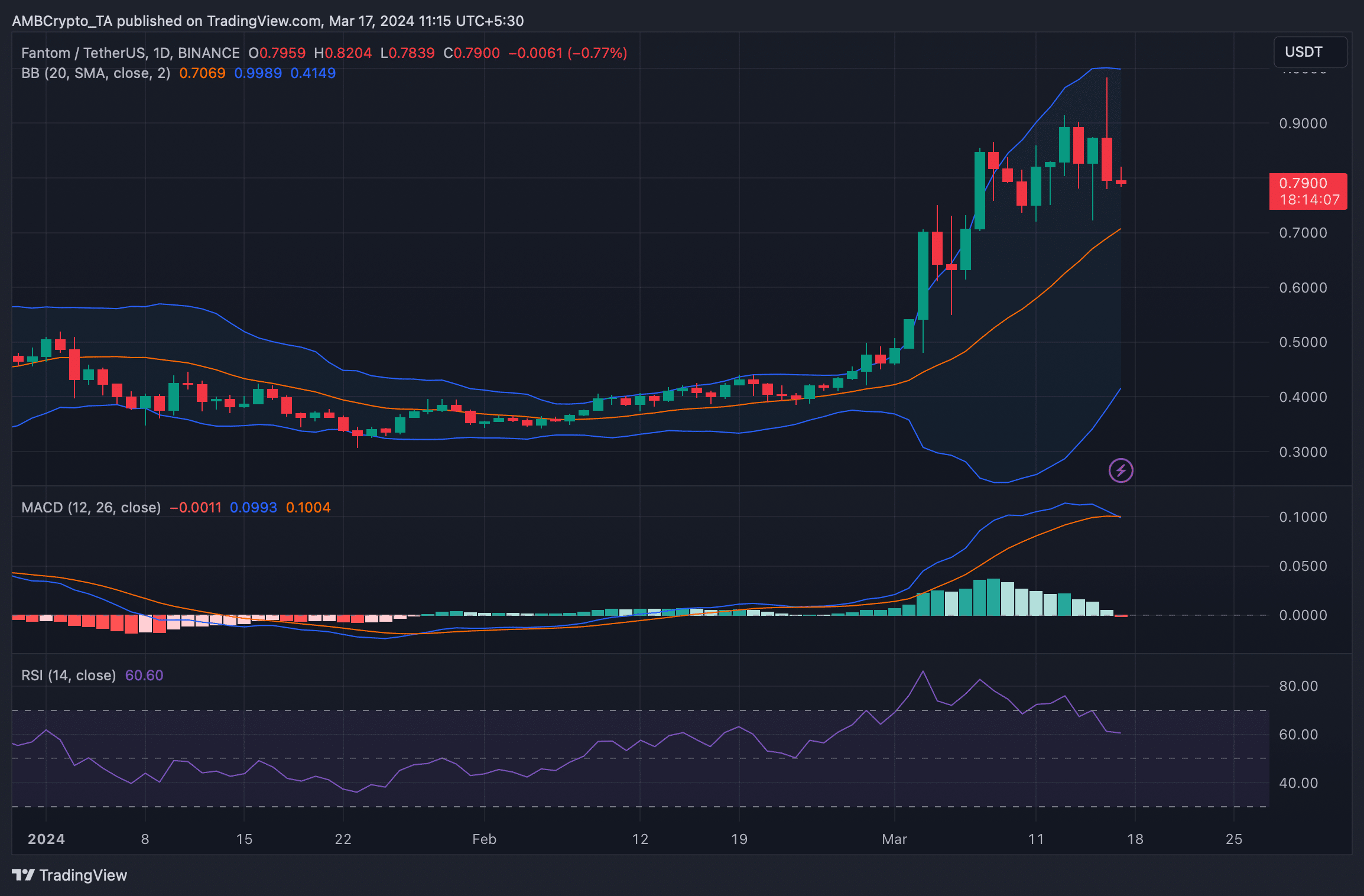

AMBCrypto also looked at Fantom’s daily chart to better understand which direction the token is heading. Technical indicator MACD indicated a possible bearish crossover.

FTM’s Relative Strength Index (RSI) was in a downward trend and was heading towards a neutral point at the time of writing, indicating a continued downward price trend in the coming days.

read Phantom (FTM) Price Prediction 2024-25

FTM’s Bollinger Bands have revealed that FTM’s price is above its 20-day simple moving average (SMA), which could be a key support level.

Therefore, the possibility of another upward rally after FTM touches the support line cannot be ruled out yet.

Source: TradingView